Answered step by step

Verified Expert Solution

Question

1 Approved Answer

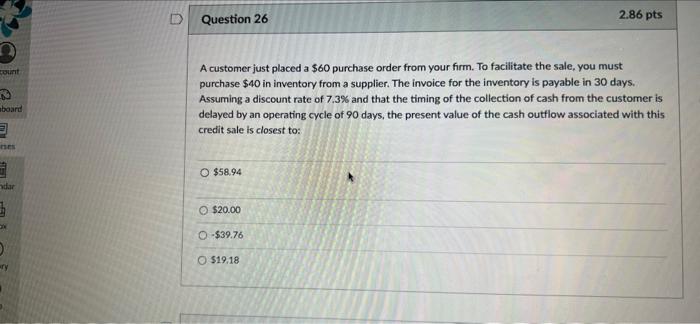

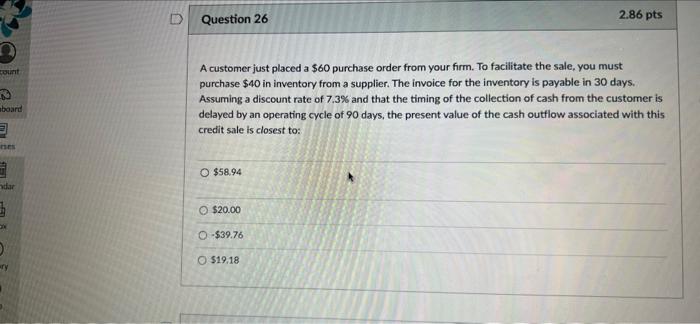

A customer made a $60 purchase order from your firm. to facilitate the sale, you must purchase $40 in inventory from a supplier... Question 26

A customer made a $60 purchase order from your firm. to facilitate the sale, you must purchase $40 in inventory from a supplier...

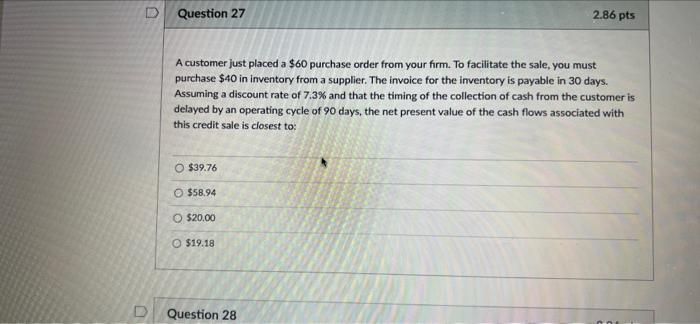

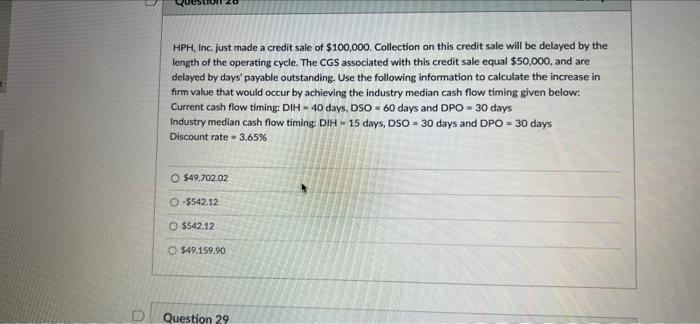

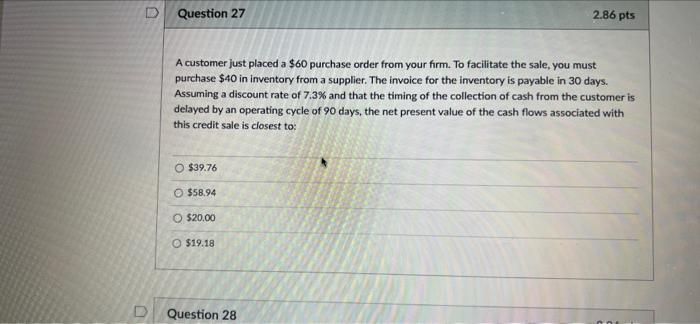

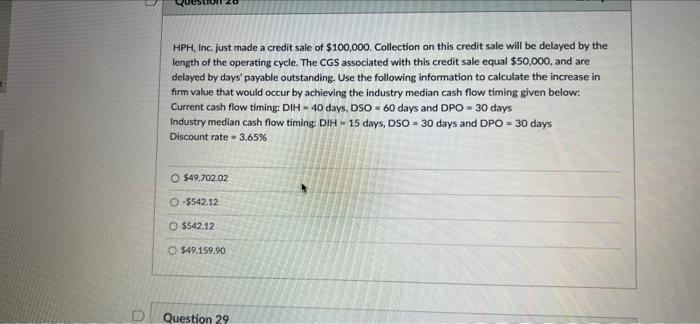

Question 26 2.86 pts count A customer just placed a $60 purchase order from your firm. To facilitate the sale, you must purchase $40 in inventory from a supplier. The invoice for the inventory is payable in 30 days. Assuming a discount rate of 7.3% and that the timing of the collection of cash from the customer is delayed by an operating cycle of 90 days, the present value of the cash outflow associated with this credit sale is closest to: board O $58.94 dar $20.00 0-$39.76 $19.18 ry D Question 27 2.86 pts A customer just placed a $60 purchase order from your firm. To facilitate the sale, you must purchase $40 in inventory from a supplier. The invoice for the inventory is payable in 30 days. Assuming a discount rate of 7.3% and that the timing of the collection of cash from the customer is delayed by an operating cycle of 90 days, the net present value of the cash flows associated with this credit sale is closest to: $39.76 $58.94 $20.00 $19.18 D Question 28 HPH, Inc. just made a credit sale of $100,000. Collection on this credit sale will be delayed by the length of the operating cycle. The CGS associated with this credit sale equal $50,000, and are delayed by days' payable outstanding. Use the following information to calculate the increase in firm value that would occur by achieving the industry median cash flow timing given below: Current cash flow timing: DIH - 40 days, DSO - 60 days and DPO - 30 days Industry median cash flow timing DIH - 15 days, DSO - 30 days and DPO - 30 days Discount rate - 3.65% $49,702.02 0.5542.12 O $542.12 O $49.159.90 D Question 29

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started