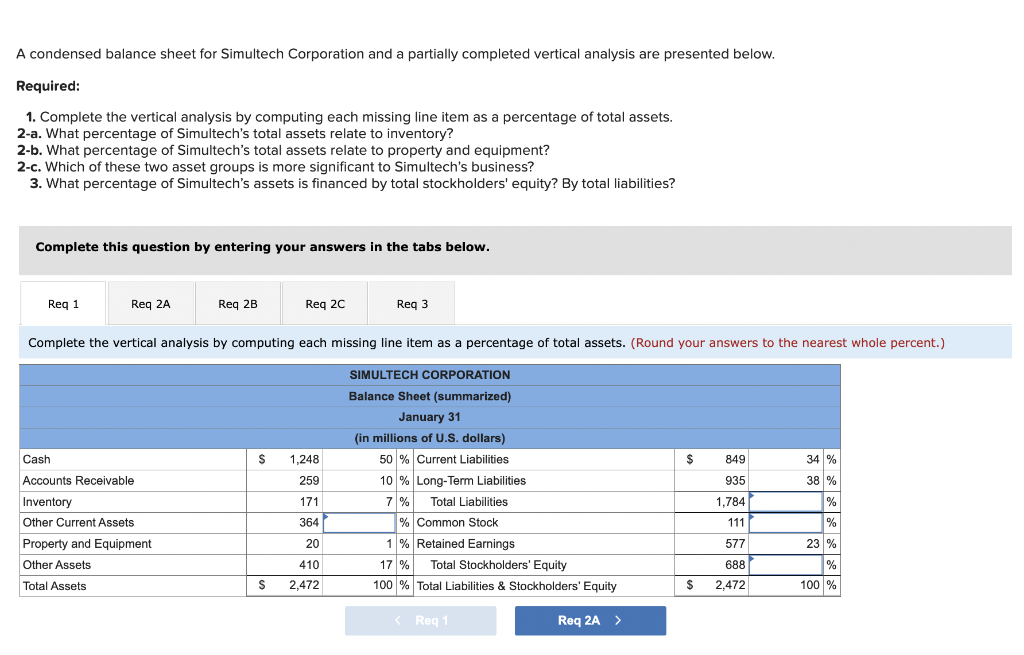

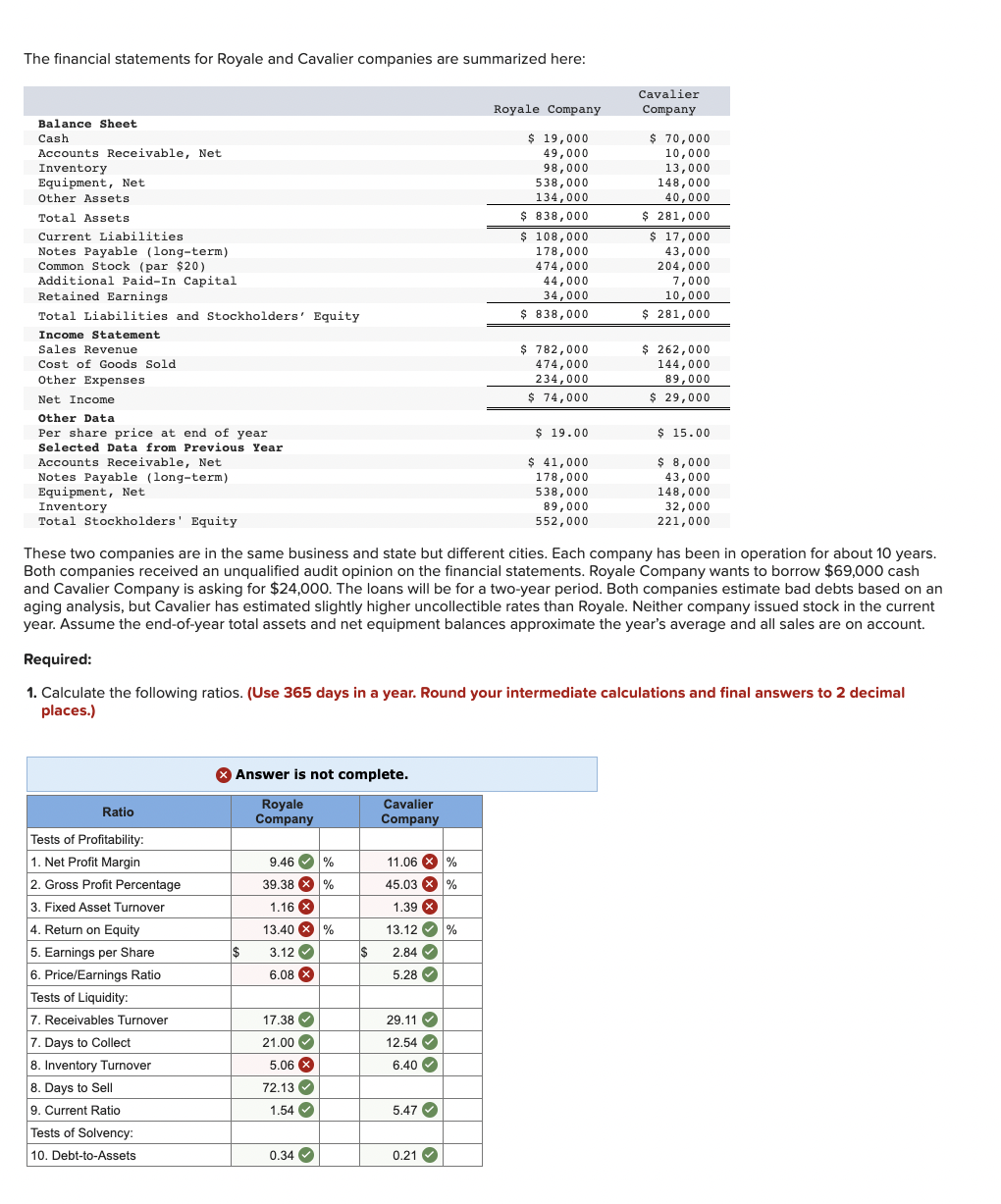

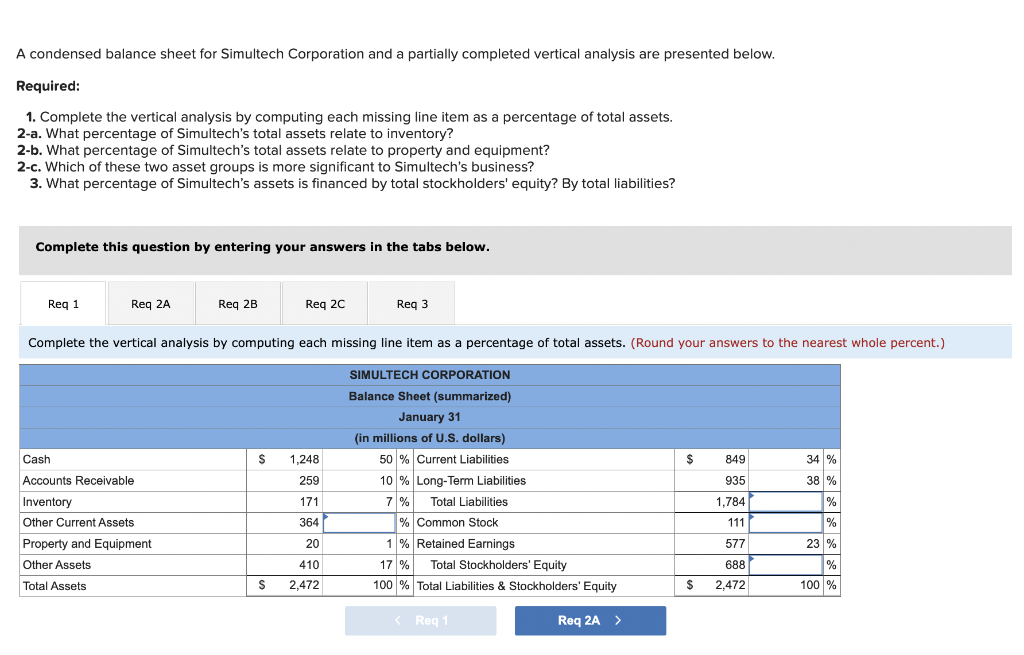

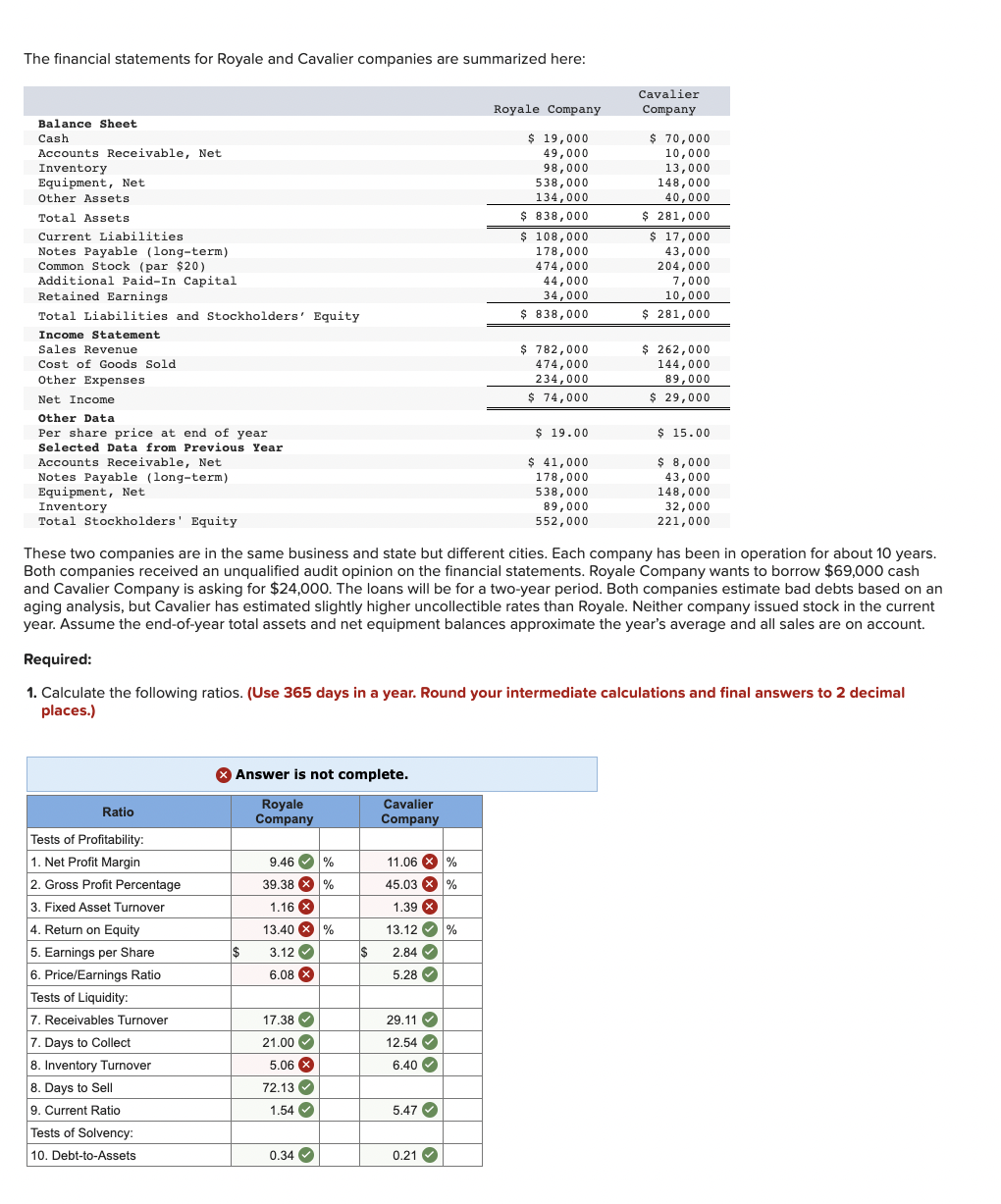

A condensed balance sheet for Simultech Corporation and a partially completed vertical analysis are presented below. Required: 1. Complete the vertical analysis by computing each missing line item as a percentage of total assets. 2-a. What percentage of Simultech's total assets relate to inventory? 2-b. What percentage of Simultech's total assets relate to property and equipment? 2-c. Which of these two asset groups is more significant to Simultech's business? 3. What percentage of Simultech's assets is financed by total stockholders' equity? By total liabilities? Complete this question by entering your answers in the tabs below. Req 1 Req 2A Req 2B Req 20 Req3 Complete the vertical analysis by computing each missing line item as a percentage of total assets. (Round your