Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a. Consider two investment opportunities A and B. Investment A: Expected return=0.08, Standard deviation=0.06, Coefficient of variation = 0.75 Investment B Expected return=0.24, Standard deviation

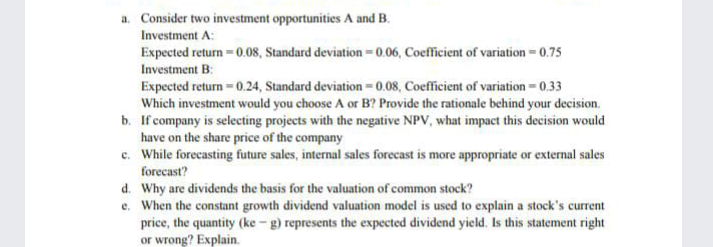

a. Consider two investment opportunities A and B. Investment A: Expected return=0.08, Standard deviation=0.06, Coefficient of variation = 0.75 Investment B Expected return=0.24, Standard deviation = 0.08, Coefficient of variation = 0.33 Which investment would you choose A or B? Provide the rationale behind your decision b. If company is selecting projects with the negative NPV, what impact this decision would have on the share price of the company c. While forecasting future sales, internal sales forecast is more appropriate or external sales forecast? d. Why are dividends the basis for the valuation of common stock? e. When the constant growth dividend valuation model is used to explain a stock's current price, the quantity (ke - g) represents the expected dividend yield. Is this statement right or wrong? Explain

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started