Answered step by step

Verified Expert Solution

Question

1 Approved Answer

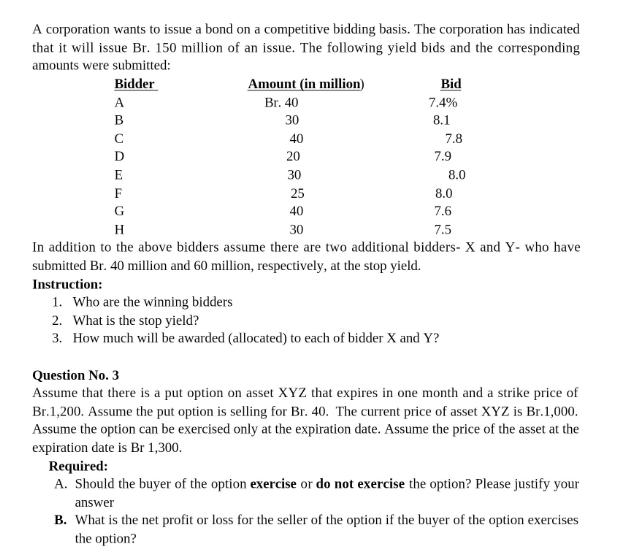

A corporation wants to issue a bond on a competitive bidding basis. The corporation has indicated that it will issue Br. 150 million of

A corporation wants to issue a bond on a competitive bidding basis. The corporation has indicated that it will issue Br. 150 million of an issue. The following yield bids and the corresponding amounts were submitted: Bidder A B D E F G Amount (in million) Br. 40 30 40 20 30 Bid 7.4% 8.1 7.8 7.9 1. Who are the winning bidders 2. What is the stop yield? 3. How much will be awarded (allocated) to each of bidder X and Y? 8.0 25 40 H 30 7.5 In addition to the above bidders assume there are two additional bidders-X and Y- who have submitted Br. 40 million and 60 million, respectively, at the stop yield. Instruction: 8.0 7.6 Question No. 3 Assume that there is a put option on asset XYZ that expires in one month and a strike price of Br.1,200. Assume the put option is selling for Br. 40. The current price of asset XYZ is Br.1,000. Assume the option can be exercised only at the expiration date. Assume the price of the asset at the expiration date is Br 1,300. Required: A. Should the buyer of the option exercise or do not exercise the option? Please justify your answer B. What is the net profit or loss for the seller of the option if the buyer of the option exercises the option?

Step by Step Solution

★★★★★

3.35 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Your image contains both a table of bond yield bids from various bidders and a question related to a put option on an asset I can address both these pieces of information Lets start with the questions ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started