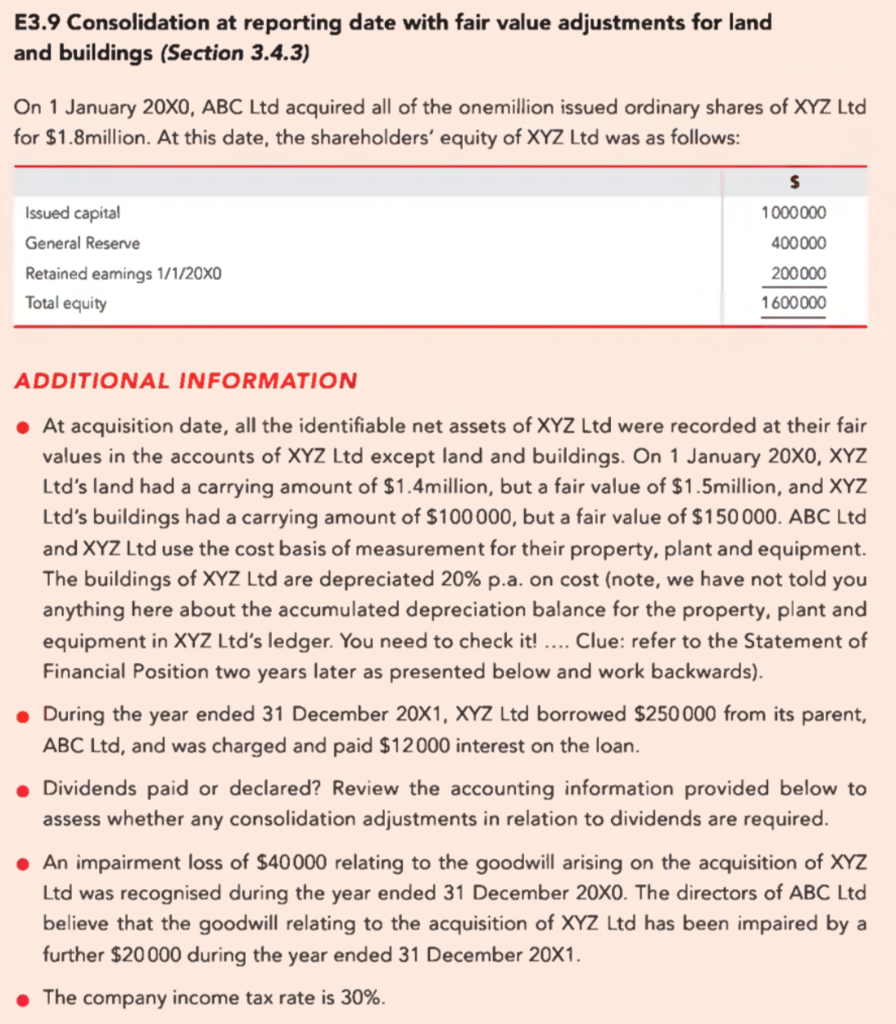

Question

a) Consolidation adjustment to recognise the fair value adjustments: In detail: Accounts DR CR You may not get time in class, but can you do

a) Consolidation adjustment to recognise the fair value adjustments:

In detail:

| Accounts | DR | CR |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

You may not get time in class, but can you do a summarised condensed version of the above journal entry:

| Accounts | DR | CR |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Analysis of investment (amounts in thousands):

| Equity acquired in net assets of subsidiary |

|

| Share capital |

|

| FVA |

|

| General Reserve |

|

| Retained earnings |

|

|

| ------- |

| Total equity acquired |

|

| Cost of investment |

|

|

| ------- |

| Goodwill |

|

|

| ==== |

b) Consolidation adjustment to eliminate the intra-group investment and recognise goodwill:

| Accounts | DR | CR |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

c) Consolidation adjustments to eliminate the intra-group loan and intra-group interest receivable:

| Accounts | DR | CR |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| DR | CR |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d) Consolidation adjustment to eliminate the intra-group dividend revenue and dividend paid:

