Question: A couple would like to create a college fund for their newborn son. They estimate they will need $150,000 in 18 years. Assume they can

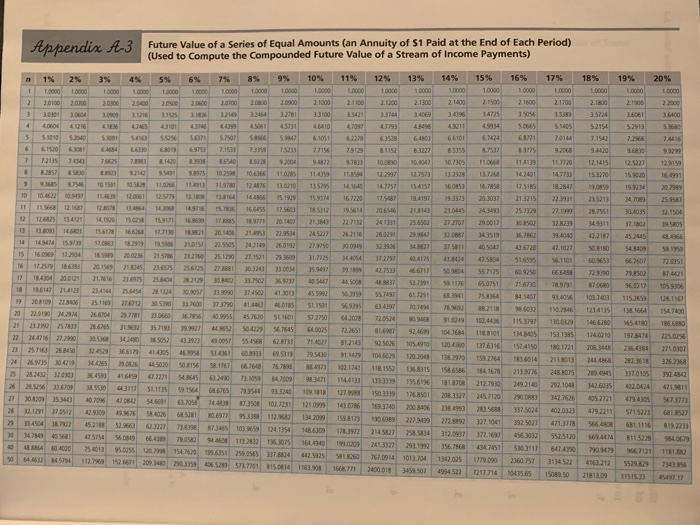

A bendix 1.3 Future Value of a series of Equal Amounts (an Annuity of 51 Paid at the End of Each Period) (Used to Compute the Compounded Future Value of a Stream of income Payments) 2% n 3% 6% 9% 18% 1% 4% 5% 7% 10% 12% 15% 16% 19% 8% 11% 13% 17% 20% 14% 1.000 10000 10000 0 1.0000 10000 10000 000 0 0 10000 1000 0000 000 1 0000 1.000 0000 20000 20000 2 20000 20000 20000 20100 20000 20000 20000 21000 2.1.200 2.1500 21800 21100 21300 2,1600 21900 21400 21700 1422 34069 136 33100 34100 3 13145 3.341 3.524 3.630130604 3.4543.7781 1.5056 36061 1611535 1.5309 5.2154 4 52913568 41216 136 4465 5051 51 64107097901991149934 SS SS 10146 595 50 5.7507 56 5 5.2040 5 5.00 510915 6 1051 6.493 674 52278 66101 68771 70144 7.2966 7.446 609 6465466330 69753 2.1533 733597.52 83227 7.315679179 5 155 6 752 150 63031 75 9.2008 9.4420 16830 9.3299 772035 TS 10 BESO 2 7004 94 97833 1020347 10.7305 11.4139 1 1.7720 12.1415 12.5927 12.9159 3 28575330 1 00 7 1025 10.63661107 11.45 TL 12997117112 14.401 147733 153270 15.900 16.4991 9 6 .7546 10.151 11570 12.46 1101013529 17757 15.4157 16.0853167858 17.5185 18.7847 13 20.7989 10 10.4622 1 12.0061 12.5 13.1608118164 16 5 .190915 1 67220120 4 97 19:3373 20.3037 21.3215 2219112 .531) 2009 25.9587 1 668 12. 1 2.2017 1708 149716 1 66455 17.5603 51219514 206546 21.8143 2104 N 25.7329 27.19992075510405 2.1504 1) 140 141 130 15.0 159 160 17.5 17 0 1 71 56500 27.2707 29.0017 30.1502328239 349311 17.1802 39.5805 13 11.0 156178 166 2.0 20.1056217214 2116 0 0 41519 67622790040 .187 452445 8.4066 14 M 173 170863 9 9 LIST 2.5505 2 9 2012 7.3050 099 17.5811 40 1 47620 47.1032 BISO 1409 58.1959 15 16.0 12.0 1999 20021576212750 25.12.201 1 23.3609 3.7725 404 37.2797 40.4175 1.0447.5804 5165 6 .101 60.565366360172.0351 16 17 186 201503 2655 256725 27 30234 1 353057 2 766717 9 55 215 60 9.250 72.979021502 74421 17 18.4304200121 216 10258054 129308402 31.750 40547 0018837 1 8 .1176 65.0751 716730 1 7.0680 360012105.9306 186 714123 23.54645422134 1 99903745041.300 400 50.3959 55.1997 751 1 75.836484.407 93.4056 103.74003 115.260 128.116 19 202109 22306 2510 276712 3050 37.37904140040185 51.150159995634097 0.1994 7 2 118 110.246 1214115138.1664 154.7400 20 22.01902334 26870497 330660 5 6409955 0 511601 57.2750 2078 205 306 1.6 102.45 115 009 146.6280 5.4180 18668 21 22 23 2622 357190 4 0.4229 56.7545 0025 72.2651 B 92.46 106 111 M 152.139510201977 2526 22 AM 27.2930 340 33923 1005755.4568 62.733 71.4001 1103 92.5026101.490 12001126316 4 15018012210 2 35 2 7107 23 257 25.8450 22 366179 1.43046 510 601 0.5319 7500911091046091202041387970 1971 1.014 211. 0 2 200365326368 24 X 30.421 4 50200156 5811571687688 3297) 2.1741 11815526831556586 134 1679 212776 OTS 2 3 32.0105 32.842 2003200 452 416 47.72715186452073.1059 700998347111440) 2139 151.615618110 212.7990 309 3140292.1043 342.6015020414471.9411 26 156 1670935530 1151113 1564666799548 340 0.181812799881501119 1268501 203 2457120 308 30252652721 479.4305 27 30.8209 5. 30 67.3773 40.709647060 7 0583 73500 102.7731210999140096 100 200 3406 238.4993 35688 317.50342020123 49.22115215223 281212911 370024293093076 SOM 5 7 0697133 112. 13400 159.817390.639 22.94992 2 3271041392.502147137566.000 114504 722 45. 2 1.1156813223 52.9653 270 1 0365134135410912 2 5431237269630325523120 30 470 45.5754 56.08966.430 8115270 406 1320 133075 0 .020924329335676134745130311141439070979 21 1982 50 644532 45754112715271 2013400 220.3359 36.52 5737701 315684160 1668. 000 34545o 1945 7211.74 1 .6 1 0 21110911515.239 .12

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts