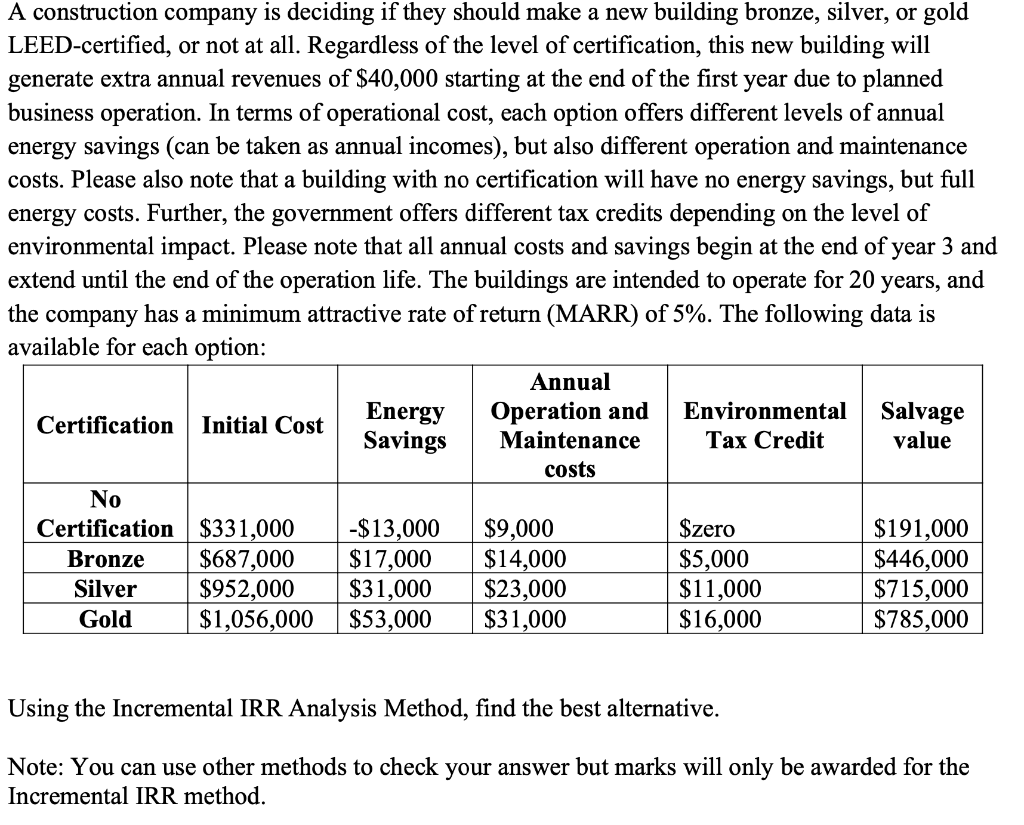

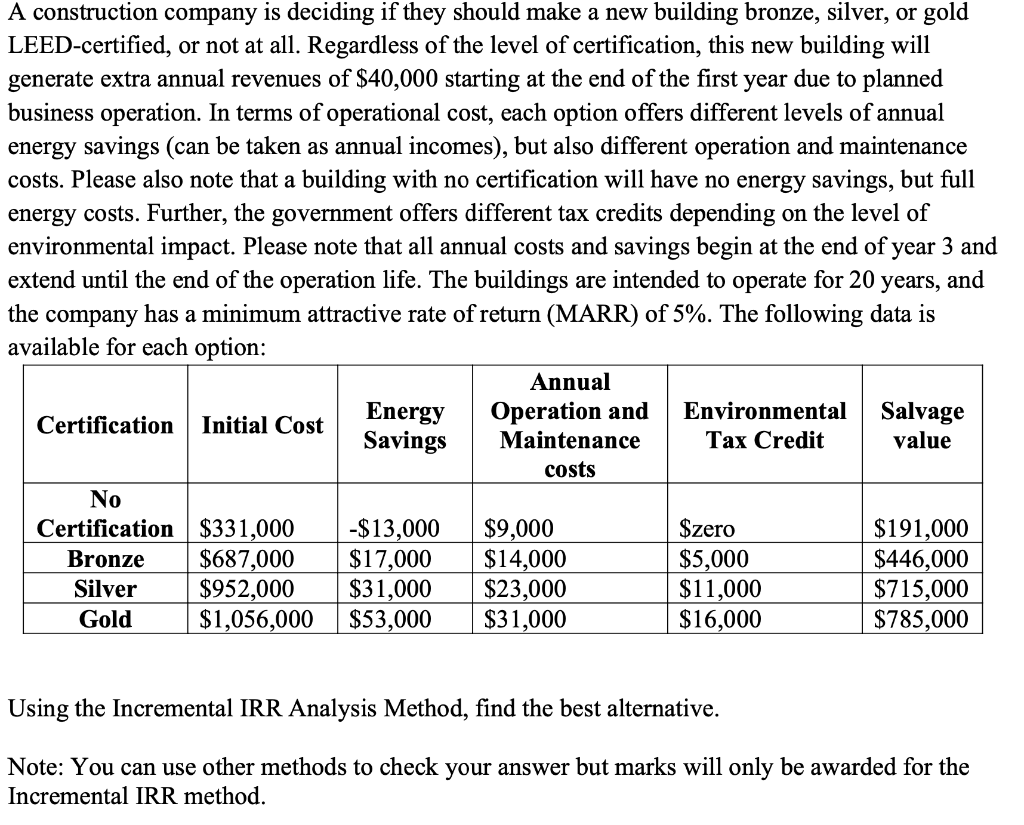

A construction company is deciding if they should make a new building bronze, silver, or gold LEED-certified, or not at all. Regardless of the level of certification, this new building will generate extra annual revenues of $40,000 starting at the end of the first year due to planned business operation. In terms of operational cost, each option offers different levels of annual energy savings (can be taken as annual incomes), but also different operation and maintenance costs. Please also note that a building with no certification will have no energy savings, but full energy costs. Further, the government offers different tax credits depending on the level of environmental impact. Please note that all annual costs and savings begin at the end of year 3 and extend until the end of the operation life. The buildings are intended to operate for 20 years, and the company has a minimum attractive rate of return (MARR) of 5%. The following data is available for each option: Annual Energy Environmental Certification Operation and Salvage Initial Cost Savings Maintenance Tax Credit value costs No Certification $331,000 -$13,000 $9,000 $zero $191,000 Bronze $687,000 $17,000 $14,000 $5,000 $446,000 Silver $952,000 $31,000 $23,000 $11,000 $715,000 Gold $1,056,000 $53,000 $31,000 $16,000 $785,000 Using the Incremental IRR Analysis Method, find the best alternative. Note: You can use other methods to check your answer but marks will only be awarded for the Incremental IRR method. A construction company is deciding if they should make a new building bronze, silver, or gold LEED-certified, or not at all. Regardless of the level of certification, this new building will generate extra annual revenues of $40,000 starting at the end of the first year due to planned business operation. In terms of operational cost, each option offers different levels of annual energy savings (can be taken as annual incomes), but also different operation and maintenance costs. Please also note that a building with no certification will have no energy savings, but full energy costs. Further, the government offers different tax credits depending on the level of environmental impact. Please note that all annual costs and savings begin at the end of year 3 and extend until the end of the operation life. The buildings are intended to operate for 20 years, and the company has a minimum attractive rate of return (MARR) of 5%. The following data is available for each option: Annual Energy Environmental Certification Operation and Salvage Initial Cost Savings Maintenance Tax Credit value costs No Certification $331,000 -$13,000 $9,000 $zero $191,000 Bronze $687,000 $17,000 $14,000 $5,000 $446,000 Silver $952,000 $31,000 $23,000 $11,000 $715,000 Gold $1,056,000 $53,000 $31,000 $16,000 $785,000 Using the Incremental IRR Analysis Method, find the best alternative. Note: You can use other methods to check your answer but marks will only be awarded for the Incremental IRR method