Answered step by step

Verified Expert Solution

Question

1 Approved Answer

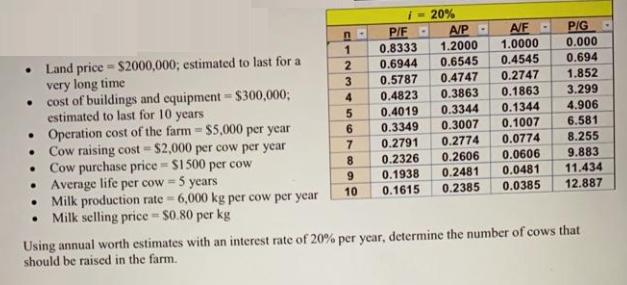

A dairy farm has the following cash estimates: -20% A/P 1 2 3 P/F D A/F- PIG 0.8333 1.2000 1.0000 0.000 0.4545 0.6944 0.6545 0.694

A dairy farm has the following cash estimates:

-20% A/P 1 2 3 P/F D A/F- PIG 0.8333 1.2000 1.0000 0.000 0.4545 0.6944 0.6545 0.694 Land price $2000,000; estimated to last for a very long time 0.5787 0.4747 0.2747 1.852 . 4 cost of buildings and equipment - $300,000; estimated to last for 10 years 0.4823 0.3863 3.299 0.1863 5 0.4019 0.3344 0.1344 4.906 6 0.3349 0.3007 0.1007 6.581 Operation cost of the farm = $5,000 per year Cow raising cost-$2,000 per cow per year Cow purchase price = $1500 per cow 7 0.2791 0.2774 0.0774 8.255 8 . 0.2326 0.2606 9.883 0.0606 Average life per cow = 5 years 9 0.1938 0.2481 0.0481 11.434 10 Milk production rate=6,000 kg per cow per year 0.1615 0.2385 0.0385 12.887 . . Milk selling price = $0.80 per kg Using annual worth estimates with an interest rate of 20% per year, determine the number of cows that should be raised in the farm.

Step by Step Solution

★★★★★

3.54 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

First lets calculate the net present value of net benefits from 1 cow Year Item ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started