Question

a) Consider the fixed asset cost of the Limited Production and Full Production scenarios. Some managers believe that these costs are S890, 000 and $480,000,

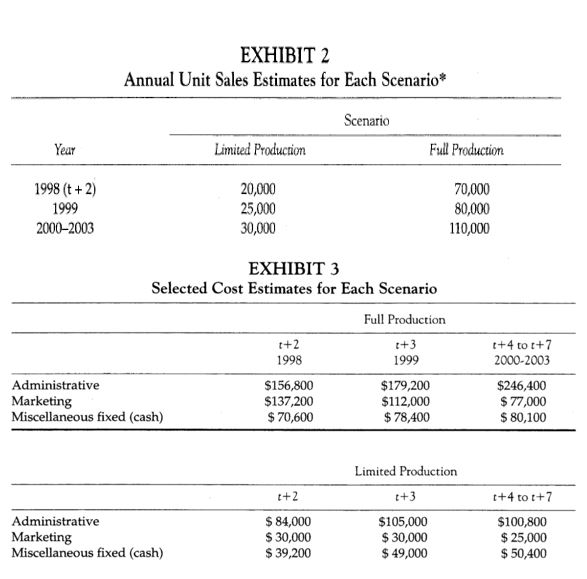

a) Consider the fixed asset cost of the Limited Production and Full Production scenarios. Some managers believe that these costs are S890, 000 and $480,000, respectively, which are the amounts that would have to be spent if all the necessary assets are purchased. Others argue that these costs should be reduced by $90,000, which is the amount of space and equipment that would be saved if production of the existing cleat is discontinued. Based on information in the case, which set of estimates is most appropriate? Explain.

(b) Estimate the cash flows in years 1998 (t+2) through 2003 (t+7) for the Full Production Scenario. Keep in mind that only the change in net working capital is relevant when calculating these cash flows, and the relevant tax rate is 40 percent.

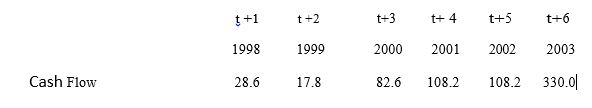

NOTE: The table below shows the annual cash flows (in $000s) of the Limited Production Scenario from 1998-2003. The amounts are based on information in the case and Exhibits 2 and 3. The year-7 amount includes the recapture of working capital plus the after-tax market value of the fixed assets.

$+1 t+2 t+3 t+4 t+5 t+6 1998 1999 2000 2001 2002 2003 Cash Flow 28.6 17.8 82.6 108.2 108.2 330.0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started