Answered step by step

Verified Expert Solution

Question

1 Approved Answer

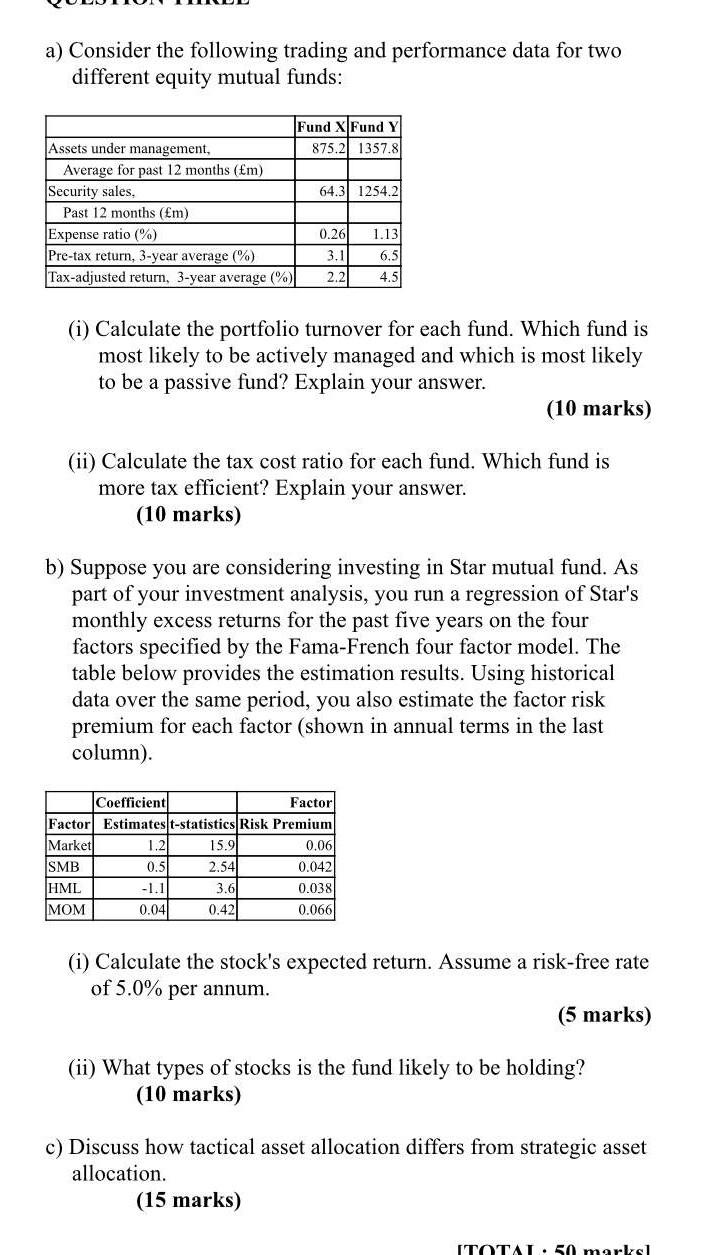

a) Consider the following trading and performance data for two different equity mutual funds: Fund X Fund Y Assets under management, 875.2 1357.8 Average for

a) Consider the following trading and performance data for two different equity mutual funds: Fund X Fund Y Assets under management, 875.2 1357.8 Average for past 12 months (Em) Security sales. 64.3] 1254.2 Past 12 months (Em) Expense ratio (%) 0.26 1.13 Pre-tax return, 3-year average (%) 3.1 6.5 Tax-adjusted return, 3-year average (%) 2.2 4.5 (i) Calculate the portfolio turnover for each fund. Which fund is most likely to be actively managed and which is most likely to be a passive fund? Explain your answer. (10 marks) (ii) Calculate the tax cost ratio for each fund. Which fund is more tax efficient? Explain your answer. (10 marks) b) Suppose you are considering investing in Star mutual fund. As part of your investment analysis, you run a regression of Star's monthly excess returns for the past five years on the four factors specified by the Fama-French four factor model. The table below provides the estimation results. Using historical data over the same period, you also estimate the factor risk premium for each factor (shown in annual terms in the last column). Coefficient Factor Factor Estimates t-statistics Risk Premium Market 1.2 15.9 0.06 SMB 0.5 2.54 0.042 -1.1 3.6 0.038 MOM 0.04 0.42 0.066 HML (i) Calculate the stock's expected return. Assume a risk-free rate of 5.0% per annum. (5 marks) (ii) What types of stocks is the fund likely to be holding? (10 marks) c) Discuss how tactical asset allocation differs from strategic asset allocation. (15 marks) TOTAL. 50 markal

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started