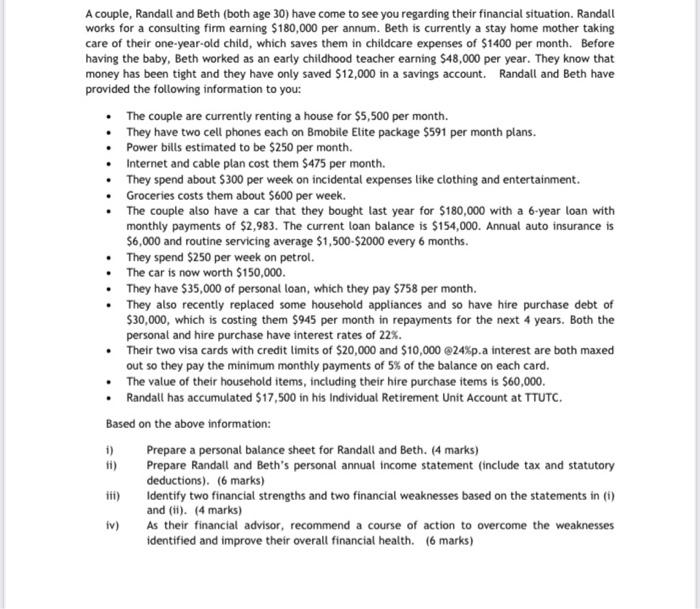

A couple, Randall and Beth (both age 30) have come to see you regarding their financial situation. Randall works for a consulting firm earning $180,000 per annum. Beth is currently a stay home mother taking care of their one-year-old child, which saves them in childcare expenses of $1400 per month. Before having the baby, Beth worked as an early childhood teacher earning $48,000 per year. They know that money has been tight and they have only saved $12,000 in a savings account. Randall and Beth have provided the following information to you: The couple are currently renting a house for $5,500 per month. They have two cell phones each on Bmobile Elite package $591 per month plans. Power bills estimated to be $250 per month. Internet and cable plan cost them $475 per month. They spend about $300 per week on incidental expenses like clothing and entertainment. Groceries costs them about $600 per week. The couple also have a car that they bought last year for $180,000 with a 6-year loan with monthly payments of $2,983. The current loan balance is $154,000. Annual auto insurance is $6,000 and routine servicing average $1,500-$2000 every 6 months. They spend $250 per week on petrol. The car is now worth $150,000. They have $35,000 of personal loan, which they pay $758 per month. They also recently replaced some household appliances and so have hire purchase debt of $30,000, which is costing them $945 per month in repayments for the next 4 years. Both the personal and hire purchase have interest rates of 22%. Their two visa cards with credit limits of $20,000 and $10,000 @24%p.a interest are both maxed out so they pay the minimum monthly payments of 5% of the balance on each card. The value of their household items, including their hire purchase items is $60,000. Randall has accumulated $17,500 in his Individual Retirement Unit Account at TTUTC. Based on the above information: i) Prepare a personal balance sheet for Randall and Beth. (4 marks) Prepare Randall and Beth's personal annual income statement (include tax and statutory deductions). (6 marks) Identify two financial strengths and two financial weaknesses based on the statements in (1) and (ii). (4 marks) iv) As their financial advisor, recommend a course of action to overcome the weaknesses identified and improve their overall financial health. (6 marks) A couple, Randall and Beth (both age 30) have come to see you regarding their financial situation. Randall works for a consulting firm earning $180,000 per annum. Beth is currently a stay home mother taking care of their one-year-old child, which saves them in childcare expenses of $1400 per month. Before having the baby, Beth worked as an early childhood teacher earning $48,000 per year. They know that money has been tight and they have only saved $12,000 in a savings account. Randall and Beth have provided the following information to you: The couple are currently renting a house for $5,500 per month. They have two cell phones each on Bmobile Elite package $591 per month plans. Power bills estimated to be $250 per month. Internet and cable plan cost them $475 per month. They spend about $300 per week on incidental expenses like clothing and entertainment. Groceries costs them about $600 per week. The couple also have a car that they bought last year for $180,000 with a 6-year loan with monthly payments of $2,983. The current loan balance is $154,000. Annual auto insurance is $6,000 and routine servicing average $1,500-$2000 every 6 months. They spend $250 per week on petrol. The car is now worth $150,000. They have $35,000 of personal loan, which they pay $758 per month. They also recently replaced some household appliances and so have hire purchase debt of $30,000, which is costing them $945 per month in repayments for the next 4 years. Both the personal and hire purchase have interest rates of 22%. Their two visa cards with credit limits of $20,000 and $10,000 @24%p.a interest are both maxed out so they pay the minimum monthly payments of 5% of the balance on each card. The value of their household items, including their hire purchase items is $60,000. Randall has accumulated $17,500 in his Individual Retirement Unit Account at TTUTC. Based on the above information: i) Prepare a personal balance sheet for Randall and Beth. (4 marks) Prepare Randall and Beth's personal annual income statement (include tax and statutory deductions). (6 marks) Identify two financial strengths and two financial weaknesses based on the statements in (1) and (ii). (4 marks) iv) As their financial advisor, recommend a course of action to overcome the weaknesses identified and improve their overall financial health. (6 marks)