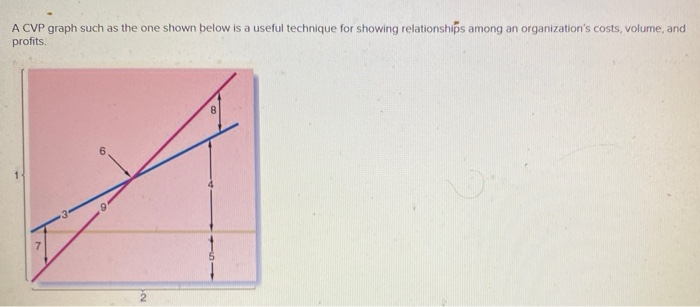

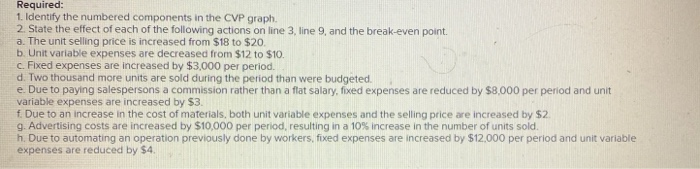

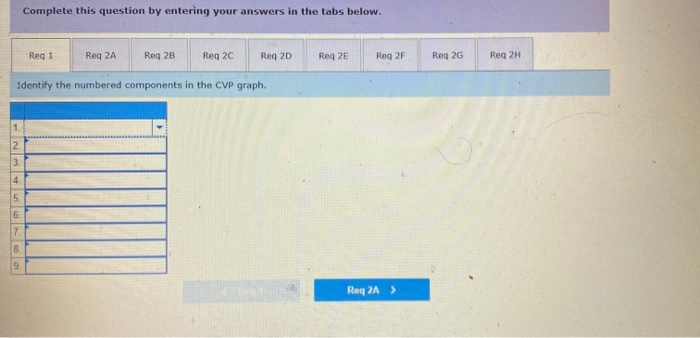

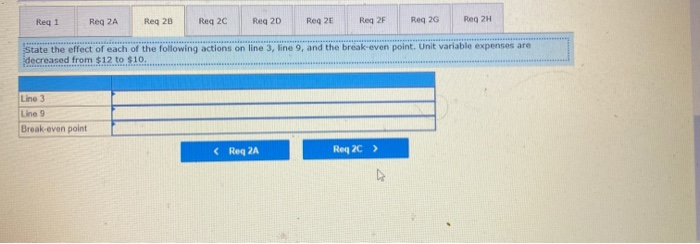

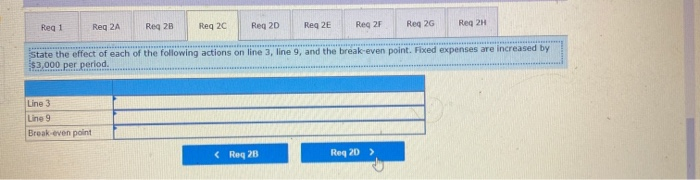

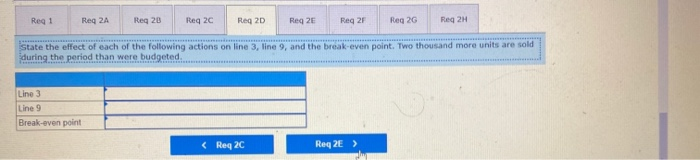

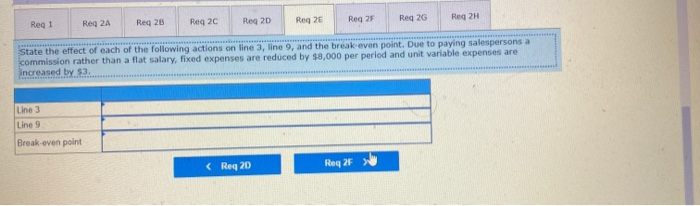

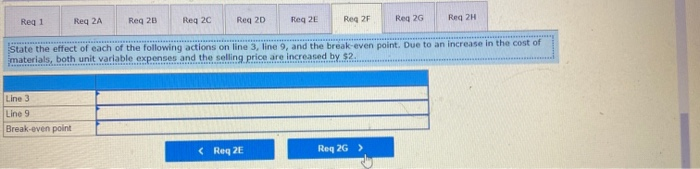

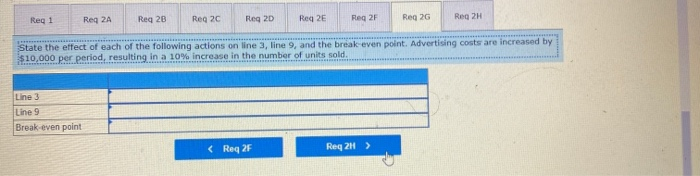

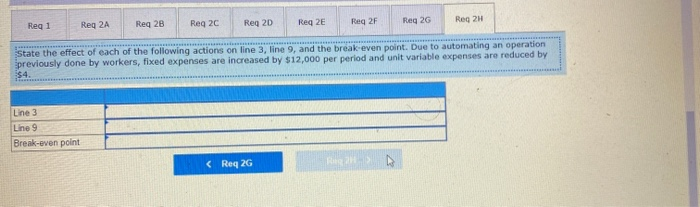

A CVP graph such as the one shown below is a useful technique for showing relationships among an organization's costs, volume, and profits Required: 1. Identify the numbered components in the CVP graph. 2. State the effect of each of the following actions on line 3, line 9, and the break-even point. a. The unit selling price is increased from $18 to $20. b. Unit variable expenses are decreased from $12 to $10. c. Fixed expenses are increased by $3,000 per period. d. Two thousand more units are sold during the period than were budgeted. e. Due to paying salespersons a commission rather than a flat salary, fixed expenses are reduced by $8,000 per period and unit variable expenses are increased by $3. f. Due to an increase in the cost of materials, both unit variable expenses and the selling price are increased by $2 9. Advertising costs are increased by $10,000 per period, resulting in a 10% increase in the number of units sold. h. Due to automating an operation previously done by workers, fixed expenses are increased by $12,000 per period and unit variable expenses are reduced by $4. Complete this question by entering your answers in the tabs below. Reg 1 Req 2A Reg 28 Reg 20 Req 2D Reg 2E Reg 2F Reg 2G Reg 2H Identify the numbered components in the CVP graph. 