Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume further that the share capital of the bank is Br. 70,000 and Retained earnings and legal reserves amounted Br. 60,000 and Br. 40,000

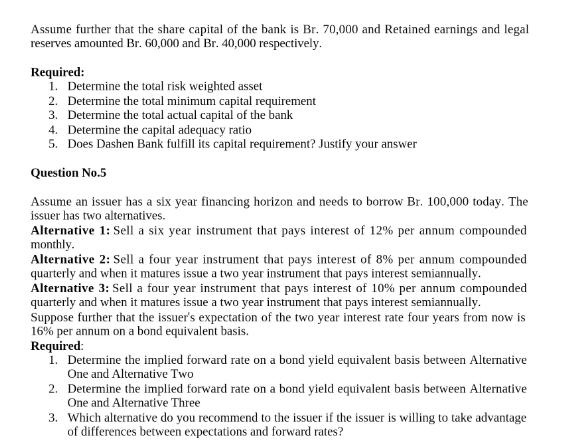

Assume further that the share capital of the bank is Br. 70,000 and Retained earnings and legal reserves amounted Br. 60,000 and Br. 40,000 respectively. Required: 1. Determine the total risk weighted asset 2. Determine the total minimum capital requirement 3. Determine the total actual capital of the bank 4. Determine the capital adequacy ratio 5. Does Dashen Bank fulfill its capital requirement? Justify your answer Question No.5 Assume an issuer has a six year financing horizon and needs to borrow Br. 100,000 today. The issuer has two alternatives. Alternative 1: Sell a six year instrument that pays interest of 12% per annum compounded monthly. Alternative 2: Sell a four year instrument that pays interest of 8% per annum compounded quarterly and when it matures issue a two year instrument that pays interest semiannually. Alternative 3: sell a four year instrument that pays interest of 10% per annum compounded quarterly and when it matures issue a two year instrument that pays interest semiannually. Suppose further that the issuer's expectation of the two year interest rate four years from now is 16% per annum on a bond equivalent basis. Required: 1. Determine the implied forward rate on a bond yield equivalent basis between Alternative One and Alternative Two 2. Determine the implied forward rate on a bond yield equivalent basis between Alternative One and Alternative Three 3. Which alternative do you recommend to the issuer if the issuer is willing to take advantage of differences between expectations and forward rates?

Step by Step Solution

★★★★★

3.45 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

The image youve provided describes a theoretical exercise related to finance specifically concerning bond yields and forward rates for various financial instruments with different interest compounding ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started