A.) Construct a five year pro forma for the property showing the property before tax cash flows, the depreciation on the building, and the cash flows with depreciation from operating the property.

this is the entire problem, I wasnt given any other information

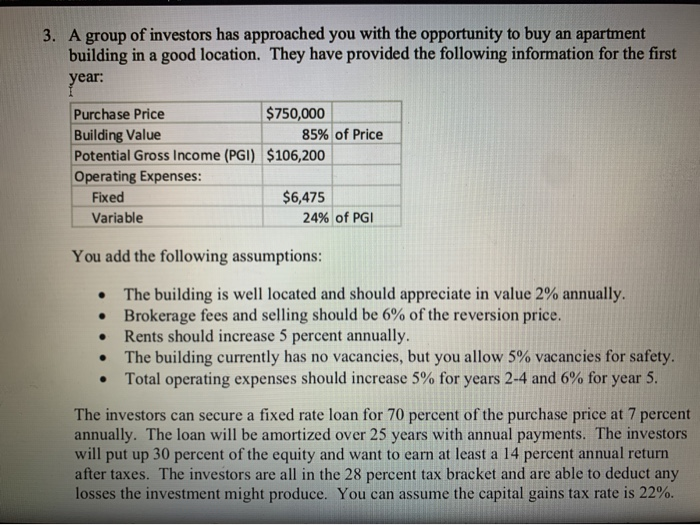

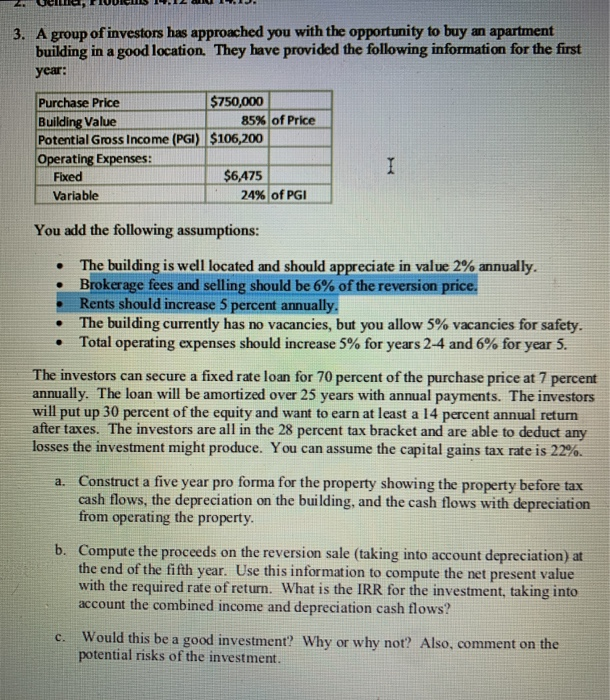

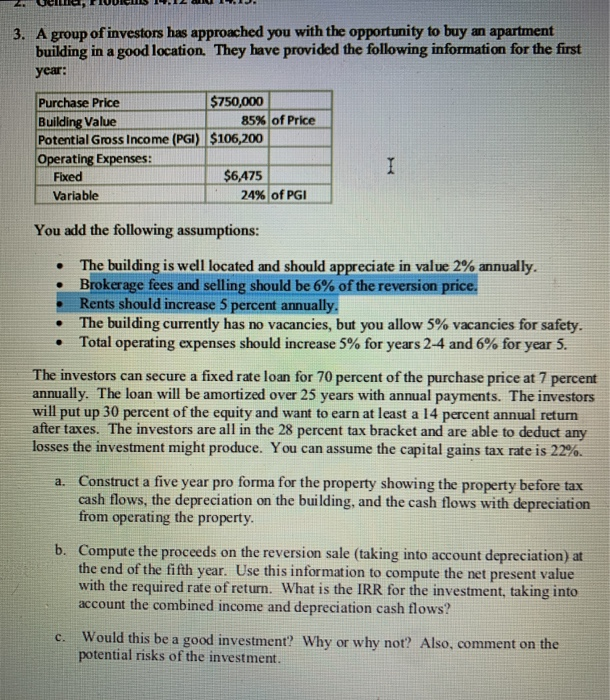

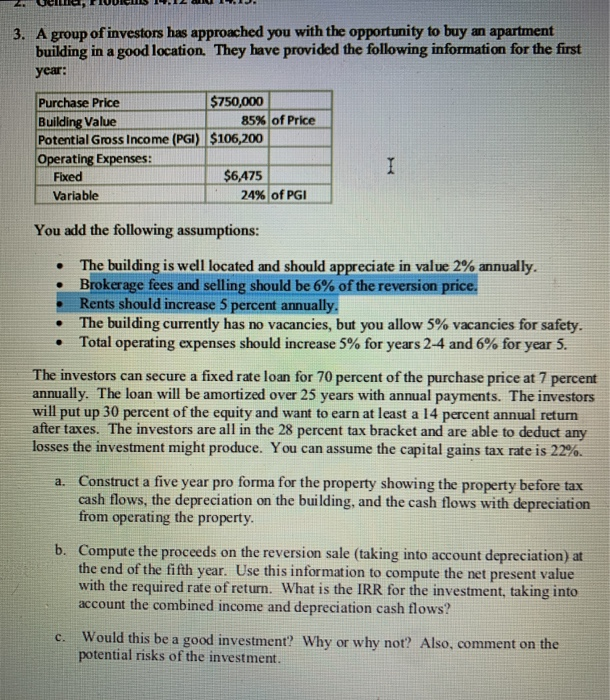

3. A group of investors has approached you with the opportunity to buy an apartment building in a good location. They have provided the following information for the first year: Purchase Price $750,000 Building Value 85% of Price Potential Gross Income (PGI) $106,200 Operating Expenses: Fixed $6,475 Variable 24% of PGI You add the following assumptions: The building is well located and should appreciate in value 2% annually. Brokerage fees and selling should be 6% of the reversion price. Rents should increase 5 percent annually. The building currently has no vacancies, but you allow 5% vacancies for safety. Total operating expenses should increase 5% for years 2-4 and 6% for year 5. The investors can secure a fixed rate loan for 70 percent of the purchase price at 7 percent annually. The loan will be amortized over 25 years with annual payments. The investors will put up 30 percent of the equity and want to earn at least a 14 percent annual return after taxes. The investors are all in the 28 percent tax bracket and are able to deduct any losses the investment might produce. You can assume the capital gains tax rate is 22%. 4. U , ERVUR E N 3. A group of investors has approached you with the opportunity to buy an apartment building in a good location. They have provided the following information for the first year: Purchase Price $750,000 Building Value 85% of Price Potential Gross Income (PGI) $106,200 Operating Expenses: Fixed $6,475 Variable 24% of PGI You add the following assumptions: The building is well located and should appreciate in value 2% annually. Brokerage fees and selling should be 6% of the reversion price. Rents should increase 5 percent annually. The building currently has no vacancies, but you allow 5% vacancies for safety. Total operating expenses should increase 5% for years 2-4 and 6% for year 5. The investors can secure a fixed rate loan for 70 percent of the purchase price at 7 percent annually. The loan will be amortized over 25 years with annual payments. The investors will put up 30 percent of the equity and want to earn at least a 14 percent annual retum after taxes. The investors are all in the 28 percent tax bracket and are able to deduct any losses the investment might produce. You can assume the capital gains tax rate is 22%. a. Construct a five year pro forma for the property showing the property before tax cash flows, the depreciation on the building, and the cash flows with depreciation from operating the property. b. Compute the proceeds on the reversion sale (taking into account depreciation) at the end of the fifth year. Use this information to compute the net present value with the required rate of return. What is the IRR for the investment, taking into account the combined income and depreciation cash flows? c. Would this be a good investment? Why or why not? Also, comment on the potential risks of the investment. 