Answered step by step

Verified Expert Solution

Question

1 Approved Answer

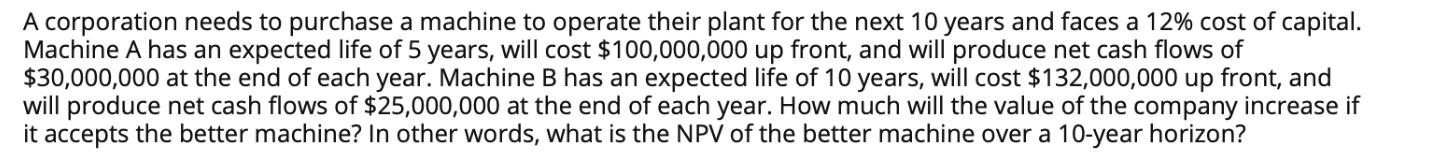

A corporation needs to purchase a machine to operate their plant for the next 10 years and faces a 12% cost of capital. Machine

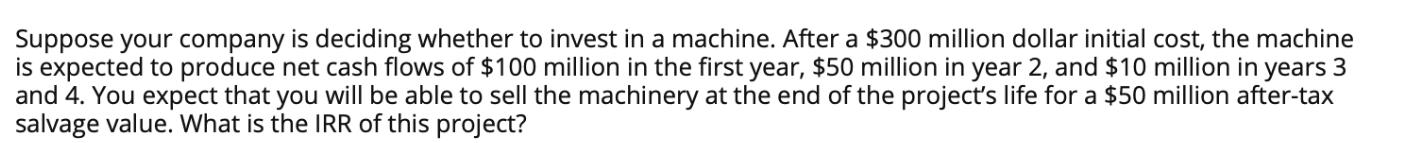

A corporation needs to purchase a machine to operate their plant for the next 10 years and faces a 12% cost of capital. Machine A has an expected life of 5 years, will cost $100,000,000 up front, and will produce net cash flows of $30,000,000 at the end of each year. Machine B has an expected life of 10 years, will cost $132,000,000 up front, and will produce net cash flows of $25,000,000 at the end of each year. How much will the value of the company increase if it accepts the better machine? In other words, what is the NPV of the better machine over a 10-year horizon? Suppose your company is deciding whether to invest in a machine. After a $300 million dollar initial cost, the machine is expected to produce net cash flows of $100 million in the first year, $50 million in year 2, and $10 million in years 3 and 4. You expect that you will be able to sell the machinery at the end of the project's life for a $50 million after-tax salvage value. What is the IRR of this project?

Step by Step Solution

★★★★★

3.52 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

It appears youve provided two distinct cases where a company is evaluating the purchase of a machine using investment appraisal methods The first case ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started