Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A condensed balance sheet for Simultech Corporation and a partially completed vertical analysis are presented below. Required: 1. Complete the vertical analysis by computing

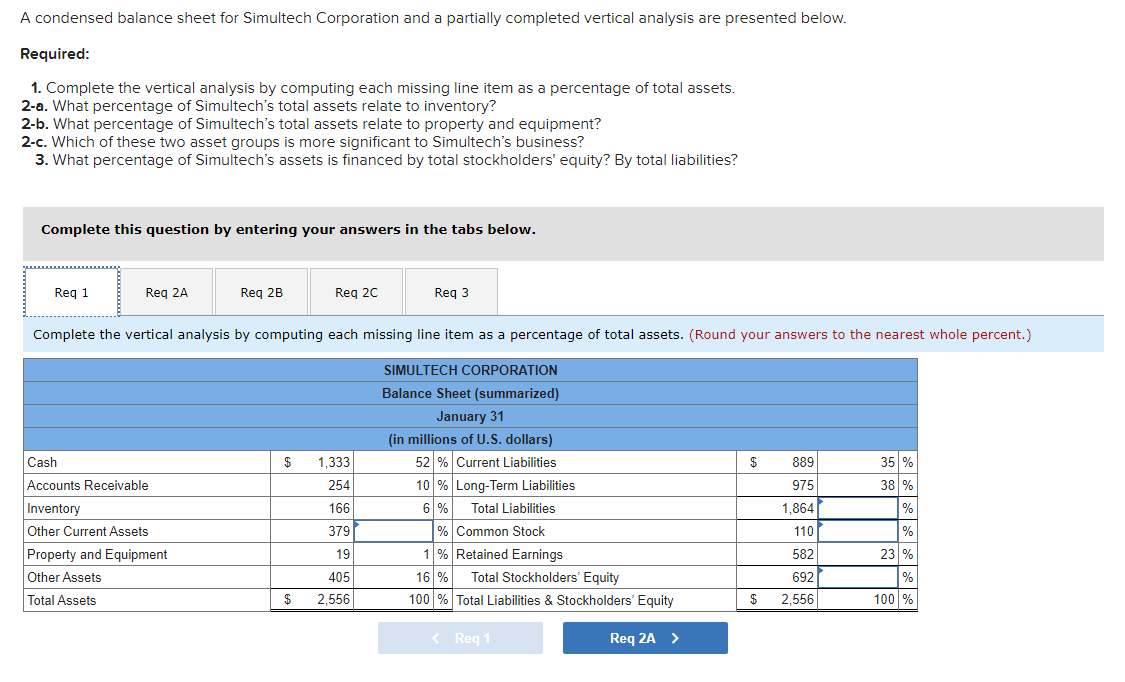

A condensed balance sheet for Simultech Corporation and a partially completed vertical analysis are presented below. Required: 1. Complete the vertical analysis by computing each missing line item as a percentage of total assets. 2-a. What percentage of Simultech's total assets relate to inventory? 2-b. What percentage of Simultech's total assets relate to property and equipment? 2-c. Which of these two asset groups is more significant to Simultech's business? 3. What percentage of Simultech's assets is financed by total stockholders' equity? By total liabilities? Complete this question by entering your answers in the tabs below. Req 1 Req 2A Req 2B Req 2C Req 3 Complete the vertical analysis by computing each missing line item as a percentage of total assets. (Round your answers to the nearest whole percent.) SIMULTECH CORPORATION Balance Sheet (summarized) January 31 (in millions of U.S. dollars) Cash $ 1,333 52 % Current Liabilities $ 889 35 % Accounts Receivable Inventory 254 10 % Long-Term Liabilities 975 38 % 166 6 % Total Liabilities 1,864 Other Current Assets 379 % Common Stock 110 % Property and Equipment 19 1 % Retained Earnings 582 23 % Other Assets 405 16 % Total Stockholders' Equity 692 % Total Assets $ 2,556 100 % Total Liabilities & Stockholders' Equity $ 2,556 100 % Req 1 Req 2A >

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started