Question

A coupon-bearing bond with a face value of $2180 and semi-annual coupons of 8% will mature in 19 years. The annual nominal yield convertible

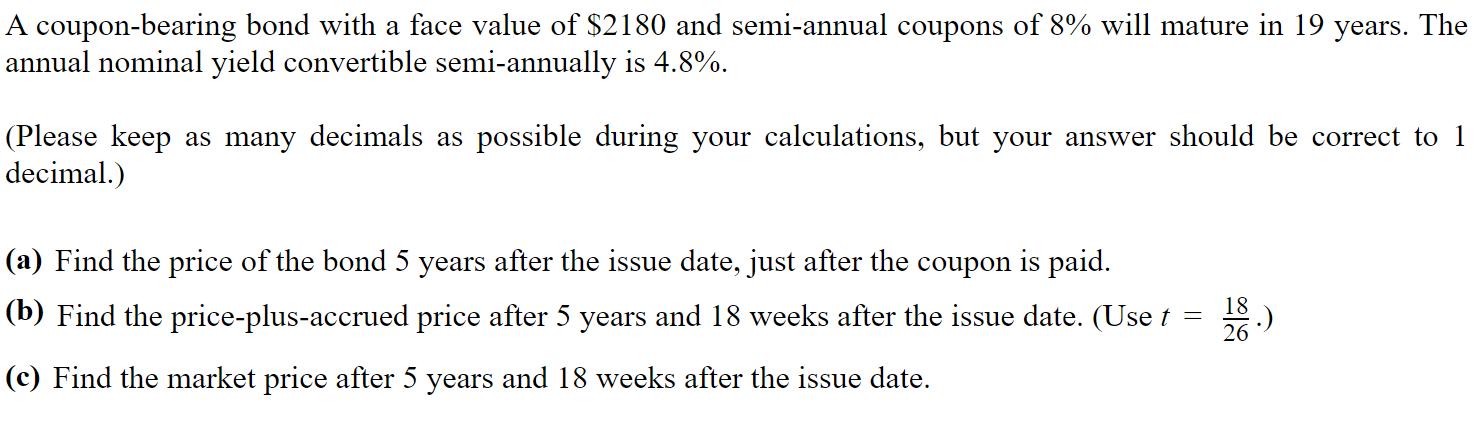

A coupon-bearing bond with a face value of $2180 and semi-annual coupons of 8% will mature in 19 years. The annual nominal yield convertible semi-annually is 4.8%. (Please keep as many decimals as possible during your calculations, but your answer should be correct to 1 decimal.) (a) Find the price of the bond 5 years after the issue date, just after the coupon is paid. (b) Find the price-plus-accrued price after 5 years and 18 weeks after the issue date. (Use t = 18 26 (c) Find the market price after 5 years and 18 weeks after the issue date.

Step by Step Solution

3.42 Rating (142 Votes )

There are 3 Steps involved in it

Step: 1

To solve this problem we can use the bond pricing formula The bond pricing formula calculates the present value of all future cash flows from the bond ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Management for Public, Health and Not-for-Profit Organizations

Authors: Steven A. Finkler, Daniel L. Smith, Thad D. Calabrese, Robert M. Purtell

5th edition

1506326846, 9781506326863, 1506326862, 978-1506326849

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App