| Accounts | DR | CR |

|

|

|

|

|

|

|

|

|

|

|

|

e) Consolidation adjustment to recognise the impairment of goodwill:

| Accounts | DR | CR |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

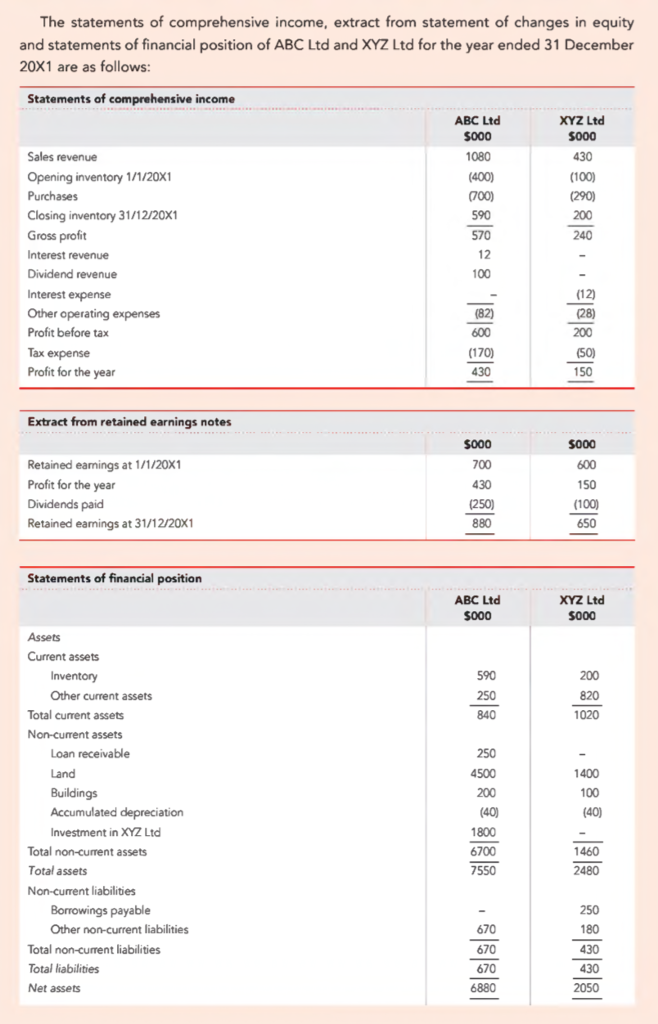

Preparation of consolidation worksheet (amounts in thousands):

