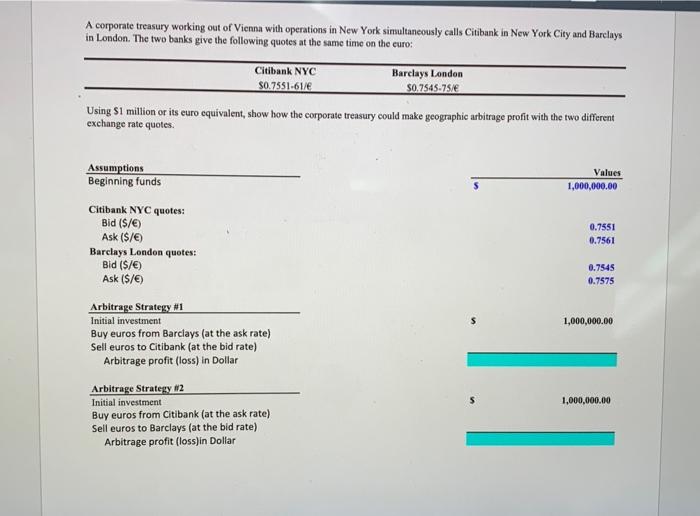

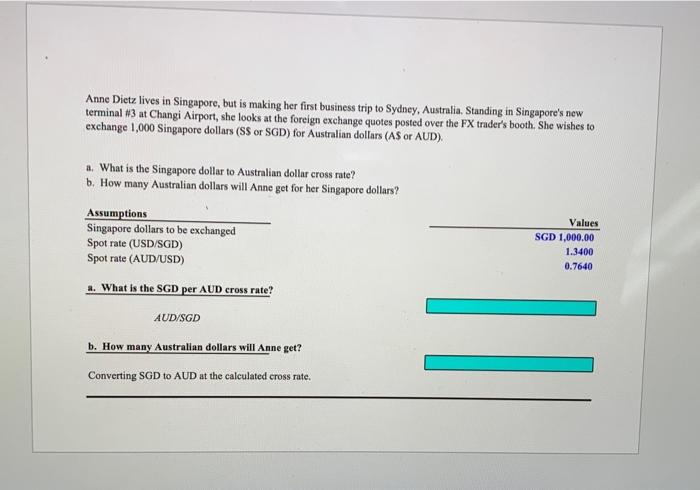

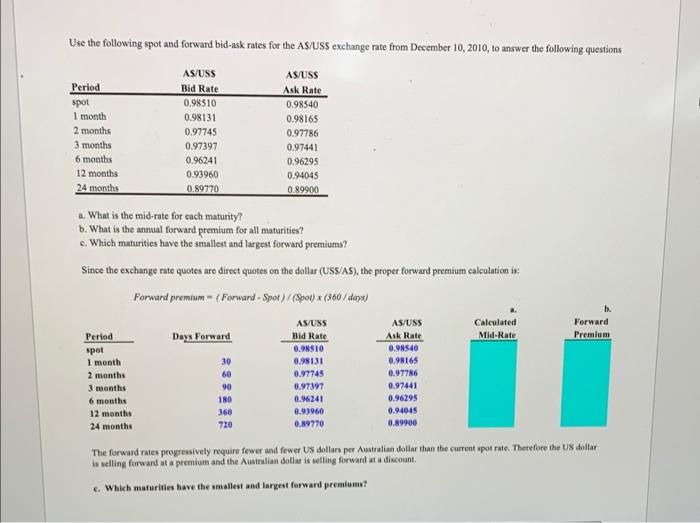

A corporate treasury working out of Vienna with operations in New York simultaneously calls Citibank in New York City and Barclays in London. The two banks give the following quotes at the same time on the euro: Using $1 million or its euro equivalent, show how the corporate treasury could make geographic arbitrage profit with the two different exchange rate quotes. Anne Dietz lives in Singapore, but is making her first business trip to Sydney, Australia. Standing in Singapore's new terminal #3 at Changi Airport, she looks at the foreign exchange quotes posted over the FX trader's booth. She wishes to exchange 1,000 Singapore dollars (SS or SGD) for Australian dollars (AS or AUD). a. What is the Singapore dollar to Australian dollar cross rate? b. How many Australian dollars will Anne get for her Singapore dollars? Use the following spot and forward bid-ask rates for the AS/USS exchange rate from December 10, 2010, to answer the following questions a. What is the mid-tate for cach maturity? b. What is the annual forward premium for all maturities? c. Which maturities have the smallest and largest forward premiums? Since the exchange nate quotes are direct quotes on the dollar (USS/AS), the proper forward premium calculation is: Forwand premium =( Fonwand Spot )/( Spot )(360/ days ) Calculated Mid-Rate The forward rates progressively require fewer and fewer US dollars per Australian dollar than the current spot rate. Therefore the US dollar is selling forward at a premium and the Ausiralian dollar is selling forwant at a discount. c. Which maturities have the sauallest and largest forward premiums? A corporate treasury working out of Vienna with operations in New York simultaneously calls Citibank in New York City and Barclays in London. The two banks give the following quotes at the same time on the euro: Using $1 million or its euro equivalent, show how the corporate treasury could make geographic arbitrage profit with the two different exchange rate quotes. Anne Dietz lives in Singapore, but is making her first business trip to Sydney, Australia. Standing in Singapore's new terminal #3 at Changi Airport, she looks at the foreign exchange quotes posted over the FX trader's booth. She wishes to exchange 1,000 Singapore dollars (SS or SGD) for Australian dollars (AS or AUD). a. What is the Singapore dollar to Australian dollar cross rate? b. How many Australian dollars will Anne get for her Singapore dollars? Use the following spot and forward bid-ask rates for the AS/USS exchange rate from December 10, 2010, to answer the following questions a. What is the mid-tate for cach maturity? b. What is the annual forward premium for all maturities? c. Which maturities have the smallest and largest forward premiums? Since the exchange nate quotes are direct quotes on the dollar (USS/AS), the proper forward premium calculation is: Forwand premium =( Fonwand Spot )/( Spot )(360/ days ) Calculated Mid-Rate The forward rates progressively require fewer and fewer US dollars per Australian dollar than the current spot rate. Therefore the US dollar is selling forward at a premium and the Ausiralian dollar is selling forwant at a discount. c. Which maturities have the sauallest and largest forward premiums