Answered step by step

Verified Expert Solution

Question

1 Approved Answer

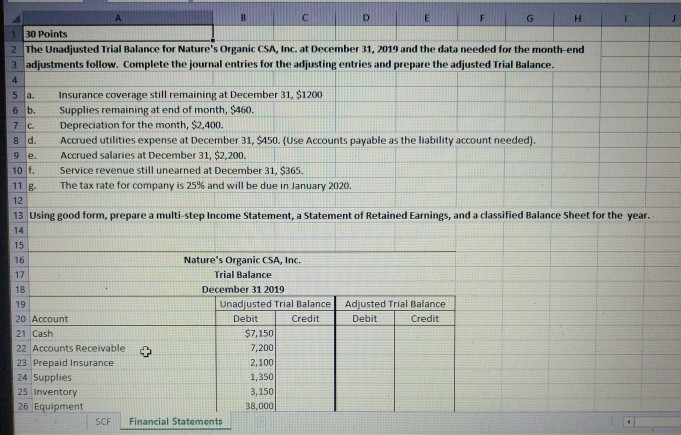

A D G B E F 130 Points 2 The Unadjusted Trial Balance for Nature's Organic CSA, Inc. at December 31, 2019 and the data

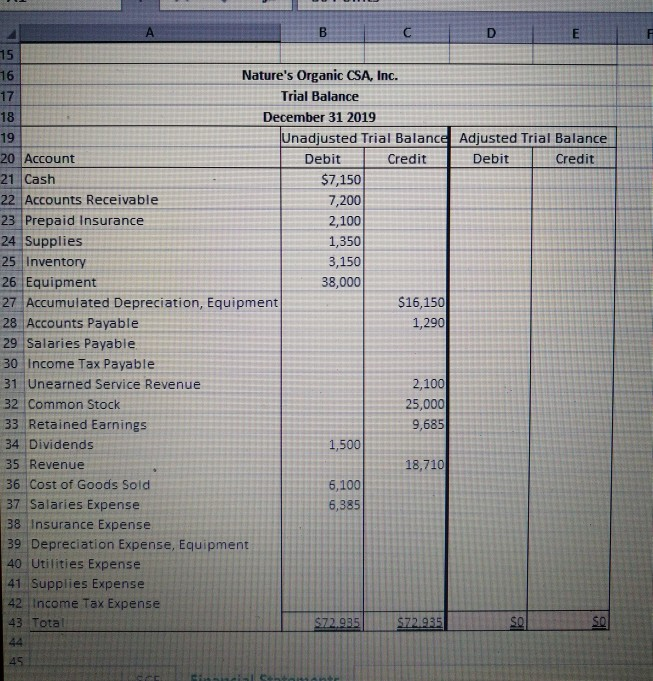

A D G B E F 130 Points 2 The Unadjusted Trial Balance for Nature's Organic CSA, Inc. at December 31, 2019 and the data needed for the month-end 3 adjustments follow. Complete the journal entries for the adjusting entries and prepare the adjusted Trial Balance. 4 5 a. Insurance coverage still remaining at December 31, $1200 6 b. Supplies remaining at end of month, $460. 7 c. Depreciation for the month, $2,400. 8 d. Accrued utilities expense at December 31, $150. (Use Accounts payable as the liability account needed). 9 e. Accrued salaries at December 31, $2,200. 10 f. Service revenue still unearned at December 31, $365. 11 g The tax rate for company is 25% and will be due in January 2020. 12 13 Using good form, prepare a multi-step Income Statement, a Statement of Retained Earnings, and a classified Balance Sheet for the year. 14 15 16 Nature's Organic CSA, Inc. 17 Trial Balance 18 December 31 2019 19 Unadjusted Trial Balance Adjusted Trial Balance 20 Account Debit Credit Debit Credit 21 Cash $7,150 22 Accounts Receivable 7,200 23 Prepaid Insurance 2,100 24 Supplies 1,350 25 Inventory 3,150 26 Equipment 38,000 Financial Statements SCF B D E F 15 16 Nature's Organic CSA, Inc. 17 Trial Balance 18 December 31 2019 19 Unadjusted Trial Balance Adjusted Trial Balance 20 Account Debit Credit Debit Credit 21 Cash $7,150 22 Accounts Receivable 7,200 23 Prepaid Insurance 2,100 24 Supplies 1,350 25 Inventory 3,150 26 Equipment 38,000 27 Accumulated Depreciation, Equipment $16,150 28 Accounts Payable 1,290 29 Salaries Payable 30 Income Tax Payable 31 Unearned Service Revenue 2,100 32 Common Stock 25,000 33 Retained Earnings 9,685 34 Dividends 1,500 35 Revenue 18,710 36 Cost of Goods Sold 6,100 37 Salaries Expense 6,385 38 Insurance Expense 39 Depreciation Expense, Equipment 40 Utilities Expense 41 Supplies Expense 42 Income Tax Expense 43 Total $72.935 $72.935 SO SO 44 45

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started