Question

A credit default swap on a $10,000,000, is a two-year agreement, whereby B (the protection buyer) agrees to pay S (the guarantor, or protection seller)

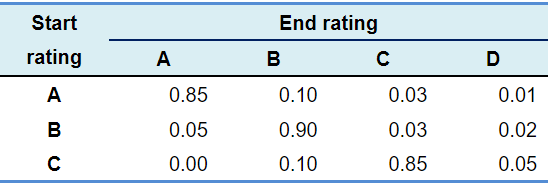

A credit default swap on a $10,000,000, is a two-year agreement, whereby B (the protection buyer) agrees to pay S (the guarantor, or protection seller) a fixed annual fee in exchange for protection against default of two-year bonds XYZ. The payout will be N(100BT)N(100BT), where BTBT is the price of the bond at expiration, if the credit event occurs and NN is the notional. Currently, XYZ bonds are rated A, have recovery rate of 50% and trade at 6.60%. The two-year T-note trades at 6.00%. A simplified transition matrix is shown below.

a. What is the average probability that XYZ bonds will default over a two-year period? (Show work)

\begin{tabular}{ccccc} \hline Start & \multicolumn{4}{c}{ End rating } \\ \cline { 2 - 5 } rating & A & B & C & D \\ \hline A & 0.85 & 0.10 & 0.03 & 0.01 \\ B & 0.05 & 0.90 & 0.03 & 0.02 \\ C & 0.00 & 0.10 & 0.85 & 0.05 \end{tabular} \begin{tabular}{ccccc} \hline Start & \multicolumn{4}{c}{ End rating } \\ \cline { 2 - 5 } rating & A & B & C & D \\ \hline A & 0.85 & 0.10 & 0.03 & 0.01 \\ B & 0.05 & 0.90 & 0.03 & 0.02 \\ C & 0.00 & 0.10 & 0.85 & 0.05 \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started