3. A group of investors has approached you with the opportunity to buy an apartment building in a good location. They have provided the following information for the first year: Purchase Price $750,000 Building Value 85% of Price Potential Gross Income (PGI) $106,200 Operating Expenses: Fixed $6,475 Variable 24% of PGI You add the following assumptions: The building is well located and should appreciate in value 2% annually. Brokerage fees and selling should be 6% of the reversion price. Rents should increase 5 percent annually. The building currently has no vacancies, but you allow 5% vacancies for safety. Total operating expenses should increase 5% for years 2-4 and 6% for year 5. The investors can secure a fixed rate loan for 70 percent of the purchase price at 7 percent annually. The loan will be amortized over 25 years with annual payments. The investors will put up 30 percent of the equity and want to earn at least a 14 percent annual return after taxes. The investors are all in the 28 percent tax bracket and are able to deduct any losses the investment might produce. You can assume the capital gains tax rate is 22%. 4. U , ERVUR E N 3. A group of investors has approached you with the opportunity to buy an apartment building in a good location. They have provided the following information for the first year: Purchase Price $750,000 Building Value 85% of Price Potential Gross Income (PGI) $106,200 Operating Expenses: Fixed $6,475 Variable 24% of PGI You add the following assumptions: The building is well located and should appreciate in value 2% annually. Brokerage fees and selling should be 6% of the reversion price. Rents should increase 5 percent annually. The building currently has no vacancies, but you allow 5% vacancies for safety. Total operating expenses should increase 5% for years 2-4 and 6% for year 5. The investors can secure a fixed rate loan for 70 percent of the purchase price at 7 percent annually. The loan will be amortized over 25 years with annual payments. The investors will put up 30 percent of the equity and want to earn at least a 14 percent annual retum after taxes. The investors are all in the 28 percent tax bracket and are able to deduct any losses the investment might produce. You can assume the capital gains tax rate is 22%. a. Construct a five year pro forma for the property showing the property before tax cash flows, the depreciation on the building, and the cash flows with depreciation from operating the property. b. Compute the proceeds on the reversion sale (taking into account depreciation) at the end of the fifth year. Use this information to compute the net present value with the required rate of return. What is the IRR for the investment, taking into account the combined income and depreciation cash flows? c. Would this be a good investment? Why or why not? Also, comment on the potential risks of the investment