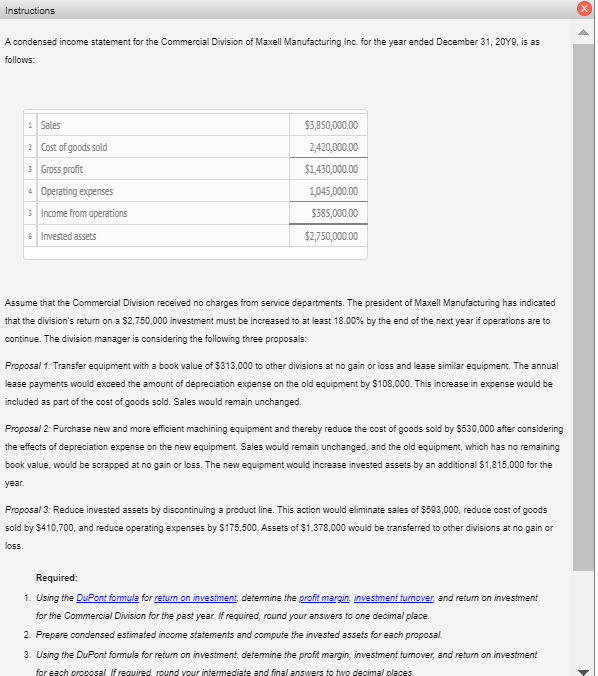

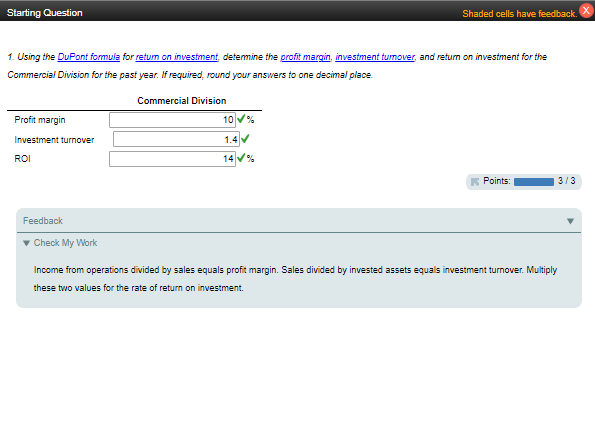

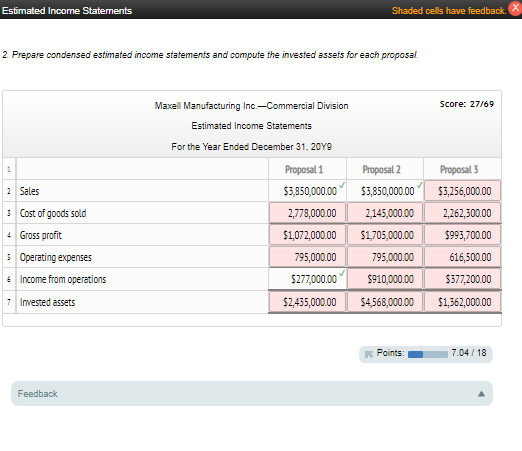

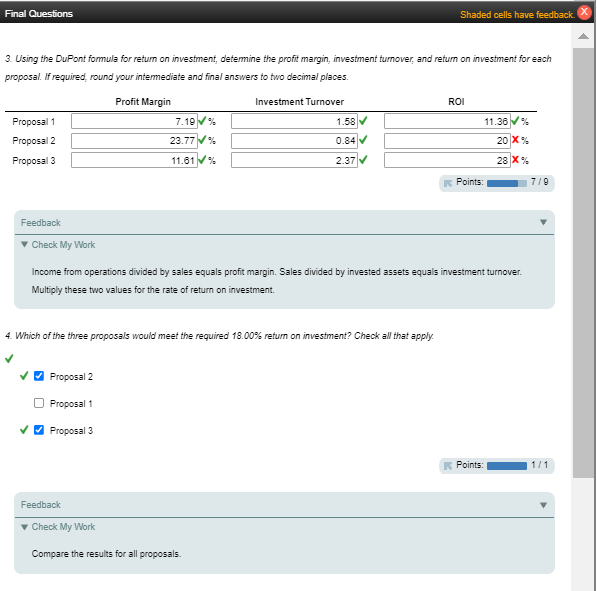

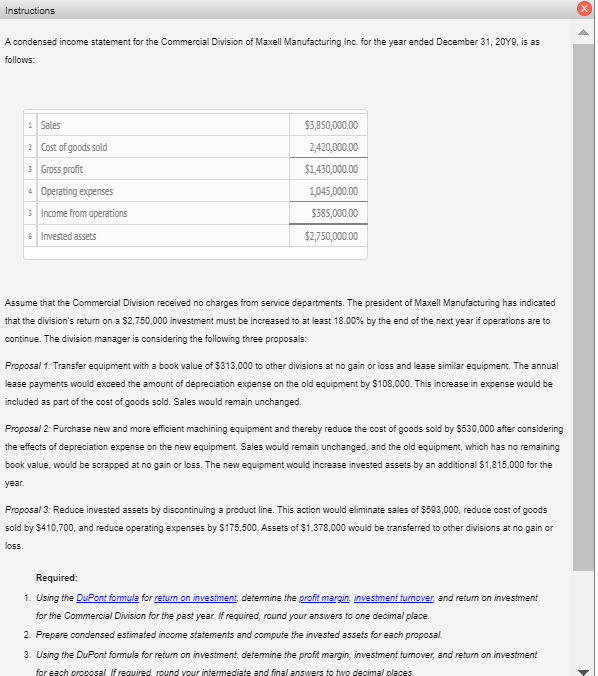

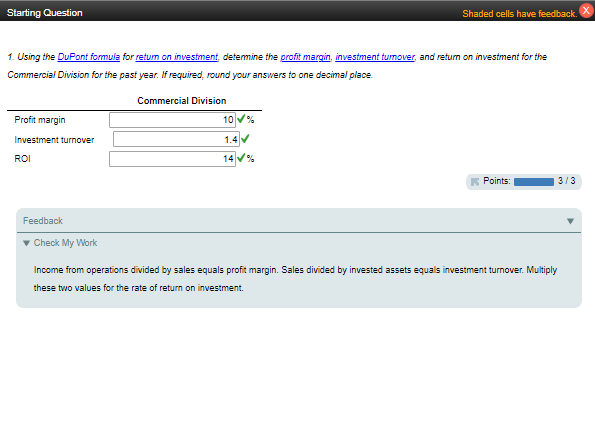

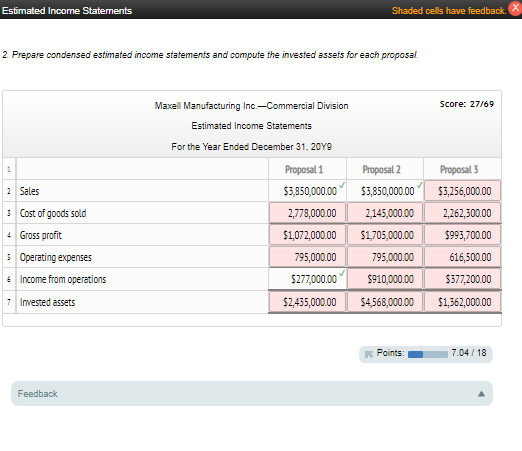

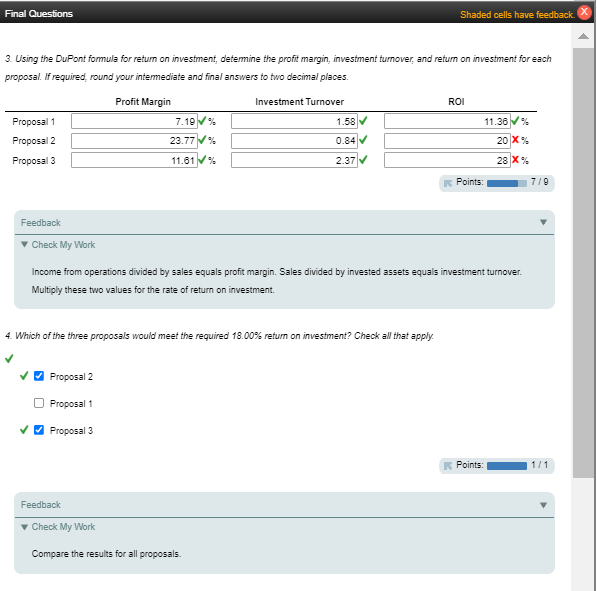

A condensed income statement for the Commercial Division of Maxell Manufacturing lnc. for the year ended December 31,20Y9, is as follows: Assume that the Commercial Division received no charges from service departments. The president of Maxell Manufacturing has indicated that the division's return on a $2,750,000 investment must be increased to at least 18.00% by the end of the next year if operations are to continue. The division manager is considering the following three proposals: Proposal 1: Transfer equipment with a book value of $313,000 to other divisions at no gain or loss and lease similar equipment. The annual lease payments would exceed the amount of depreciation expense on the old equipment by 5108,000 . This increase in expense would be included as part of the cost of goods sold. Sales would remain unchanged. Proposal 2: Purchase new and more efficient machining equipment and thereby reduce the cost of goods sold by 5530,000 after considering the effects of depreciation expense on the new equipment. Sales would remain unchanged, and the old equipment, which has no remaining book value, would be scrapped at no gain or loss. The new equipment would increase invested assets by an additional 51,815,000 for the year. Proposal 3: Reduce invested assets by discontinuing a product line. This action would eliminate sales of $593,000, reduce cost of