Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a. construct the loss matrix for david byrne'. Make sure you show loss in the top row and out-of-pocket cost in the bottom row in

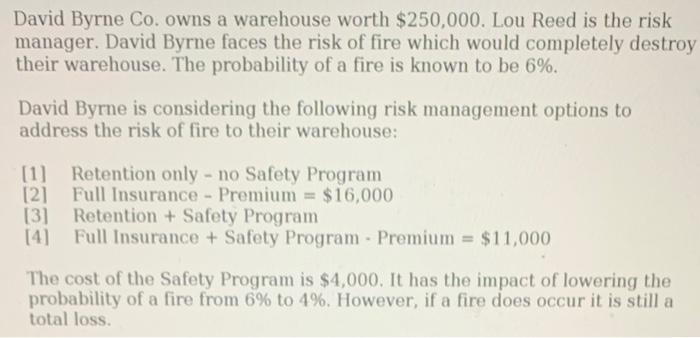

a. construct the loss matrix for david byrne'. Make sure you show loss in the top row and out-of-pocket cost in the bottom row in each cell of the loss matrix.

b. Assume Reed's worry value for retention without safety (WVr) is $1,200 and his worry value for retention with safety (WVrs) is $700. calculate the total expected cost of each of the four risk management options.

c. If Reed's decision rule is to pick the option that minimizes total expected cost, what risk management option does he choose?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started