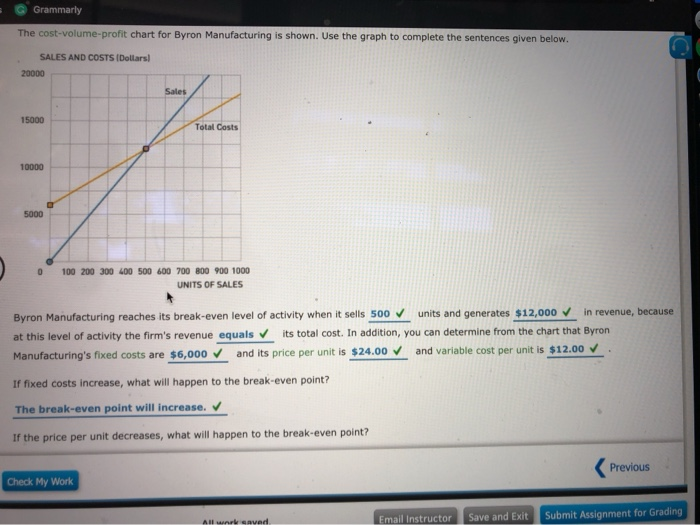

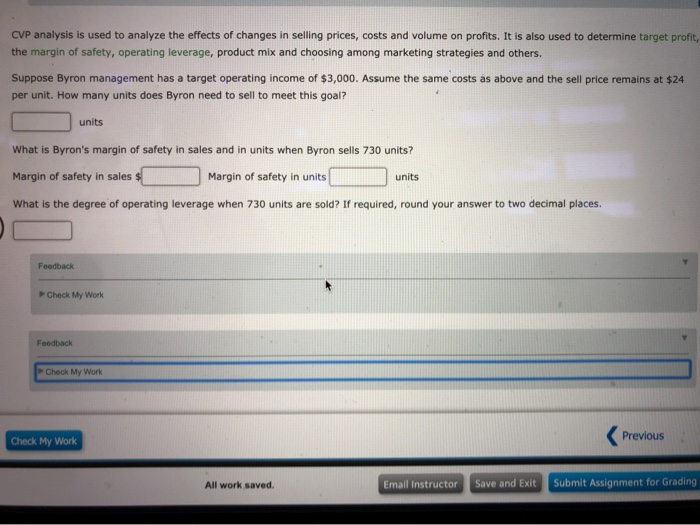

A contribution margin income statement organizes costs by behavior (variable or fixed), rather than by function (operating, selling, or administrative). The contribution margin is the difference between sales and variable expenses Byron Manufacturing has one product that sells for $24.00 per unit. The company estimates fixed costs at $6,000, direct materials at $4.00 per unit, direct lator at $5.00 per unit, and variable overhead costs at $3.00 per unit. Fill in the contribution margin income statement when 730 units are sold: Byron Manufacturing Contribution Margin Income Statement Sales Less: Variable costs Contribution margin Less: Fixed costs Operating income Calculate Byron Manufacturing's per unit contribution margin: $ The contribution margin ratio is 50% Calculating the Break-even Point: units. The break-even point in sales dollars is $ which is a break-even point in units of Previous Check My Work Submit Assignment for Grading All work saved Save and Exit Email Instructor Grammarly The cost-volume-profit chart for Byron Manufacturing is shown. Use the graph to complete the sentences given below. SALES AND COSTS (Dollars 20000 Sales 15000 Total Costs 10000 5000 100 200 300 400 500 600 700 800 900 1000 UNITS OF SALES in revenue, because units and generates $12,000 Byron Manufacturing reaches its break-even level of activity when it sells 500 at this level of activity the firm's revenue equals its total cost. In addition, you can determine from the chart that Byron Manufacturing's fixed costs are $6,000 and its price per unit is $24.00 and variable cost per unit is $12.00 If fixed costs increase, what will happen to the break-even point? The break-even point will increase. If the price per unit decreases, what will happen to the break-even point? Previous Check My Work Submit Assignment for Grading Save and Exit Email Instructor All work saved CVP analysis is used to analyze the effects of changes in selling prices, costs and volume on profits. It is also used to determine target profit, the margin of safety, operating leverage, product mix and choosing among marketing strategies and others. Suppose Byron management has a target operating income of $3,000. Assume the same costs as above and the sell price remains at $24 per unit. How many units does Byron need to sell to meet this goal? units What is Byron's margin of safety in sales and in units when Byron sells 730 units? Margin of safety in units Margin of safety in sales $ units What is the degree of operating leverage when 730 units are sold? If required, round your answer to two decimal places. Feedback Check My Work Feedback Check My Work ( Previous Check My Work Submit Assignment for Grading Save and Exit Email Instructor All work saved