1 6 7 8 9 Req2A > Reg 1 Reg 2A Reg 28 Req 2c Reg 2D Reg 2E Reg 2 Reg 2G Reg 2H State the effect of each of the following actions on line 3, line 9, and the break-even point. The unit selling price is increased From $18 to $20. Line 3 Line 9 Break-even point Req 1 Reg 2A Reg 20 Reg 2C Reg 20 Reg 2 Reg 2F Req 2G Reg 2H State the effect of each of the following actions on line 3, line 9, and the break-even point. Unit variable expenses are decreased from $12 to $10. Line 3 Line 9 Break-even point Reg 1 Reg 2A Reg 28 Reg 20 Reg 20 Reg 2 Reg 2F Reg 2G Reg 2H State the effect of each of the following actions on line 3, line 9, and the break-even point. Fixed expenses are increased by $3,000 per period. Line 3 Line 9 Break-even point Req1 Reg 2 Reg 28 Reg 20 Reg 20 Reg 2H Reg 26 Reg 2G Reg 2F State the effect of each of the following actions on line 3, line 9, and the break-even point. Due to paying salespersons a commission rather than a flat salary, fixed expenses are reduced by $8,000 per period and unit variable expenses are Increased by $3. Line 3 Line 9 Break-even point Reg 1 Reg 2 Req 2B Reg 2 Reg 20 Req 2E Reg 2 Reg 2G Reg 2H State the effect of each of the following actions on line 3, line 9, and the break even point. Advertising costs are increased by $10,000 per period, resulting in a 10% Increase in the number of units sold. Line 3 Line 9 Break-even point Reg 2A Reg 1 Reg 28 Reg 2c Reg 20 Reg 2E Reg 2F Reg 2H Reg 2G State the effect of each of the following actions on line 3, line 9, and the break even point. Due to automating an operation previously done by workers, fixed expenses are increased by $12,000 per period and unit variable expenses are reduced by $4. Line 3 Line 9 Break-even point