Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A CPA recently completed an earnings and profits (E&P) study for Mylan Corp., a calendar-year C corporation. The results of the study indicated that

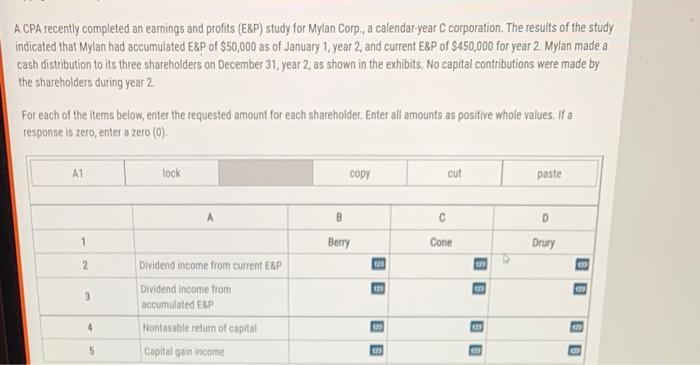

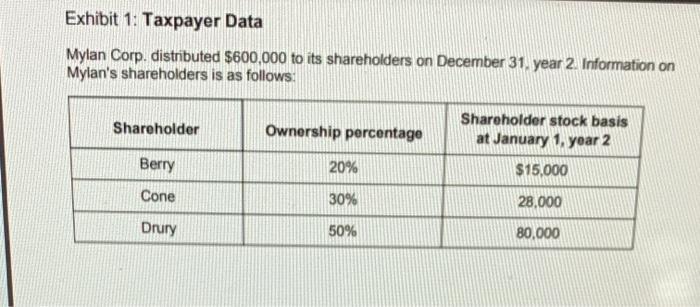

A CPA recently completed an earnings and profits (E&P) study for Mylan Corp., a calendar-year C corporation. The results of the study indicated that Mylan had accumulated E&P of $50,000 as of January 1, year 2, and current E&P of $450,000 for year 2. Mylan made a cash distribution to its three shareholders on December 31, year 2, as shown in the exhibits. No capital contributions were made by the shareholders during year 2. For each of the items below, enter the requested amount for each shareholder. Enter all amounts as positive whole values. If a response is zero, enter a zero (0). A1 lock copy cut paste B. Berry Cone Drury 2. Dividend income from current E&P Dividend income from accumulated E&P 23 23 Nontaxable return of capital Capital gain income Exhibit 1: Taxpayer Data Mylan Corp. distributed $600,000 to its shareholders on December 31, year 2. Information on Mylan's shareholders is as follows: Shareholder stock basis Shareholder Ownership percentage at January 1, year 2 Berry 20% $15,000 Cone 30% 28,000 Drury 50% 80,000

Step by Step Solution

★★★★★

3.45 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

When C corporations distributed dividend then it is reported to shareholders tax return as investment income If C corporation distribute more than its current and accumulated earning profit then it wi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started