Question

a) Consider the derivation of the optimal hedge ratio in the context of cross hedging. Please define the formula denoting the total variance of

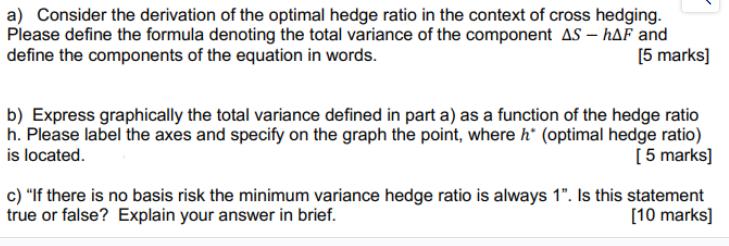

a) Consider the derivation of the optimal hedge ratio in the context of cross hedging. Please define the formula denoting the total variance of the component AS - hAF and define the components of the equation in words. [5 marks] b) Express graphically the total variance defined in part a) as a function of the hedge ratio h. Please label the axes and specify on the graph the point, where h* (optimal hedge ratio) is located. [5 marks] c) "If there is no basis risk the minimum variance hedge ratio is always 1". Is this statement true or false? Explain your answer in brief. [10 marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a The optimal hedge ratio in the context of cross hedging can be derived using the concept of minimu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Introduction To Derivatives And Risk Management

Authors: Don M. Chance, Robert Brooks

10th Edition

130510496X, 978-1305104969

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App