Question

a. Construct a balanceof-payments table (in $ billion) based on the following data of a hypothesized country A and calculate how much dollar should be

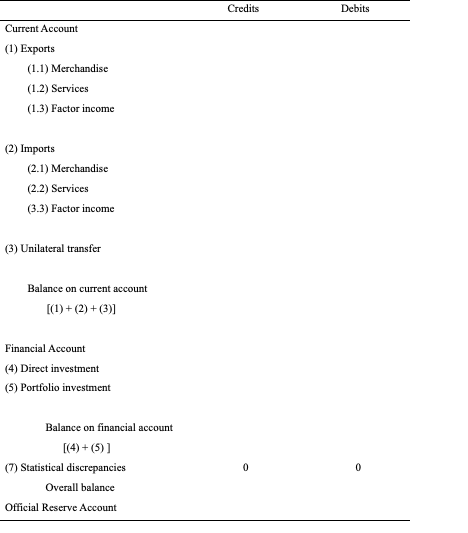

a. Construct a balanceof-payments table (in $ billion) based on the following data of a hypothesized country A and calculate how much dollar should be demanded (or supplied) through the official reserve account. Specifically, show your calculation on net exports, imports, current account balance, financial account balance, overall account balance and official reserve account.

- Exports are $1120 billion in merchandise, $550 billion in service, and $480 billion factor income.

- Imports are $3200 billion in merchandise, $1000 billion in service, and $520 billion factor income.

- Country A provides $100 billion financial aid to foreign countries. - Country As direct investment overseas is $230 billion and foreign direct investment in Country A is $330 billion. - Investors in Country A invest $610 billion in foreign securities while foreign investors invest $1000 billion in Country As securities.

- Assume no statistical discrepancy.

b. What would the central bank of Country A do to achieve the reserve account balance?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started