Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(a) d + c. The larger is, the more dividend are contained in the stock price S, and thus more likely to execute early. (d)

(a) d + c. The larger is, the more dividend are contained in the stock price S, and thus more likely to execute early. (d) Similar with (b) (c).

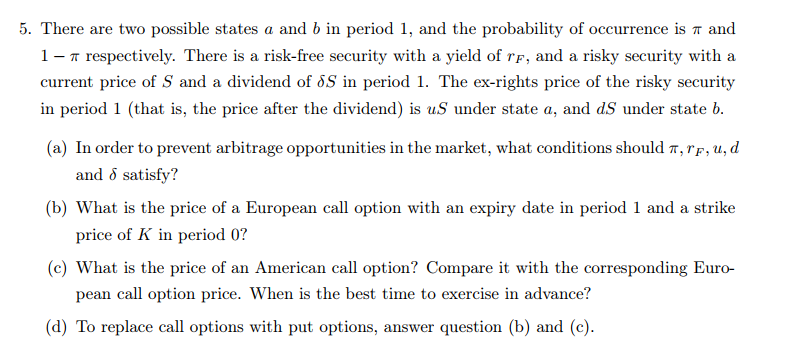

5. There are two possible states a and b in period 1, and the probability of occurrence is a and 1- respectively. There is a risk-free security with a yield of rf, and a risky security with a current price of S and a dividend of 8S in period 1. The ex-rights price of the risky security in period 1 (that is, the price after the dividend) is us under state a, and dS under state b. (a) In order to prevent arbitrage opportunities in the market, what conditions should a, rf, u, d and 8 satisfy? (b) What is the price of a European call option with an expiry date in period 1 and a strike price of K in period 0? (c) What is the price of an American call option? Compare it with the corresponding Euro- pean call option price. When is the best time to exercise in advance? (d) To replace call options with put options, answer question (b) and (c). 5. There are two possible states a and b in period 1, and the probability of occurrence is a and 1- respectively. There is a risk-free security with a yield of rf, and a risky security with a current price of S and a dividend of 8S in period 1. The ex-rights price of the risky security in period 1 (that is, the price after the dividend) is us under state a, and dS under state b. (a) In order to prevent arbitrage opportunities in the market, what conditions should a, rf, u, d and 8 satisfy? (b) What is the price of a European call option with an expiry date in period 1 and a strike price of K in period 0? (c) What is the price of an American call option? Compare it with the corresponding Euro- pean call option price. When is the best time to exercise in advance? (d) To replace call options with put options, answer question (b) and (c)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started