Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A country has two citizens, Bill and Ted. Bill has a private legal business. He earns $ 1 0 0 per hour. At a tax

A country has two citizens, Bill and Ted.

Bill has a private legal business. He earns $ per hour. At a tax rate of Bill

works hours. At a tax rate, he chooses to work hours, and at a tax

rate, he would work only hours per week.

Ted works a manufacturing job. He works hours per week and earns $ per hour,

regardless of the tax rate.

The government is considering imposing an income tax of either or on Bill and

using the revenues to make transfer payments to Ted. The following table summarizes the

three possible policies.

Effects of Redistributive Policies

a Suppose that Bill and Ted care only about net income, ie their utility function is

linear in net income

i Is either policy proposal more efficient than the status quo of no taxes? Why?

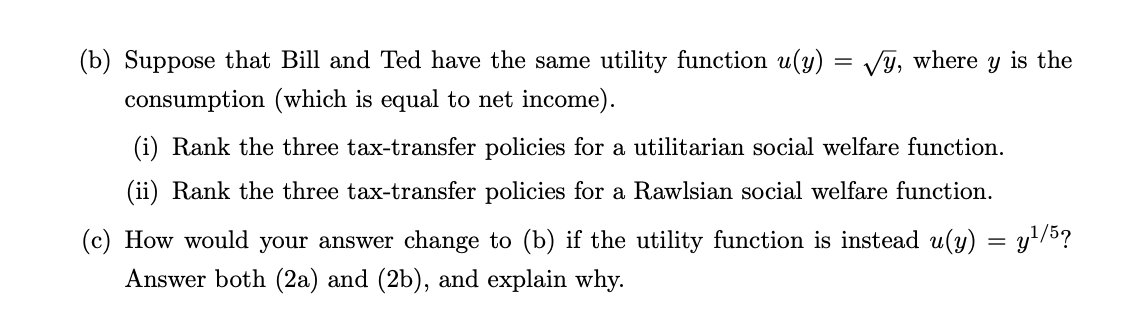

ii Is either taxtransfer proposal less than optimal? Explain.b Suppose that Bill and Ted have the same utility function where is the

consumption which is equal to net income

i Rank the three taxtransfer policies for a utilitarian social welfare function.

ii Rank the three taxtransfer policies for a Rawlsian social welfare function.

c How would your answer change to b if the utility function is instead

Answer both a and b and explain why.

PLEASE SHOW ALL WORK ON PAPER OR DOC. THANK YOU

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started