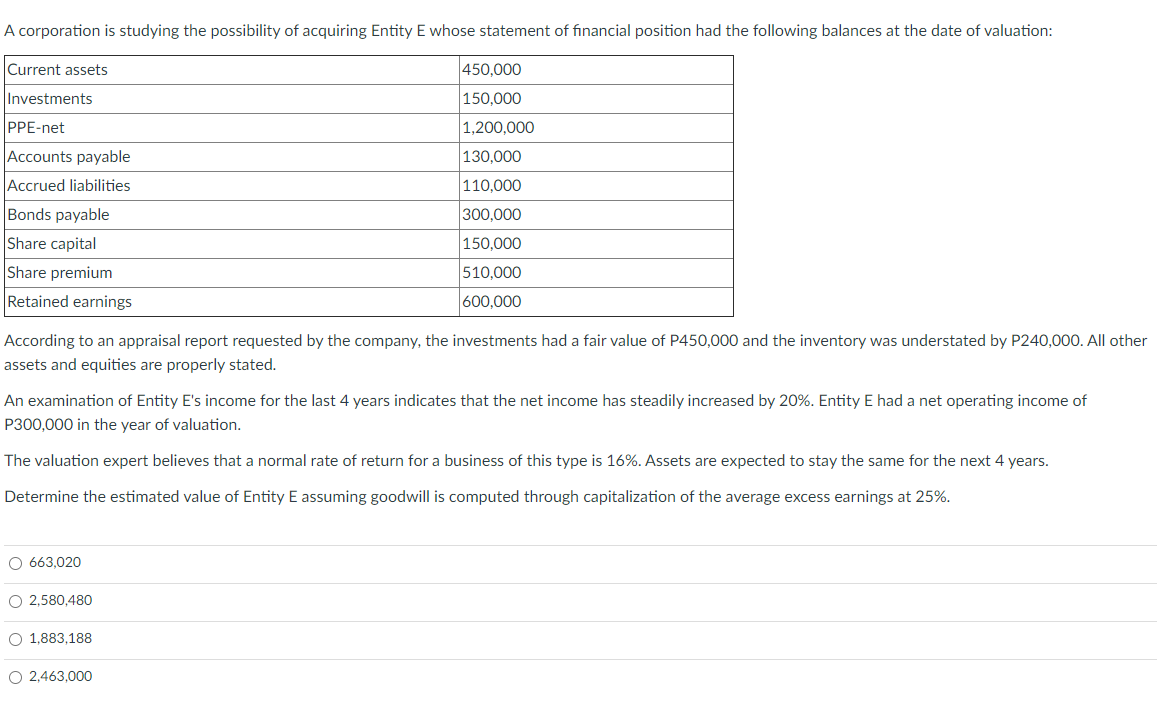

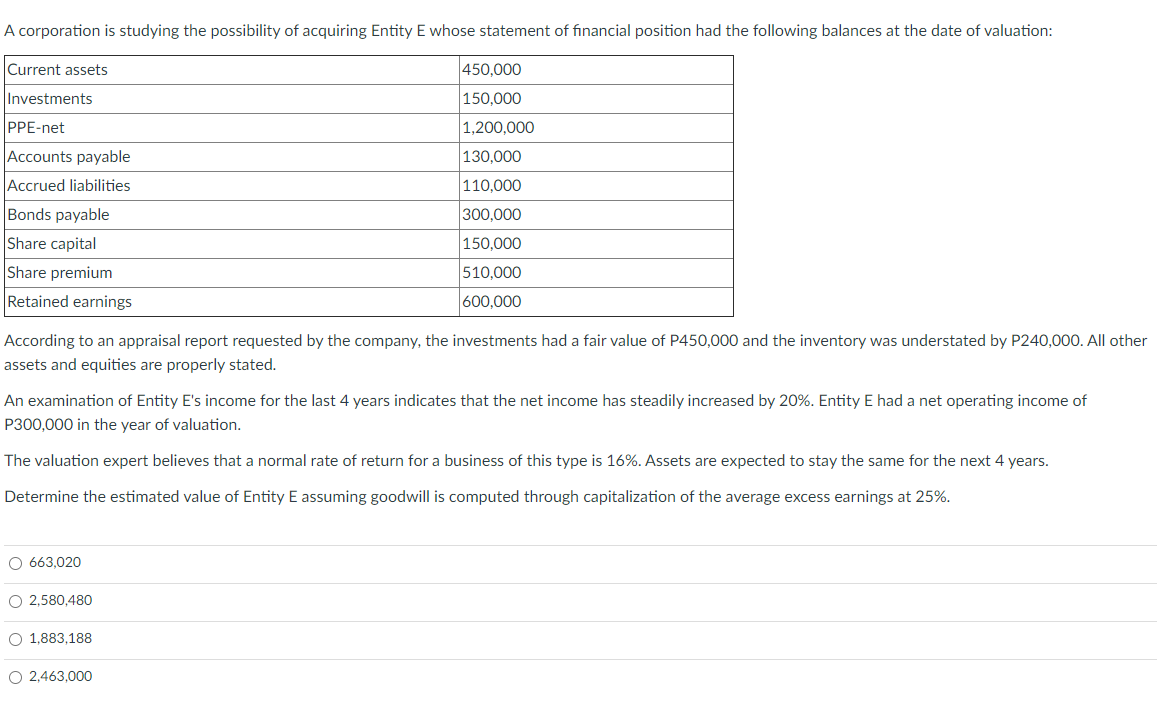

A corporation is studying the possibility of acquiring Entity E whose statement of financial position had the following balances at the date of valuation: Current assets 450,000 Investments 150,000 PPE-net 1,200,000 Accounts payable 130,000 Accrued liabilities 110,000 300,000 150,000 Bonds payable Share capital Share premium Retained earnings 510.000 600,000 According to an appraisal report requested by the company, the investments had a fair value of P450,000 and the inventory was understated by P240,000. All other assets and equities are properly stated. An examination of Entity E's income for the last 4 years indicates that the net income has steadily increased by 20%. Entity E had a net operating income of P300,000 in the year of valuation. The valuation expert believes that a normal rate of return for a business of this type is 16%. Assets are expected to stay the same for the next 4 years. Determine the estimated value of Entity E assuming goodwill is computed through capitalization of the average excess earnings at 25%. 0 663,020 O 2.580.480 O 1,883,188 O 2,463,000 A corporation is studying the possibility of acquiring Entity E whose statement of financial position had the following balances at the date of valuation: Current assets 450,000 Investments 150,000 PPE-net 1,200,000 Accounts payable 130,000 Accrued liabilities 110,000 300,000 150,000 Bonds payable Share capital Share premium Retained earnings 510.000 600,000 According to an appraisal report requested by the company, the investments had a fair value of P450,000 and the inventory was understated by P240,000. All other assets and equities are properly stated. An examination of Entity E's income for the last 4 years indicates that the net income has steadily increased by 20%. Entity E had a net operating income of P300,000 in the year of valuation. The valuation expert believes that a normal rate of return for a business of this type is 16%. Assets are expected to stay the same for the next 4 years. Determine the estimated value of Entity E assuming goodwill is computed through capitalization of the average excess earnings at 25%. 0 663,020 O 2.580.480 O 1,883,188 O 2,463,000