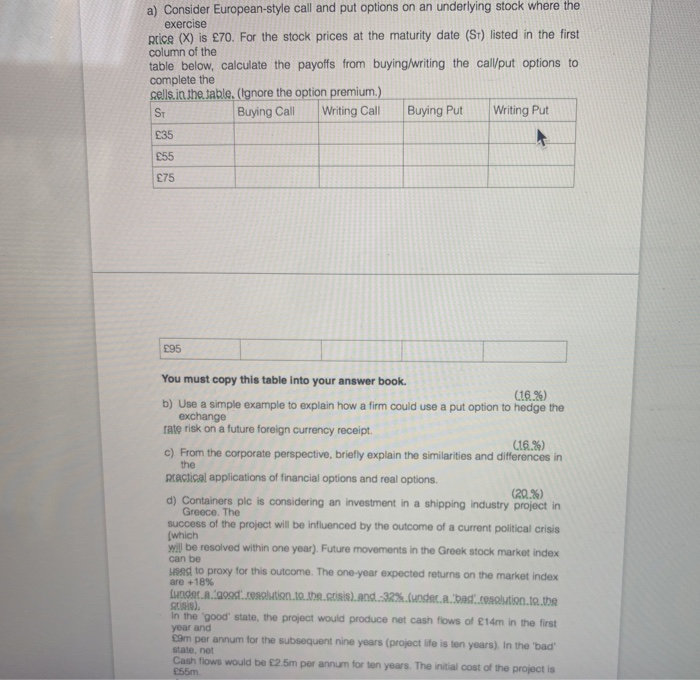

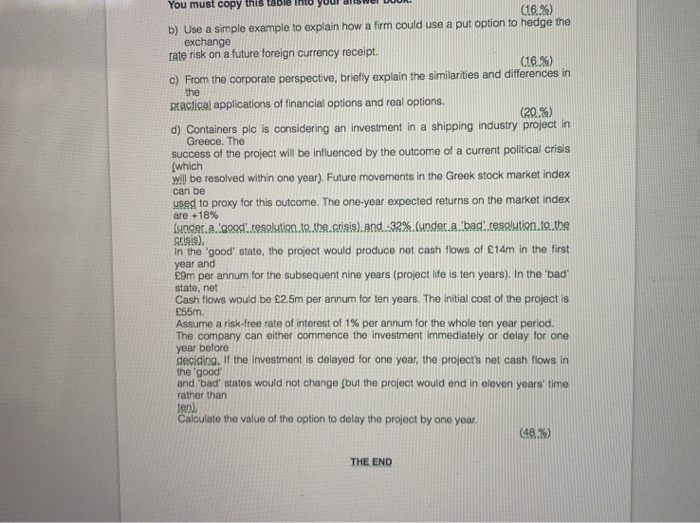

a) Consider European-style call and put options on an underlying stock where the exercise price (X) is 70. For the stock prices at the maturity date (St) listed in the first column of the table below, calculate the payoffs from buying/writing the call/put options to complete the cells in the table. (Ignore the option premium.) ST Buying Call Writing Call Buying Put Writing Put 35 55 75 195 the You must copy this table into your answer book. (16%) b) Use a simple example to explain how a firm could use a put option to hedge the exchange rate risk on a future foreign currency receipt. (16.%) c) From the corporate perspective, briefly explain the similarities and differences in Reactical applications of financial options and real options. (20%) d) Containers plc is considering an investment in a shipping industry project in success of the project will be influenced by the outcome of a current political crisis will be resolved within one year). Future movements in the Greek stock market index sused to proxy for this outcome. The one-year expected returns on the market index are +18% Lunder.food.solution to the crisis.and.-32% (undet.a. bad.cosolution to the SUSIS). In the 'good' state, the project would produce net cash flows of 14m in the first year and m per annum for the subsequent nine years (project life is ten years). In the 'bad state, net Cash flows would be 25m per annum for ten years. The initial cost of the project is 55m can be You must copy this talo (16.%) b) Use a simple example to explain how a firm could use a put option to hedge the exchange rate risk on a future foreign currency receipt. (16%) c) From the corporate perspective, briefly explain the similarities and differences in the Reactical applications of financial options and real options. (20%) d) Containers plc is considering an investment in a shipping industry project in Greece. The Success of the project will be influenced by the outcome of a current political crisis (which will be resolved within one year). Future movements in the Greek stock market index can be used to proxy for this outcome. The one-year expected returns on the market index are +18% under a Caos.esolution 10. the crisis) and 32% (under a..bad.cesolution 10 the crisis). In the 'good' state, the project would produce net cash flows of 14m in the first year and 9m per annum for the subsequent nine years (project life is ten years). In the 'bad' stato, net Cash flows would be 2.5m per annum for ten years. The initial cost of the project is 55m. Assume a risk-free rate of interest of 1% per annum for the whole ten year period. The company can either commence the investment immediately or delay for one year before deciding. If the investment is delayed for one year, the project's net cash flows in the 'good' and bad' states would not change (but the project would end in eleven years' time rather than ten), Calculate the value of the option to delay the project by one year. (48%) THE END