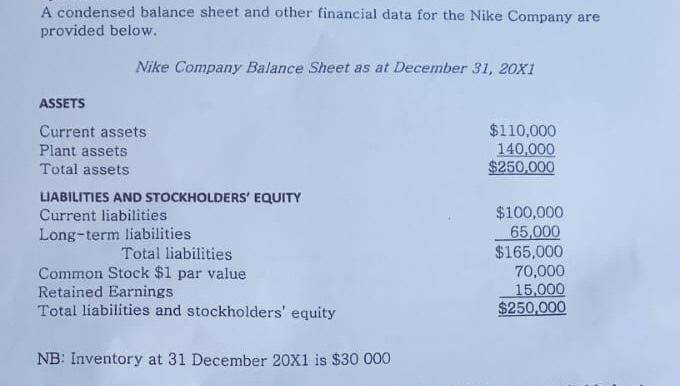

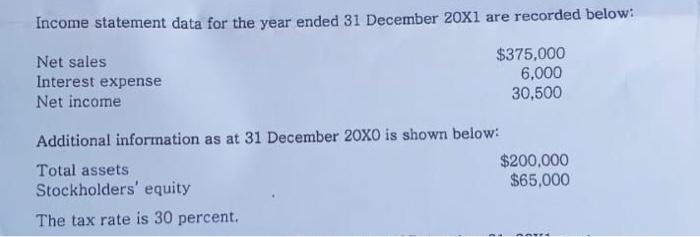

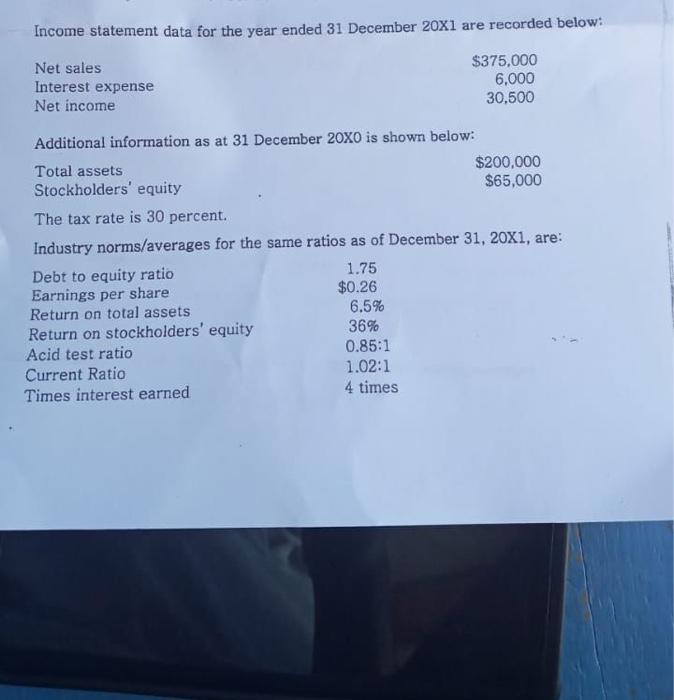

A condensed balance sheet and other financial data for the Nike Company are provided below. Nike Company Balance Sheet as at December 31, 20X1 ASSETS $110,000 140,000 $250,000 Current assets Plant assets Total assets LIABILITIES AND STOCKHOLDERS' EQUITY Current liabilities Long-term liabilities Total liabilities Common Stock $1 par value Retained Earnings Total liabilities and stockholders' equity $100,000 65,000 $165,000 70,000 15,000 $250.000 NB: Inventory at 31 December 20X1 is $30 000 Income statement data for the year ended 31 December 20X1 are recorded below: Net sales $375,000 Interest expense 6,000 Net income 30,500 Additional information as at 31 December 20XO is shown below: Total assets $200,000 Stockholders' equity $65,000 The tax rate is 30 percent. Income statement data for the year ended 31 December 20X1 are recorded below: Net sales $375,000 Interest expense 6.000 Net income 30,500 Additional information as at 31 December 20X0 is shown below: Total assets $200,000 Stockholders' equity $65,000 The tax rate is 30 percent. Industry norms/averages for the same ratios as of December 31, 20x1, are: Debt to equity ratio 1.75 Earnings per share $0.26 Return on total assets 6.5% Return on stockholders' equity 36% Acid test ratio 0.85:1 Current Ratio 1.02:1 Times interest earned 4 times A condensed balance sheet and other financial data for the Nike Company are provided below. Nike Company Balance Sheet as at December 31, 20X1 ASSETS $110,000 140,000 $250,000 Current assets Plant assets Total assets LIABILITIES AND STOCKHOLDERS' EQUITY Current liabilities Long-term liabilities Total liabilities Common Stock $1 par value Retained Earnings Total liabilities and stockholders' equity $100,000 65,000 $165,000 70,000 15,000 $250.000 NB: Inventory at 31 December 20X1 is $30 000 Income statement data for the year ended 31 December 20X1 are recorded below: Net sales $375,000 Interest expense 6,000 Net income 30,500 Additional information as at 31 December 20XO is shown below: Total assets $200,000 Stockholders' equity $65,000 The tax rate is 30 percent. Income statement data for the year ended 31 December 20X1 are recorded below: Net sales $375,000 Interest expense 6.000 Net income 30,500 Additional information as at 31 December 20X0 is shown below: Total assets $200,000 Stockholders' equity $65,000 The tax rate is 30 percent. Industry norms/averages for the same ratios as of December 31, 20x1, are: Debt to equity ratio 1.75 Earnings per share $0.26 Return on total assets 6.5% Return on stockholders' equity 36% Acid test ratio 0.85:1 Current Ratio 1.02:1 Times interest earned 4 times