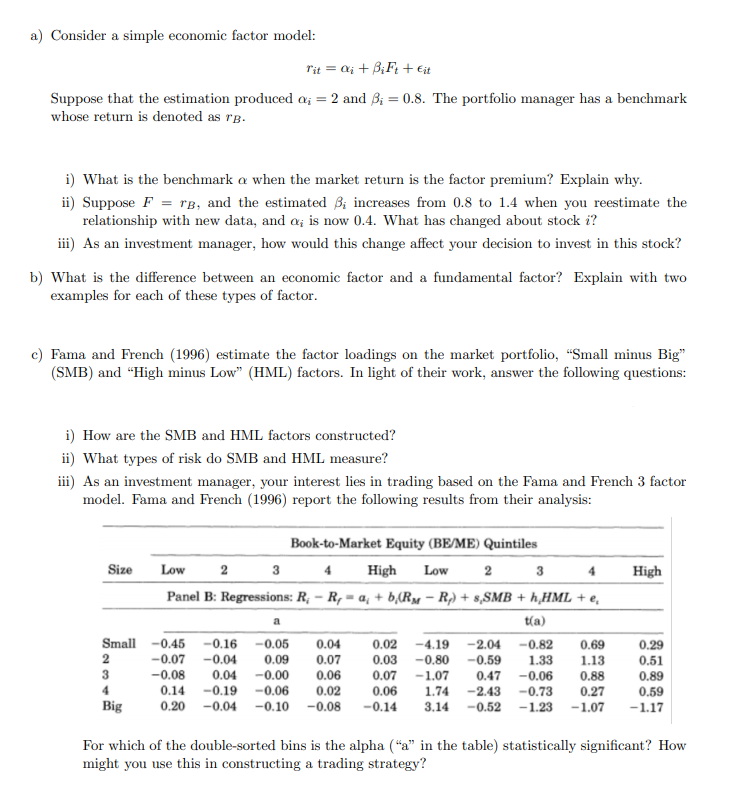

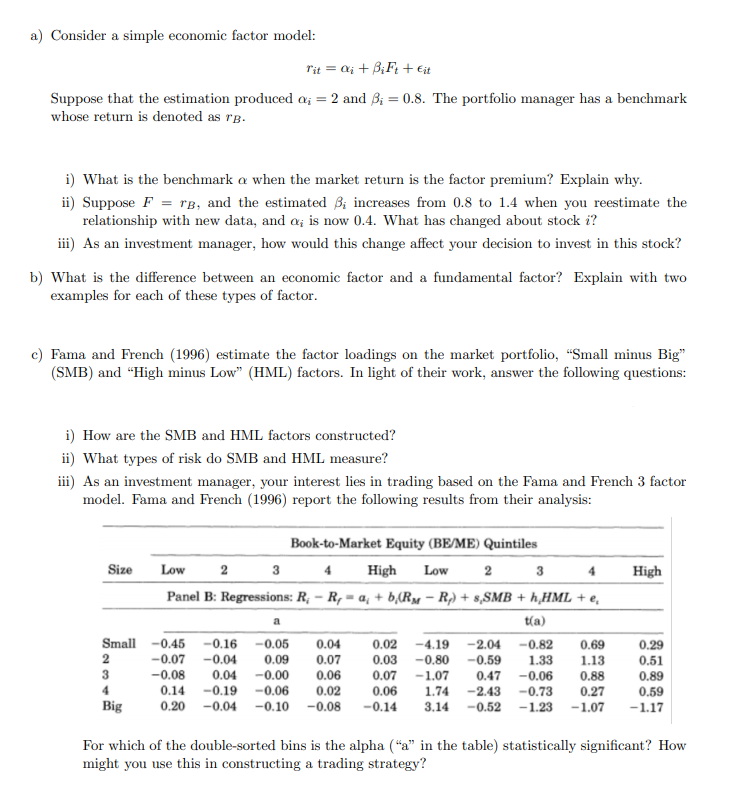

a) Consider a simple economic factor model: rit = a; + B;Ft + Eit Suppose that the estimation produced a; = 2 and B; = 0.8. The portfolio manager has a benchmark whose return is denoted as rb. i) What is the benchmark a when the market return is the factor premium? Explain why. ii) Suppose F = rs, and the estimated B; increases from 0.8 to 1.4 when you reestimate the relationship with new data, and a; is now 0.4. What has changed about stock i? iii) As an investment manager, how would this change affect your decision to invest in this stock? b) What is the difference between an economic factor and a fundamental factor? Explain with two examples for each of these types of factor. c) Fama and French (1996) estimate the factor loadings on the market portfolio, "Small minus Big" (SMB) and High minus Low (HML) factors. In light of their work, answer the following questions: i) How are the SMB and HML factors constructed? ii) What types of risk do SMB and HML measure? iii) As an investment manager, your interest lies in trading based on the Fama and French 3 factor model. Fama and French (1996) report the following results from their analysis: High a Book-to-Market Equity (BE/ME) Quintiles Size Low 2 3 4 High Low 23 4 Panel B: Regressions: R. - R, - ; + b (RM-R) + 8,SMB + h HML + e, t(a) Small -0.45 -0.16 -0.05 0.04 0.02 -4.19 -2.04 -0.82 0.69 2 -0.07 -0.04 0.09 0.07 0.03 -0.80 -0.59 1.33 1.13 3 -0.08 0.04 -0.00 0.06 0.07 -1.07 0.47 -0.06 0.88 4 0.14 -0.19 -0.06 0.02 0.06 1.74 -2.43 -0.73 0.27 Big 0.20 -0.04 -0.10 -0.08 -0.14 -0.52 -1.23 -1.07 0.29 0.51 0.89 0.59 - 1.17 3.14 For which of the double-sorted bins is the alpha ("a" in the table) statistically significant? How might you