goods sold by $410,700, and reduce operating expenses by $175,500. Assets of $1,378,000 would be transferred to other divisions at no gain or loss. Required: 1. Using the for detemine the investment fumover, and retum on investment for the Commercial Division for the past year. If required, round your answers to one decimal place. 2. Prepare condensed estimated income statements and compute the invested assets for each proposal. 3. Using the DuPont fomula for retum on investment, detemine the profit margin, investment turnover, and retum on investment 1. Using the DuPont formula for defemine the orofit margin, investment tumover, and refum on investment for the Commercial Division for the past year. If required, round your answers to one decimal place Points: 3/3 Feedback Check My Work Income from operations divided by sales equals proft margin. Sales divided by invested assets equals investment turnover. Multiply these two values for the rate of return on investment. Prepare condensed estimated income statements and compute the invested assefs for each proposal. 3. Using the DuPont formula for retum on investment, detemine the profit margin, investment turnover, and return on investment for each proposal. If required, round your intemediate and final answers to two decimal places. Feedback Check My Work Income from operations divided by sales equals profit margin. Sales divided by invested assets equals investment turnover. Multiply these two values for the rate of return on investment. 4. Which of the three proposals would meet the required 18.00% retum on investment? Check all that apply. Proposal 2 Proposal 1 Proposal 3 Feedback Check My Work Compare the results for all proposals