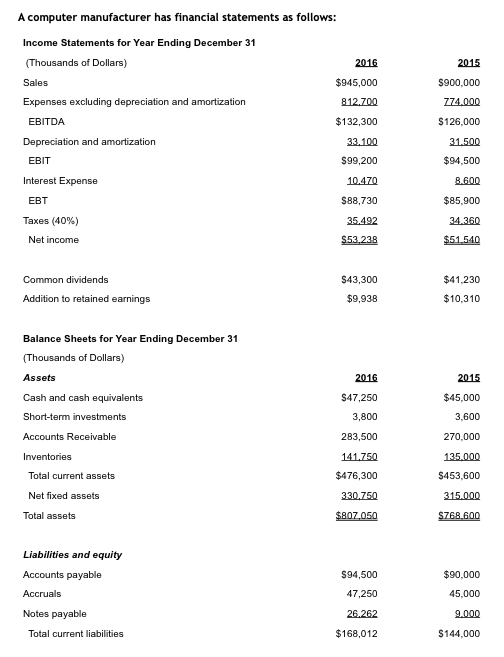

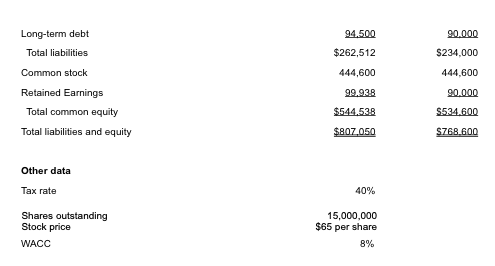

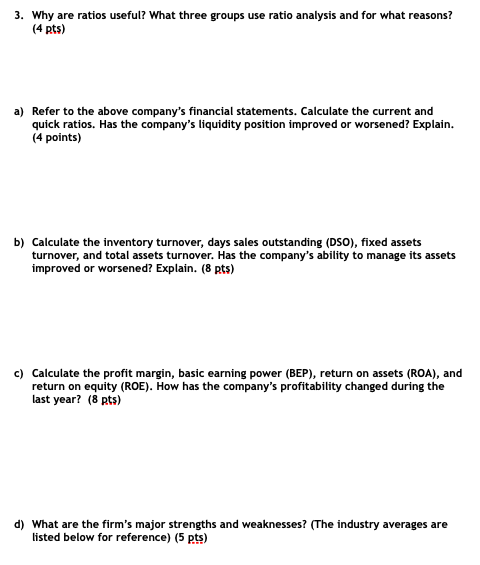

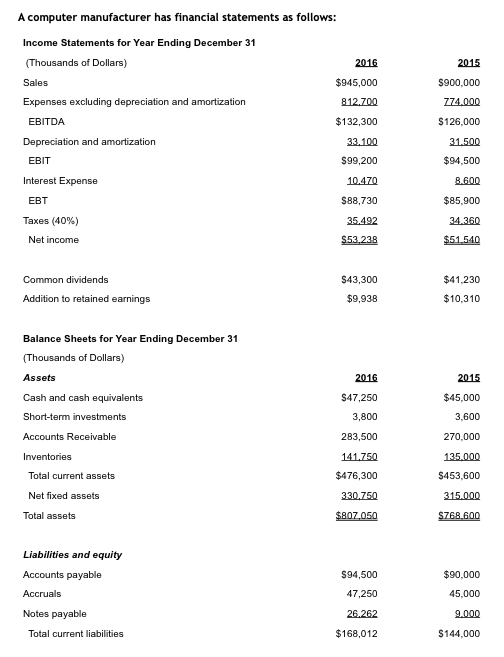

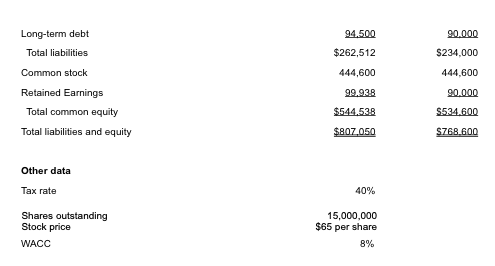

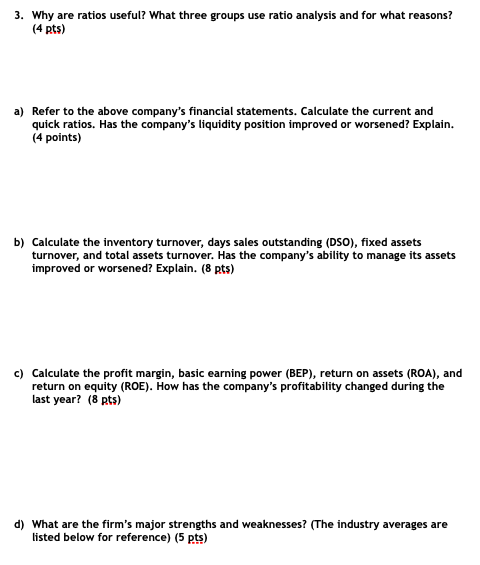

A computer manufacturer has financial statements as follows: Income Statements for Year Ending December 31 Thousands of Dollars) 2016 2015 $945,000 S900,000 EBITDA $132,300 33100 $99,200 10470 S88,730 35,492 S126,000 31500 $94,500 EBIT Interest Expense EBT $85.900 Taxes (40%) 34.360 Net income Common dividends S43,300 $41.230 $10,310 Addition to retained earnings $9,938 Balance Sheets for Year Ending December 31 Thousands of Dollars) Assets Cash and cash equivalents Short-term investments 2016 $47,250 3,800 283,500 2015 $45.000 3,600 270,000 Total current assets $476,300 $453,600 Net fixed assets 330.750 Total assets Liabilities and equity Accounts payable S94,500 $90,000 47,250 45,000 Notes payable Total current liabilities $168,012 S144,000 Long-term debt 94.500 $262,512 444,600 99.938 $544 538 $807,050 90.000 S234.000 44,600 90.000 $534.600 S768 600 Total liabilities Common stock Retained Earnings Total common equity Total liabilities and equity Other data Tax rate 40% Shares outstanding Stock price WACC 15,000,000 $65 per share 8% 3. Why are ratios useful? What three groups use ratio analysis and for what reasons? (4 pts) a) Refer to the above company's financial statements. Calculate the current and quick ratios. Has the company's liquidity position improved or worsened? Explain (4 points) b) Calculate the inventory turnover, days sales outstanding (DSO), fixed assets turnover, and total assets turnover. Has the company's ability to manage its assets improved or worsened? Explain. (8 pts) c) Calculate the profit margin, basic earning power (BEP), return on assets (ROA), and return on equity (ROE). How has the company's profitability changed during the last year? (8 