use this in constructing a trading strategy? a) Consider a simple economic factor model: rit = a; + B;Ft + Eit Suppose that the estimation produced a; = 2 and B; = 0.8. The portfolio manager has a benchmark whose return is denoted as rb. i) What is the benchmark a when the market return is the factor premium? Explain why. ii) Suppose F = rs, and the estimated B; increases from 0.8 to 1.4 when you reestimate the relationship with new data, and a; is now 0.4. What has changed about stock i? iii) As an investment manager, how would this change affect your decision to invest in this stock? b) What is the difference between an economic factor and a fundamental factor? Explain with two examples for each of these types of factor. c) Fama and French (1996) estimate the factor loadings on the market portfolio, "Small minus Big" (SMB) and High minus Low (HML) factors. In light of their work, answer the following questions: i) How are the SMB and HML factors constructed? ii) What types of risk do SMB and HML measure? iii) As an investment manager, your interest lies in trading based on the Fama and French 3 factor model. Fama and French (1996) report the following results from their analysis: High a Book-to-Market Equity (BE/ME) Quintiles Size Low 2 3 4 High Low 23 4 Panel B: Regressions: R. - R, - ; + b (RM-R) + 8,SMB + h HML + e, t(a) Small -0.45 -0.16 -0.05 0.04 0.02 -4.19 -2.04 -0.82 0.69 2 -0.07 -0.04 0.09 0.07 0.03 -0.80 -0.59 1.33 1.13 3 -0.08 0.04 -0.00 0.06 0.07 -1.07 0.47 -0.06 0.88 4 0.14 -0.19 -0.06 0.02 0.06 1.74 -2.43 -0.73 0.27 Big 0.20 -0.04 -0.10 -0.08 -0.14 -0.52 -1.23 -1.07 0.29 0.51 0.89 0.59 - 1.17 3.14 For which of the double-sorted bins is the alpha ("a" in the table) statistically significant? How might you use this in constructing a trading strategy