Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a) Consider a position consisting of a K100, 000 investment in asset A and a K100, 000 investment in asset B. Assume that the daily

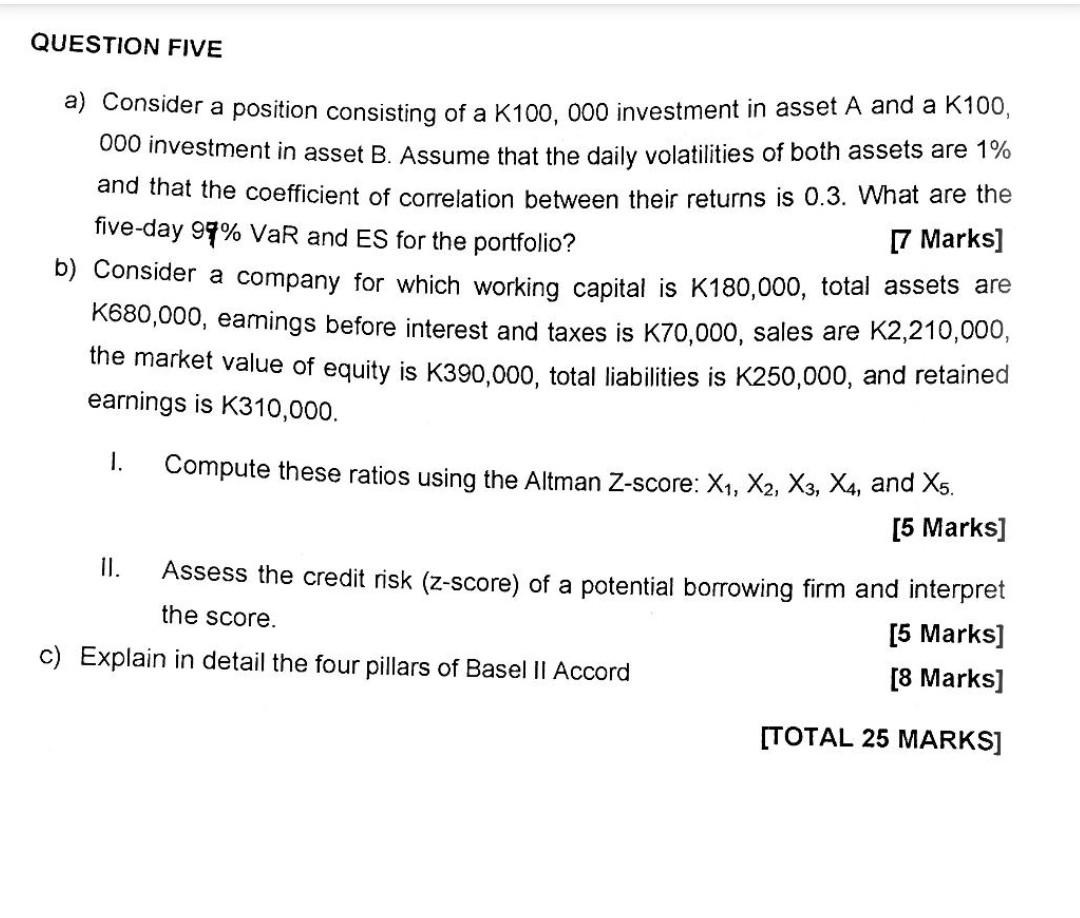

a) Consider a position consisting of a K100, 000 investment in asset A and a K100, 000 investment in asset B. Assume that the daily volatilities of both assets are 1% and that the coefficient of correlation between their returns is 0.3 . What are the five-day 97%VaR and ES for the portfolio? [7 Marks] b) Consider a company for which working capital is K180,000, total assets are K680,000, eamings before interest and taxes is K70,000, sales are K2,210,000, the market value of equity is K390,000, total liabilities is K250,000, and retained earnings is K310,000. I. Compute these ratios using the Altman Z-score: X1,X2,X3,X4, and X5. [5 Marks] II. Assess the credit risk (z-score) of a potential borrowing firm and interpret the score. c) Explain in detail the four pillars of Basel II Accord [5 Marks] [8 Marks] [TOTAL 25 MARKS] a) Consider a position consisting of a K100, 000 investment in asset A and a K100, 000 investment in asset B. Assume that the daily volatilities of both assets are 1% and that the coefficient of correlation between their returns is 0.3 . What are the five-day 97%VaR and ES for the portfolio? [7 Marks] b) Consider a company for which working capital is K180,000, total assets are K680,000, eamings before interest and taxes is K70,000, sales are K2,210,000, the market value of equity is K390,000, total liabilities is K250,000, and retained earnings is K310,000. I. Compute these ratios using the Altman Z-score: X1,X2,X3,X4, and X5. [5 Marks] II. Assess the credit risk (z-score) of a potential borrowing firm and interpret the score. c) Explain in detail the four pillars of Basel II Accord [5 Marks] [8 Marks] [TOTAL 25 MARKS]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started