Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A currency trader in Hong Kong currently holds 100,000 New Zealand Dollars (NZD). To hedge the risk, the trader wants to use futures, but

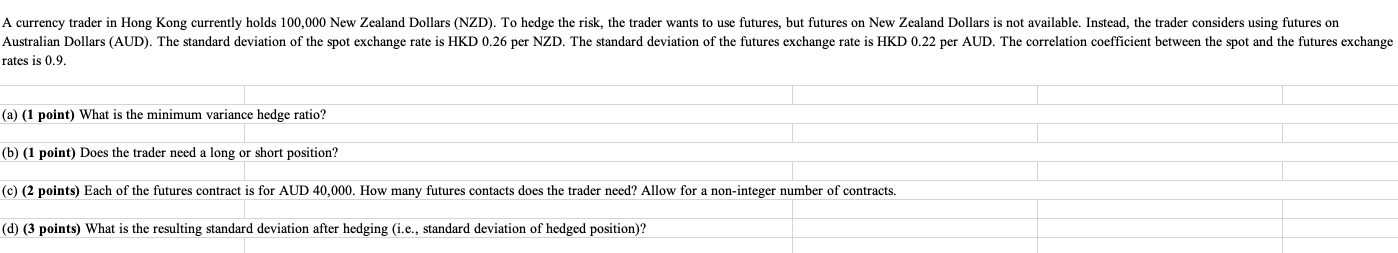

A currency trader in Hong Kong currently holds 100,000 New Zealand Dollars (NZD). To hedge the risk, the trader wants to use futures, but futures on New Zealand Dollars is not available. Instead, the trader considers using futures on Australian Dollars (AUD). The standard deviation of the spot exchange rate is HKD 0.26 per NZD. The standard deviation of the futures exchange rate is HKD 0.22 per AUD. The correlation coefficient between the spot and the futures exchange rates is 0.9. (a) (1 point) What is the minimum variance hedge ratio? (b) (1 point) Does the trader need a long or short position? (c) (2 points) Each of the futures contract is for AUD 40,000. How many futures contacts does the trader need? Allow for a non-integer number of contracts. (d) (3 points) What is the resulting standard deviation after hedging (i.e., standard deviation of hedged position)?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the minimum variance hedge ratio we need to use the formula H spot futures where H Hedg...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started