|

| ABC | XYZ | Adjustments | Group | ||

|

|

| Debit | Credit |

| ||

| Sales revenue | $1080 | $ 430 |

|

|

| |

| Less Cost of goods sold |

|

|

|

|

| |

| Opening inventory | 400 | 100 |

|

|

| |

| Purchases | 700 | 290 |

|

|

| |

| Less Closing inv | 590 | 200 |

|

|

| |

| Cost of goods sold | 510 | 190 |

|

|

| |

| Gross profit | 570 | 240 |

|

|

| |

| Add Interest revenue | 12 |

|

|

|

| |

| Add Dividend revenue | 100 |

|

|

|

| |

| Less Interest expense |

| 12 |

|

|

| |

| Less Other operating exp | 82 ____ | 28 ____ |

|

|

| |

| Profit before tax | $ 600 | $ 200 |

|

|

| |

| Less Income tax expense | 170 | 50 |

|

|

| |

| Profit for the year | $ 430 | $ 150 |

|

|

| |

| Add Retained earnings 1 January 20X1 | 700 | 600 |

|

|

| |

| Less Dividend paid | 250 | 100 |

|

|

| |

| Retained earnings 31.12.X1 | $ 880 | $ 650 |

|

|

| |

| Share capital | 6000 | 1000 |

|

|

| |

| General reserve |

| 400 |

|

|

| |

| FVA | ____ | ____ |

|

|

| |

| Shareholders equity | $6880 | $2050 |

|

|

| |

|

| ==== | ==== |

|

|

| |

| Assets |

|

|

|

|

| |

| Inventory | $ 590 | $ 200 |

|

|

| |

| Other current assets | 250 | 820 |

|

|

| |

| Loan receivable | 250 |

|

|

|

| |

| Land | 4500 | 1400 |

|

|

| |

| Buildings | 200 | 100 |

|

|

| |

| Less Acc depreciation | 40 | 40 |

|

|

| |

| Investment in sub | 1800 |

|

|

|

| |

| Goodwill | ____ | ____ |

|

|

| |

| Total assets | $7550 | $2480 |

|

|

| |

|

| ==== | ==== |

|

|

| |

| Liabilities |

|

|

|

|

| |

| Borrowings payable |

| $ 250 |

|

|

| |

| Other non-current L | 670 | 180 |

|

|

| |

| Deferred tax liability | ____ | ____ |

|

|

| |

| Total liabilities | $ 670 | $ 430 |

|

|

| |

|

| ==== | ==== |

|

|

| |

| Net assets | $6880 | $2050 | * | * |

| |

* always check that these totals equal and demonstrate on any exam question asking you to do a consolidation worksheet

Notes to worksheet:

Adjustment to recognise the effects of the valuation increments at acquisition

Adjustment to eliminate the intra-group investment and recognise goodwill

Adjustment to eliminate the effects of the intra-group loan and interest

Adjustments to eliminate the intra-group dividend revenue and dividend paid

Adjustment to recognise the impairment of goodwill

_____________________________________________________________________

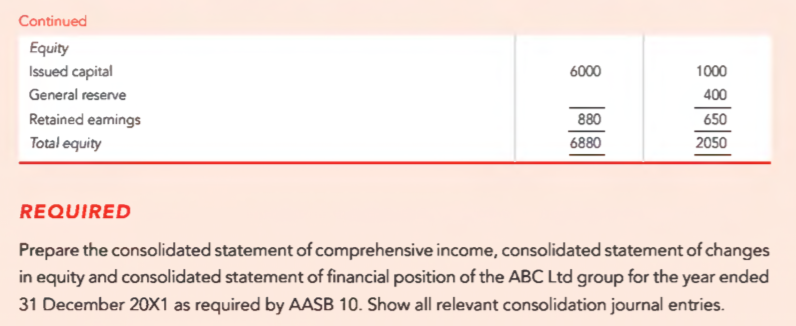

ABC Ltd Group

Consolidated Income Statement for the Year ended December 31 20X1

(amounts in thousands)

| Sales revenue |

|

| Less cost of goods sold |

|

| Gross profit |

|

| Less operating expenses |

|

| Profit before tax |

|

| Less income tax expense |

|

| Profit for the year |

|

ABC Ltd Group

Consolidated Balance Sheet as at December 31 20X1

(amounts in thousands)

|

| $ | $ |

| Assets |

|

|

| Current assets |

|

|

| Inventory |

|

|

| Other |

|

|

| Total current assets |

|

|

| Non-current assets |

|

|

| Property, plant and equipment |

|

|

| Intangibles |

|

|

| Total non-current assets |

|

|

| Total assets |

|

|

| Less non-current liabilities |

|

|

| Sundry |

|

|

| Deferred tax |

|

|

| Total liabilities |

|

|

| Net assets |

|

|

|

|

|

|

| Shareholders equity |

|

|

| Share capital |

|

|

| Retained earnings |

|

|

| Total shareholders equity |

|

|

|

|

|

|

ABC Ltd Group

Consolidated Statement of the Changes in Equity Year ended December 31 20X1

(amounts in thousands)

|

| Retained Earnings | Share Capital | Shareholders Equity |

| Balances at January 1 20X1 | $1053.0 | $6000 | $7053.0 |

| Add profit for the year |

|

|

|

| Less dividend paid |

|

|

|

| Balances at December 31 20X1 |

|

|

|

|

| ==== | ==== | ===== |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started