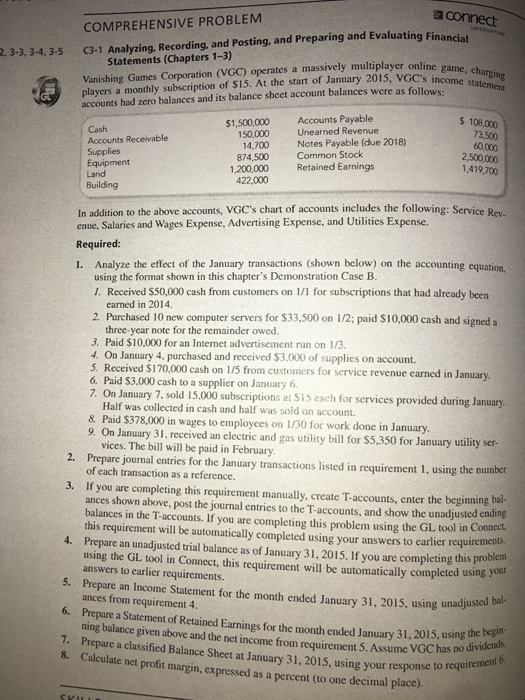

a connedt COMPREHENSIVE PROBLEM 2. 3-3, 3-4,3-5 C3-1 Analyzing, Recording, and Posting, and Preparing and Evaluating Financial Statements (Chapters 1-3) Vanishing Games Corporation (VGC) operates a massively multiplayer online players a monthly subscription of S15. At the start of January 2015, VGCme, ch accounts had zero balances and its balance sheet account balances were as follows ing income statement Accounts Payable Unearned Revenue Cash Accounts Receivable Supplies Equipment Land Building $1,500,000 150,000 14,700 874,500 s 108,000 73,500 60,000 2,500,000 1.419,700 Notes Payable (due 2018) Common Stock 1.200,000 Retained Earnings 422,000 In addition to the above accounts, VGC's chart of accounts includes the following: Service Rew enue. Salaries and Wages Expense, Advertising Expense, and Utilities Expense. Required 1. Analyze the effect of the January transactions (shown below) on the accounting equation using the format shown in this chapter's Demonstration Case B . Received $50,000 cash from customers on 1/1 for subscriptions that had already been earned in 2014 2. Purchased 10 new computer servers for $33.500 on 1/2; paid S10,000 cash and signed a three-year note for the remainder owed. 3. Paid $10,000 for an Internet advertisement run on 1/3. 4. On January 4, purchased and received $3.000 of supplies on account. 5. Received $170,000 cash on 1/5 from customers for service revenue earned in January 6. Paid $3.000 cash to a supplier on January 6 7. On January 7, sold 15.000 subscriptions at S15 each for services provided during January Half was collected in cash and half was sold on account. 8 Paid $378,000 in wages to employees on 1/30 for work done in January 9. On January 31, received an electric and gas utility bill for $5,350 for January utility ser vices. The bill will be paid in February 2. Prepare journal entries for the January transactions listed in requirement 1, using the number 3. If you are completing this requirement manually, create T-accounts, enter the beginning of each transaction as a reference. ances shown above, post the journal entries to the T-accounts, and show the unadjusted ending balances in the T-accounts. If you are completing this problem using the GL tool in Conect. this requirement will be automatically completed using your answers to earlier requirements Prepare an unadjusted trial balance as of January 31, 2015. If you are completing this prob using the GL tool in Connect, this requirement will be automatically completed using your 4. S. Prepare an Income Statement for the month ended January 31, 201s, using unadjusted ba 6. Prepure a Statement of Retained Earnings for the month ended January 31, 2015, using 7. Prepare a classified Balance Sheet at January 31, 2015, using your response 8. Calculate net profit margin, expressed as a percent (to one decimal place) answers to earlier requirements. ances from requirement 4 ning balance given above and the net income from requirement 5. Assume g the begin- VGC has no to requirement 6