Question

A corporation owns an office building and land. The office building and land were acquired in 1978 for $1,100,000 and $80,000, respectively. During the current

A corporation owns an office building and land. The office building and land were acquired in 1978 for $1,100,000 and $80,000, respectively. During the current year, the properties are sold for $1,180,000 with 40% of the selling price being allocated to the land. The assets as shown on the corporation's books before their sale are as follows:

Building $1,100,000

Accumulated depreciation 980,000(a) $120,000

Land 80,000

(a) If the straight-line method of depreciation had been used, the accumulated depreciation would be $860,000.

A. What is the recognized gain due to the sale of the building?

B.

ANSWER BOTH CORRECTLY AND I WILL RATE YOU HIGHLY THANKS!

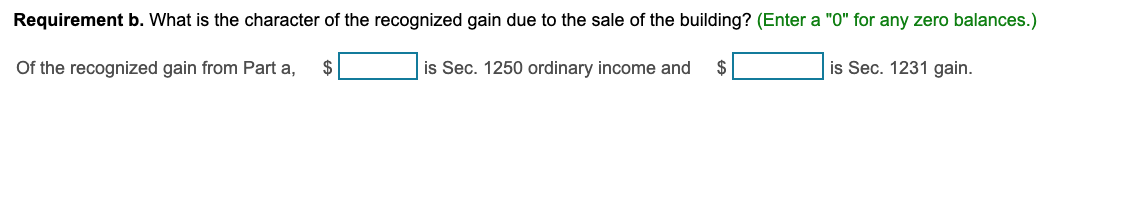

Requirement b. What is the character of the recognized gain due to the sale of the building? (Enter a "0" for any zero balances.) Of the recognized gain from Parta, $ is Sec. 1250 ordinary income and $ is Sec. 1231 gainStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started