Question

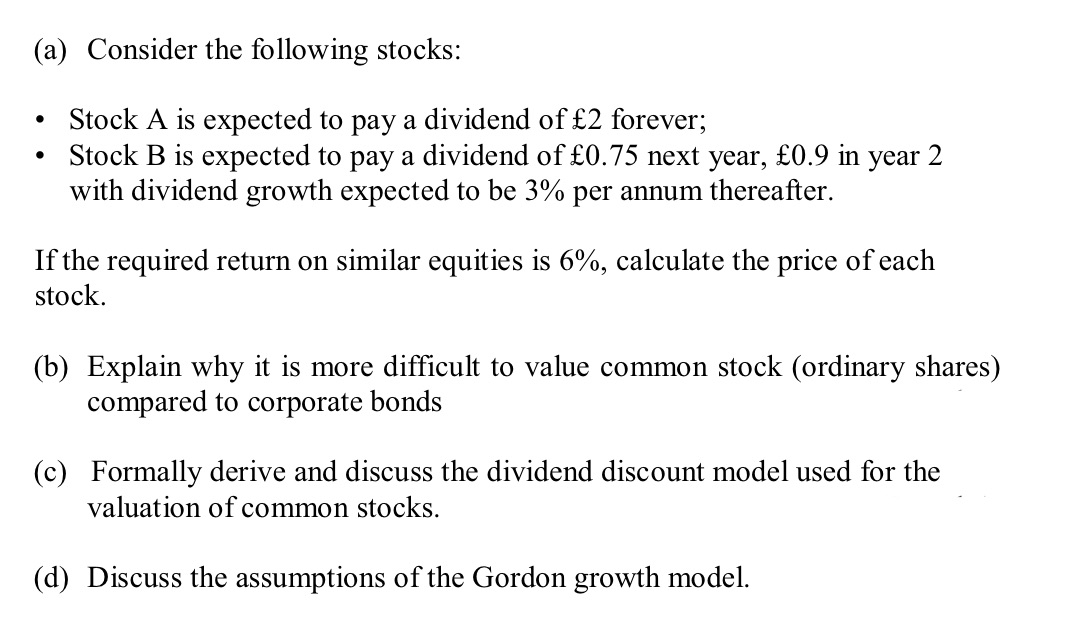

(a) Consider the following stocks: Stock A is expected to pay a dividend of 2 forever; Stock B is expected to pay a dividend

(a) Consider the following stocks: Stock A is expected to pay a dividend of 2 forever; Stock B is expected to pay a dividend of 0.75 next year, 0.9 in year 2 with dividend growth expected to be 3% per annum thereafter. If the required return on similar equities is 6%, calculate the price of each stock. (b) Explain why it is more difficult to value common stock (ordinary shares) compared to corporate bonds (c) Formally derive and discuss the dividend discount model used for the valuation of common stocks. (d) Discuss the assumptions of the Gordon growth model.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Stock Valuation and Dividend Discount Model a Stock Prices Stock A This stock represents a perpetuity because the dividend is expected to be constant ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Calculus And Its Applications

Authors: Larry Goldstein, David Lay, David Schneider, Nakhle Asmar

14th Edition

0134437772, 9780134437774

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App