Rts) d) What are the firm's major strengths and weaknesses? (The industry averages are listed below for reference) (5 pts) A computer manufacturer has financial statements as follows: Income Statements for Year Ending December 31 Thousands of Dollars) 2016 2015 $945,000 S900,000 EBITDA $132,300 33100 $99,200 10470 S88,730 35,492 S126,000 31500 $94,500 EBIT Interest Expense EBT $85.900 Taxes (40%) 34.360 Net income Common dividends S43,300 $41.230 $10,310 Addition to retained earnings $9,938 Balance Sheets for Year Ending December 31 Thousands of Dollars) Assets Cash and cash equivalents Short-term investments 2016 $47,250 3,800 283,500 2015 $45.000 3,600 270,000 Total current assets $476,300 $453,600 Net fixed assets 330.750 Total assets Liabilities and equity Accounts payable S94,500 $90,000 47,250 45,000 Notes payable Total current liabilities $168,012 S144,000 Long-term debt 94.500 $262,512 444,600 99.938 $544 538 $807,050 90.000 S234.000 44,600 90.000 $534.600 S768 600 Total liabilities Common stock Retained Earnings Total common equity Total liabilities and equity Other data Tax rate 40% Shares outstanding Stock price WACC 15,000,000 $65 per share 8% 3. Why are ratios useful? What three groups use ratio analysis and for what reasons? (4 pts) a) Refer to the above company's financial statements. Calculate the current and quick ratios. Has the company's liquidity position improved or worsened? Explain (4 points) b) Calculate the inventory turnover, days sales outstanding (DSO), fixed assets turnover, and total assets turnover. Has the company's ability to manage its assets improved or worsened? Explain. (8 pts) c) Calculate the profit margin, basic earning power (BEP), return on assets (ROA), and return on equity (ROE). How has the company's profitability changed during the last year? (8 Rts) d) What are the firm's major strengths and weaknesses? (The industry averages are listed below for reference) (5 pts)