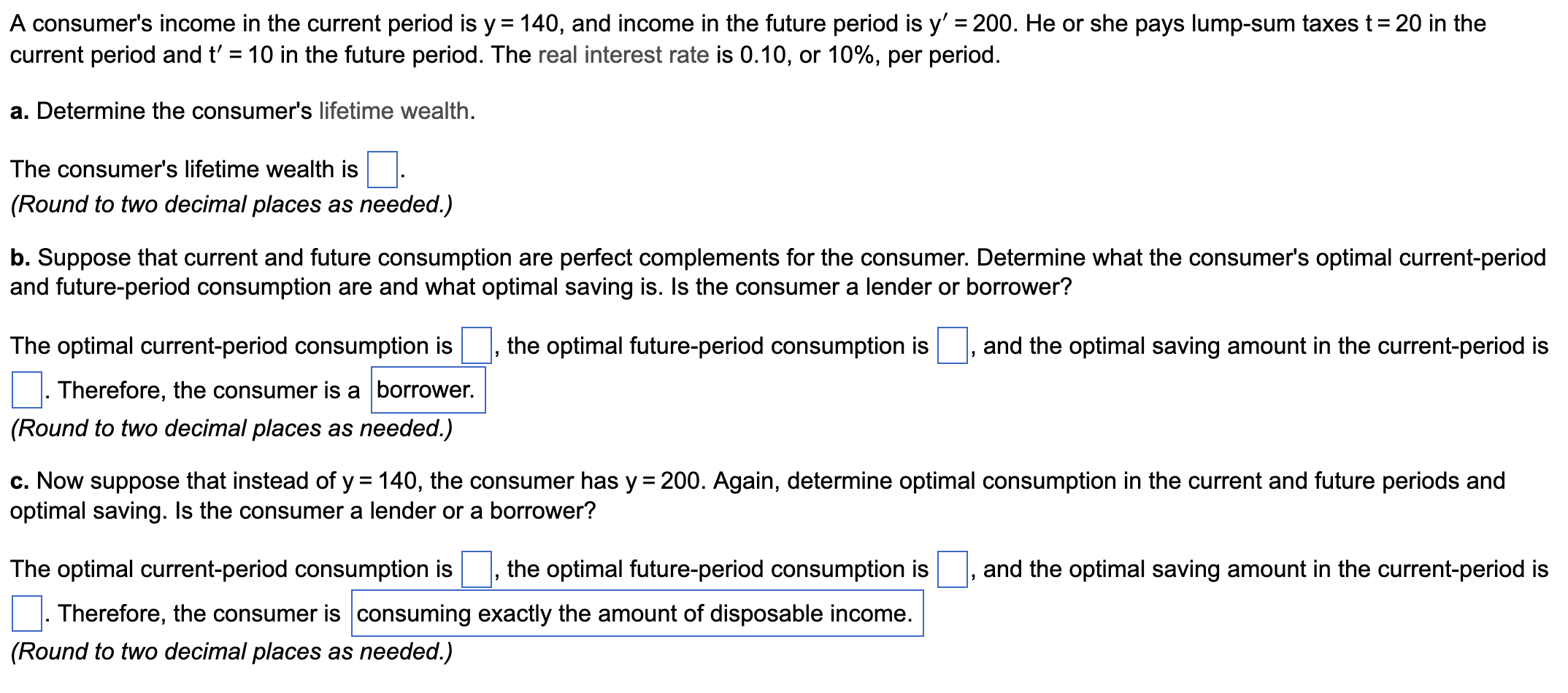

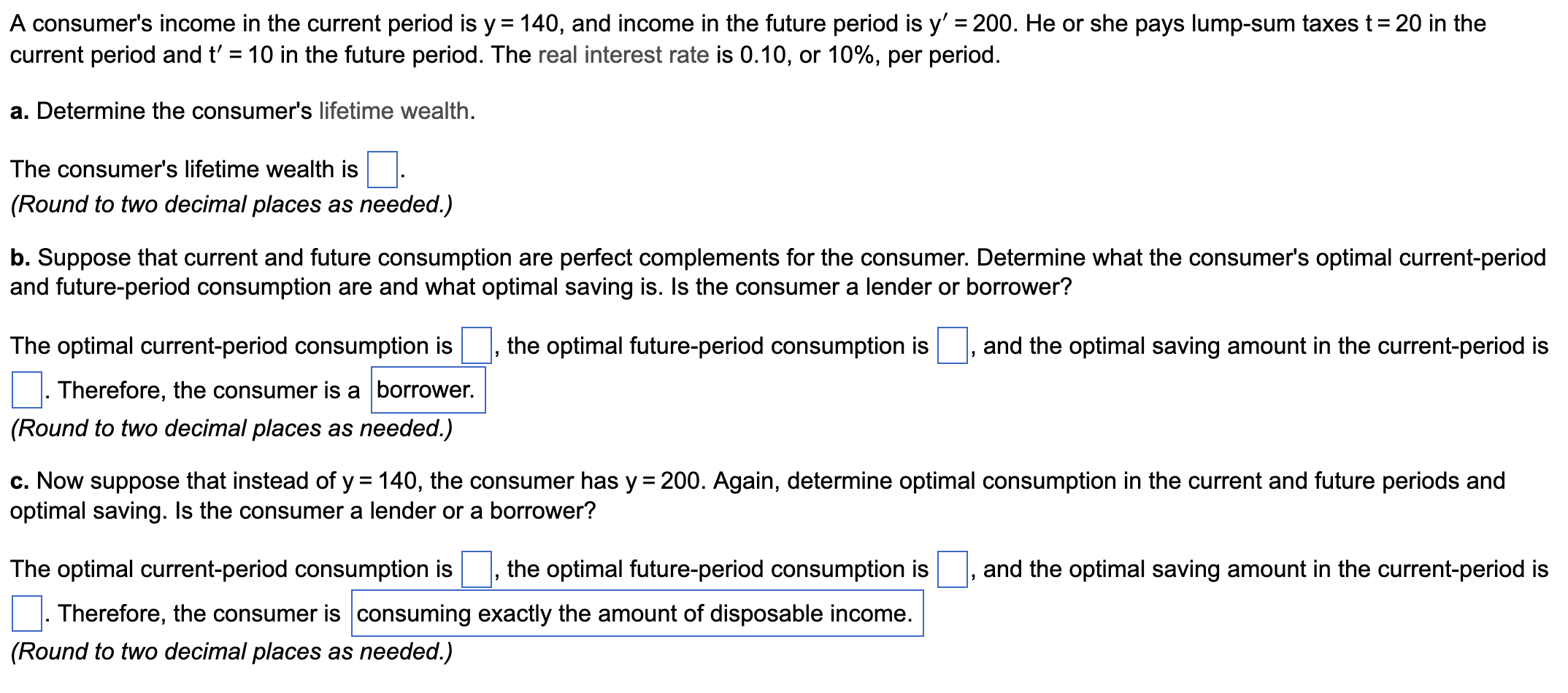

A consumer's income in the current period is y=140, and income in the future period is y=200. He or she pays lump-sum taxes t=20 in the current period and t=10 in the future period. The real interest rate is 0.10, or 10%, per period. a. Determine the consumer's lifetime wealth. The consumer's lifetime wealth is (Round to two decimal places as needed.) b. Suppose that current and future consumption are perfect complements for the consumer. Determine what the consumer's optimal current-period and future-period consumption are and what optimal saving is. Is the consumer a lender or borrower? The optimal current-period consumption is , the optimal future-period consumption is, and the optimal saving amount in the current-period is Therefore, the consumer is a (Round to two decimal places as needed.) c. Now suppose that instead of y=140, the consumer has y=200. Again, determine optimal consumption in the current and future periods and optimal saving. Is the consumer a lender or a borrower? The optimal current-period consumption is the optimal future-period consumption is and the optimal saving amount in the current-period is Therefore, the consumer is consuming exactly the amount of disposable income. (Round to two decimal places as needed.) A consumer's income in the current period is y=140, and income in the future period is y=200. He or she pays lump-sum taxes t=20 in the current period and t=10 in the future period. The real interest rate is 0.10, or 10%, per period. a. Determine the consumer's lifetime wealth. The consumer's lifetime wealth is (Round to two decimal places as needed.) b. Suppose that current and future consumption are perfect complements for the consumer. Determine what the consumer's optimal current-period and future-period consumption are and what optimal saving is. Is the consumer a lender or borrower? The optimal current-period consumption is , the optimal future-period consumption is, and the optimal saving amount in the current-period is Therefore, the consumer is a (Round to two decimal places as needed.) c. Now suppose that instead of y=140, the consumer has y=200. Again, determine optimal consumption in the current and future periods and optimal saving. Is the consumer a lender or a borrower? The optimal current-period consumption is the optimal future-period consumption is and the optimal saving amount in the current-period is Therefore, the consumer is consuming exactly the amount of disposable income. (Round to two decimal places as needed.)