Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A computer problem at Mike Owjai Finance has resulted in incomeplete financial statements. Management of the company has asked you to see if you can

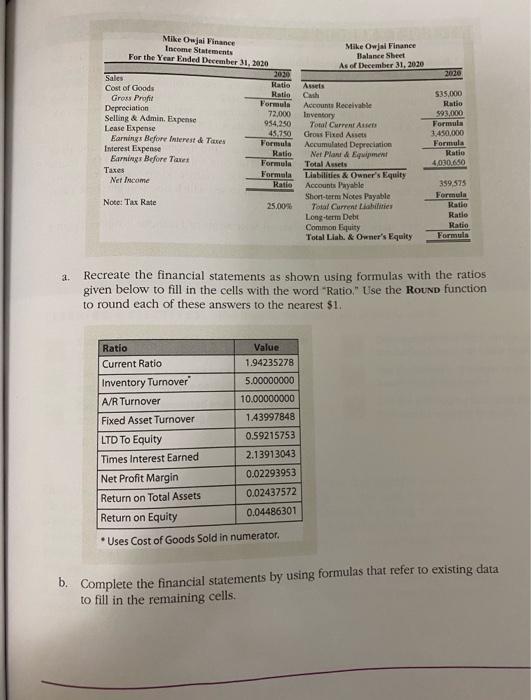

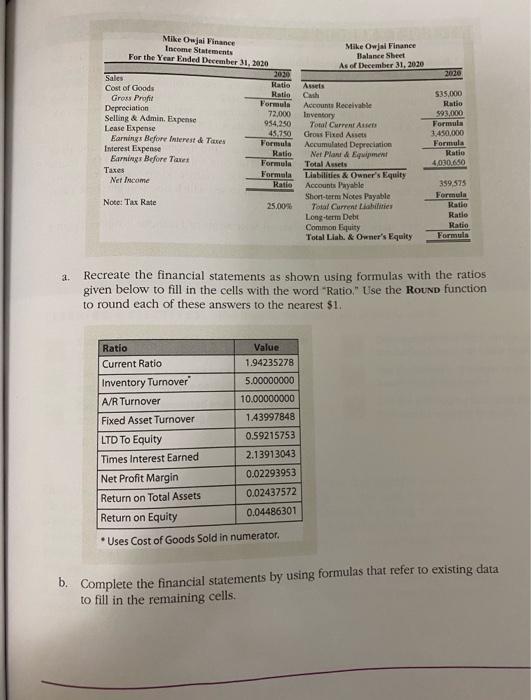

A computer problem at Mike Owjai Finance has resulted in incomeplete financial statements. Management of the company has asked you to see if you can fill in the missing data.

2020 Hati Mike Ojal Finance Income Statements Mike Owjal Finance For the Year Ended December 31, 2020 Balance Sheet As of December 31, 2020 2020 Sales Asus Cost of Goods Gross Profit Ratio Cash Formula Accounts Receivable Depreciation 72,000 Inventory Selling & Admin Expense 954,250 Toral Current Lease Expense 45.750 GrossFixed Asset Earnings Before Interest Taxe Formula Accumulated Depreciation Interest Expense Ratio Earnings Before Taxe Net Plan Egment Formula Total Assets Taxes Formula Liabilities & Owner's Equity Net Income katio Accounts Payable Short-term Notes Payable Note: Tax Rate 25.00% Total Current Liabilities Long-term Debt Common Equity Total Llab. & Owner's Equity $35.000 Ratio 59.000 Formula 3.450.000 Formula Ratio 4,030.610 359,575 Formula Ratio Ratio Ratio Formula Recreate the financial statements as shown using formulas with the ratios given below to fill in the cells with the word "Ratio." Use the Round function to round each of these answers to the nearest $1. Ratio Value Current Ratio 1.94235278 Inventory Turnover 5.00000000 A/R Turnover 10.00000000 Fixed Asset Turnover 1.43997848 LTD TO Equity 0.59215753 Times Interest Earned 2.13913043 Net Profit Margin 0.02293953 Return on Total Assets 0.02437572 Return on Equity 0.04486301 * Uses Cost of Goods Sold in numerator. b. Complete the financial statements by using formulas that refer to existing data to fill in the remaining cells

*please show ratios and equations used*

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started