answers to the nearest whole percent.) $ 1,248 $ 849 34 % 259 SIMULTECH CORPORATION Balance Sheet (summarized) January 31 (in millions of U.S. dollars) 50 % Current Liabilities 10 % Long-Term Liabilities 7% Total Liabilities % Common Stock 1 % Retained Earnings 17% Total Stockholders' Equity 100 % Total Liabilities & Stockholders' Equity 38 % 935 1,784 171 Cash Accounts Receivable Inventory Other Current Assets Property and Equipment Other Assets Total Assets % 364 111 % 20 577 23 % 410 2.472 688 2.472 % 100 % S $ Req 1 Req 2A > The financial statements for Royale and Cavalier companies are summarized here: Royale Company Cavalier Company $ 19,000 49,000 98,000 538,000 134,000 $ 838,000 $ 108,000 178,000 474,000 44,000 34,000 $ 838,000 $ 70,000 10,000 13,000 148,000 40,000 $ 281,000 $ 17,000 43,000 204,000 7,000 10,000 $ 281,000 Balance Sheet Cash Accounts Receivable, Net Inventory Equipment, Net Other Assets Total Assets Current Liabilities Notes Payable (long-term) Common Stock (par $20) Additional Paid-In Capital Retained Earnings Total Liabilities and Stockholders' Equity Income Statement Sales Revenue Cost of Goods Sold Other Expenses Net Income Other Data Per share price at end of year Selected Data from Previous Year Accounts Receivable, Net Notes Payable (long-term) Equipment, Net Inventory Total Stockholders' Equity $ 782,000 474,000 234,000 $ 74,000 $ 262,000 144,000 89,000 $ 29,000 $ 19.00 $ 15.00 $ 41,000 178,000 538,000 89,000 552,000 $ 8,000 43,000 148,000 32,000 221,000 These two companies are in the same business and state but different cities. Each company has been in operation for about 10 years. Both companies received an unqualified audit opinion on the financial statements. Royale Company wants to borrow $69,000 cash and Cavalier Company is asking for $24,000. The loans will be for a two-year period. Both companies estimate bad debts based on an aging analysis, but Cavalier has estimated slightly higher uncollectible rates than Royale. Neither company issued stock in the current year. Assume the end-of-year total assets and net equipment balances approximate the year's average and all sales are on account. Required: 1. Calculate the following ratios. (Use 365 days in a year. Round your intermediate calculations and final answers to 2 decimal places.) Answer is not complete. Ratio Royale Company Cavalier Company 11.06 X % 9.46 % 39.38 X % 1.16 X 45.03 X % 1.39 X 13.12% $ 13.40 X % 3.12 6.08 % IS 2.84 5.28 Tests of Profitability: 1. Net Profit Margin 2. Gross Profit Percentage 3. Fixed Asset Turnover 4. Return on Equity 5. Earnings per Share 6. Price/Earnings Ratio Tests of Liquidity: 7. Receivables Turnover 7. Days to Collect 8. Inventory Turnover 8. Days to Sell 9. Current Ratio Tests of Solvency: 10. Debt-to-Assets 17.38 21.00 5.06 X 29.11 12.54 6.40 000 OO 72.13 1.54 5.47 0.34 0.21