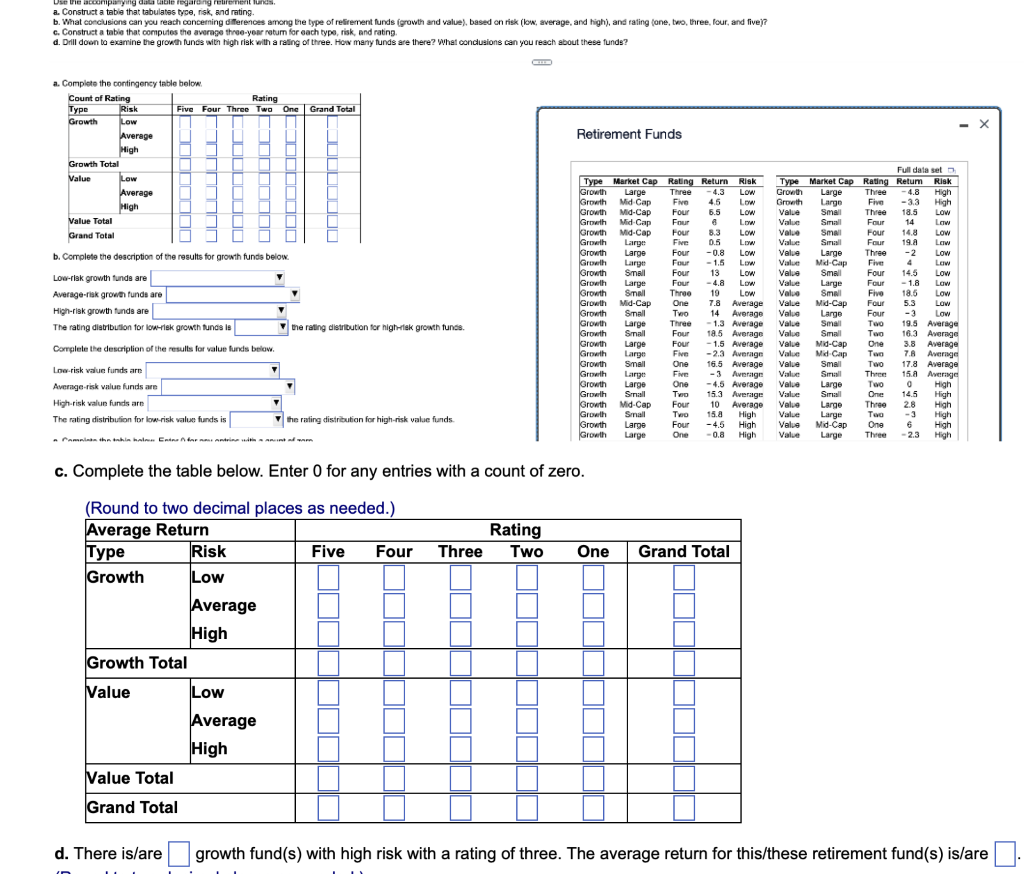

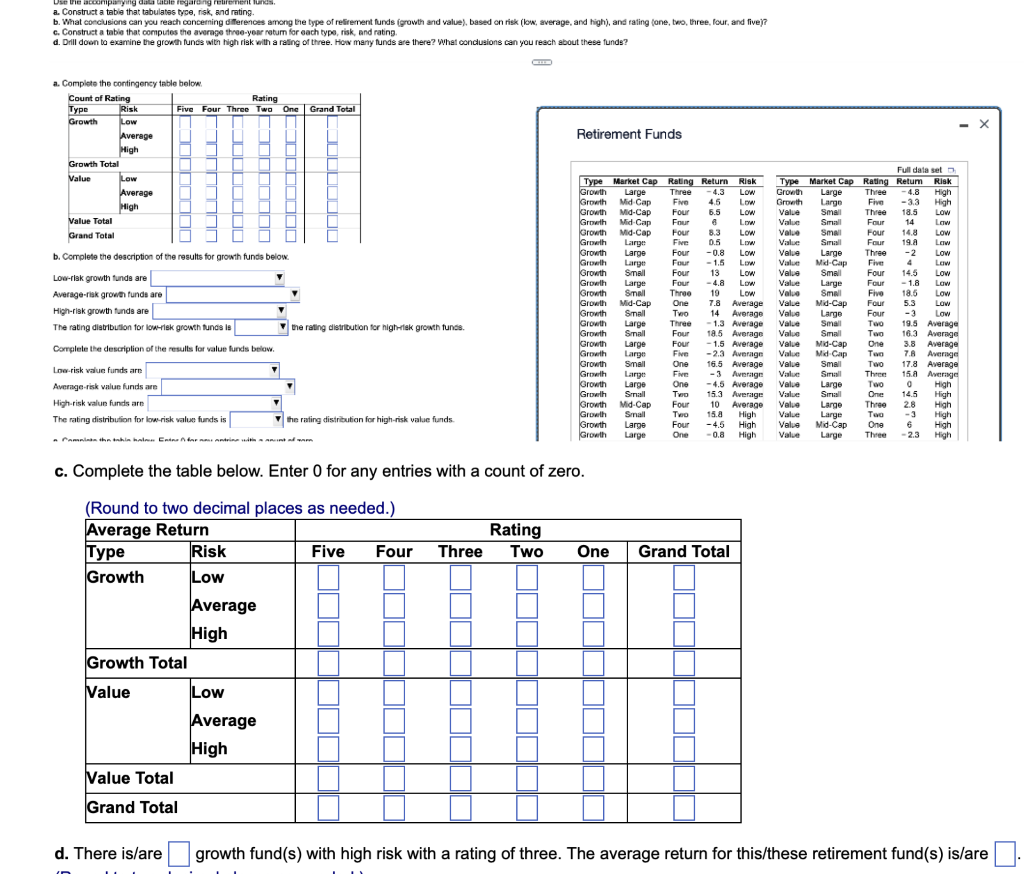

a. Construct a tabia that tabulates tyse, risk, Bnd reting. b. What coecusions can you reach concerning differences among ble type of retirement funds (growth and value), based en risk (low, average, and high), and tating (one, two, three, lour, and five)? c. Construst a tabie that compuses the average thee-year rotum for each type, risk, and rating d. Dill doen to examine the groweth funds with high risk with a raling of three. How marly funds are there? What conclusions can you reach about these funds? a. Complete the contingency table below: Retirement Funds b. Complete the description of the results for growth funds below. Low-rlak growth funde are Average-fiak growe funds ai High-risk growth funds are The rating diabribution for low-riek growth tunds is the rating distribution for high-riak growth funts. Corpplete the descriplion of the results for value funds belavi. Lne.risk value funds are Averige-risk value funds a High-risk valun funds arn The rating distribution for low-risk value funds is the rating distribution for high-risk value funds. c. Complete the table below. Enter 0 for any entries with a count of zero. (Round to two decimal nlaces as needed ) a. Construct a tabia that tabulates tyse, risk, Bnd reting. b. What coecusions can you reach concerning differences among ble type of retirement funds (growth and value), based en risk (low, average, and high), and tating (one, two, three, lour, and five)? c. Construst a tabie that compuses the average thee-year rotum for each type, risk, and rating d. Dill doen to examine the groweth funds with high risk with a raling of three. How marly funds are there? What conclusions can you reach about these funds? a. Complete the contingency table below: Retirement Funds b. Complete the description of the results for growth funds below. Low-rlak growth funde are Average-fiak growe funds ai High-risk growth funds are The rating diabribution for low-riek growth tunds is the rating distribution for high-riak growth funts. Corpplete the descriplion of the results for value funds belavi. Lne.risk value funds are Averige-risk value funds a High-risk valun funds arn The rating distribution for low-risk value funds is the rating distribution for high-risk value funds. c. Complete the table below. Enter 0 for any entries with a count of zero. (Round to two decimal nlaces as needed )