Answered step by step

Verified Expert Solution

Question

1 Approved Answer

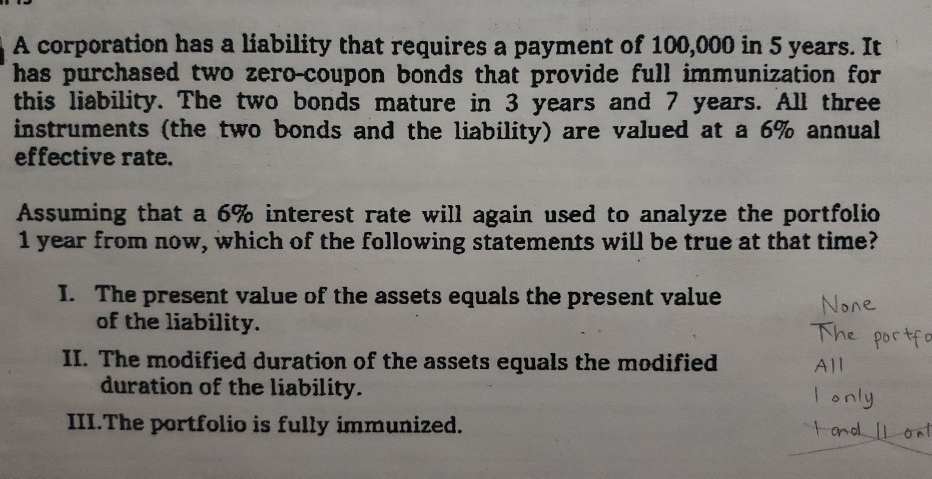

A corporation has a liability that requires a payment of 100,000 in 5 years. It has purchased two zero-coupon bonds that provide full immunization for

A corporation has a liability that requires a payment of 100,000 in 5 years. It has purchased two zero-coupon bonds that provide full immunization for this liability. The two bonds mature in 3 years and 7 yea instruments (the two bonds and the liability) are valued at a 6% annual effective rate. Assuming that a 6% interest rate will again used to analyze the portfolio 1 year from now, which of the following statements will be true at that time? portfo 1. The present value of the assets equals the present value of the liability. II. The modified duration of the assets equals the modified duration of the liability. III. The portfolio is fully immunized. None The All Tonly tand out

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started