Answered step by step

Verified Expert Solution

Question

1 Approved Answer

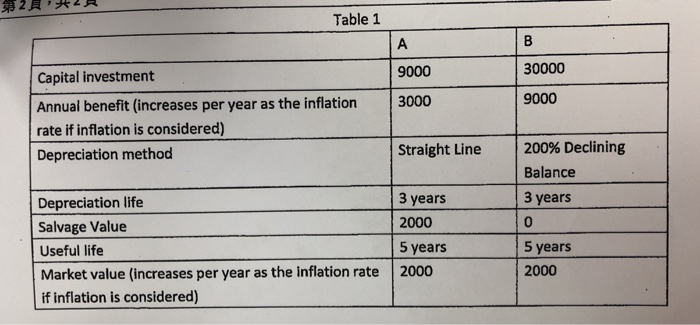

A construction company is considering to acquire new equipment. Table 1 is the information of two alternatives for this new equipment. Complete the following questions

A construction company is considering to acquire new equipment. Table 1 is the information of two alternatives for this new equipment. Complete the following questions according to the PW analysis The after-tax market minimum attractive acquire

(1) Which alternative should the company acquire?

(2) If the inflation rate is 2% per year and the base year is year 0, which company should you choose?

2 Table 1 Capital investment Annual benefit (increases per year as the inflation rate if inflation is considered) Depreciation method Depreciation life Salvage Value Useful life Market value (increases per year as the inflation rate if inflation is considered) A 9000 3000 Straight Line 3 years 2000 5 years 2000 B 30000 9000 200% Declining Balance 3 years 0 5 years 2000

Step by Step Solution

★★★★★

3.54 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Present ValuePV of Cash Flow Cash Flow1iN idiscount rate MARR12012 NYear of Cash Flow TAX RATE Assum...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started