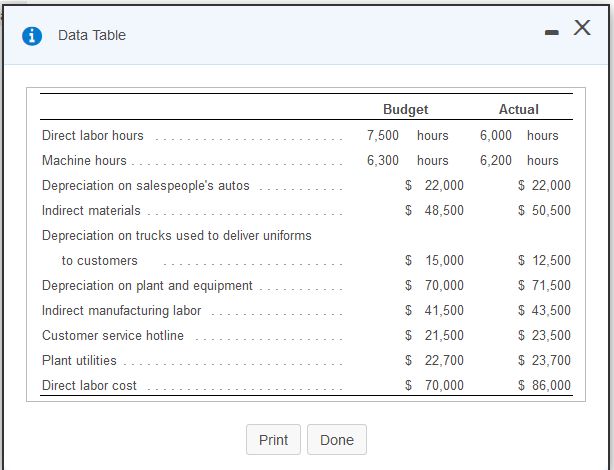

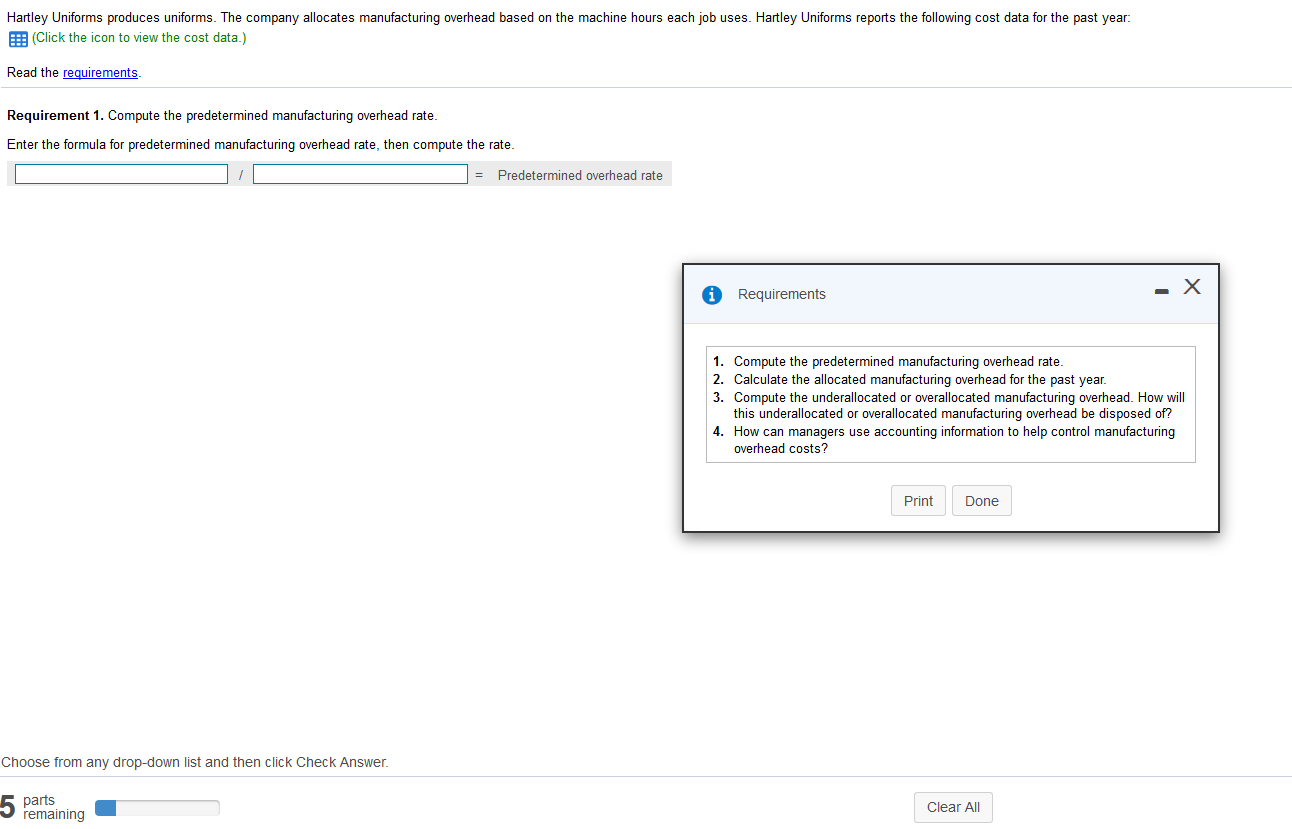

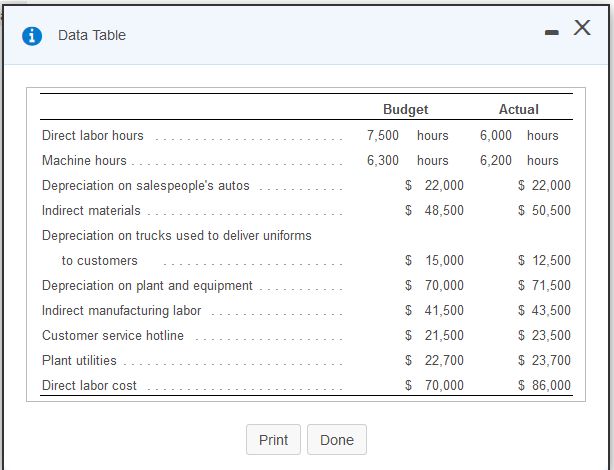

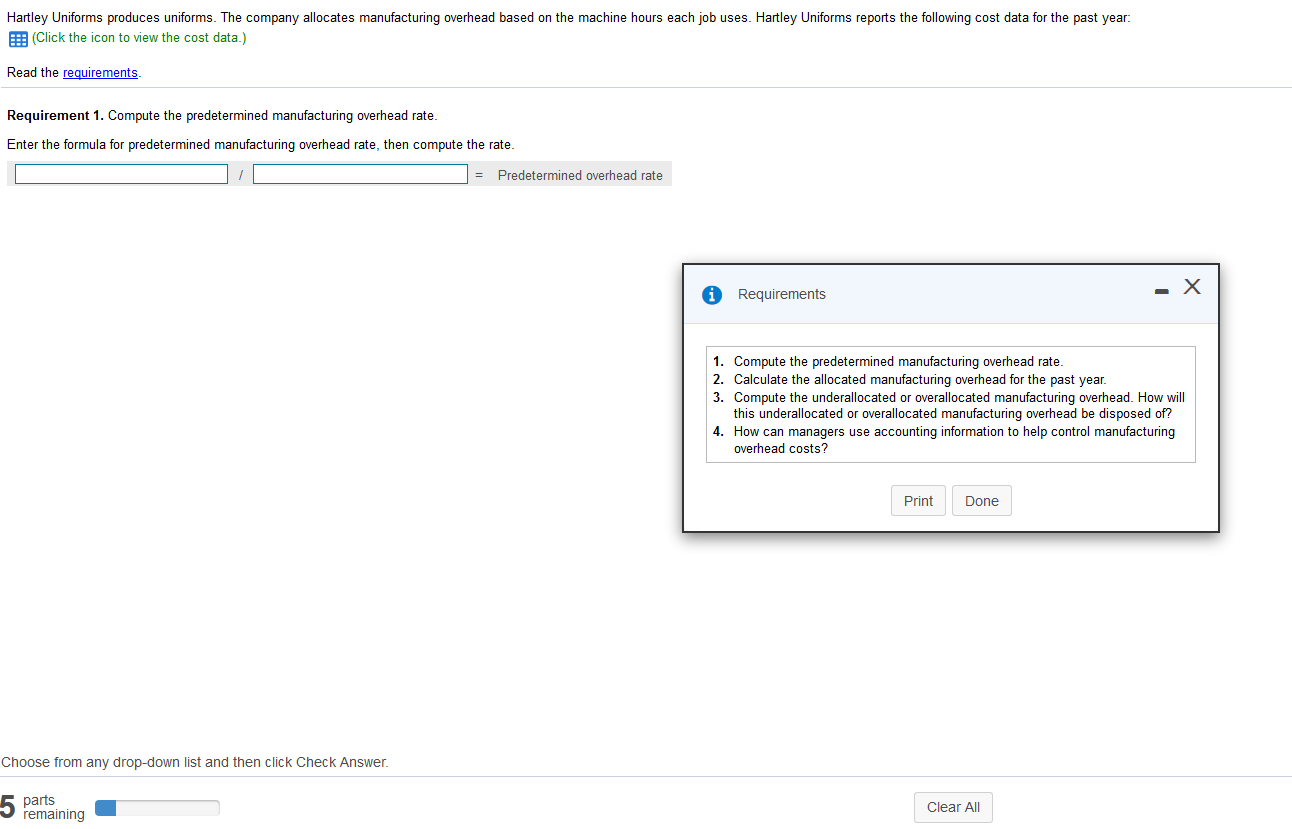

A Data Table Actual Budget 7,500 hours 6,300 hours $ 22,000 $ 48,500 6,000 hours 6,200 hours $ 22,000 $ 50,500 Direct labor hours Machine hours... Depreciation on salespeople's autos ........... Indirect materials ..... Depreciation on trucks used to deliver uniforms to customers Depreciation on plant and equipment Indirect manufacturing labor .. Customer service hotline $ 15,000 $ 70,000 $ 41,500 $ 21,500 $ 22,700 $ 70,000 $ 12,500 $ 71,500 $ 43,500 $ 23,500 $ 23,700 $ 86,000 Plant utilities .. Direct labor cost Print Done Hartley Uniforms produces uniforms. The company allocates manufacturing overhead based on the machine hours each job uses. Hartley Uniforms reports the following cost data for the past year: (Click the icon to view the cost data.) Read the requirements. Requirement 1. Compute the predetermined manufacturing overhead rate. Enter the formula for predetermined manufacturing overhead rate, then compute the rate. = Predetermined overhead rate Requirements 1. Compute the predetermined manufacturing overhead rate. 2. Calculate the allocated manufacturing overhead for the past year. 3. Compute the underallocated or overallocated manufacturing overhead. How will this underallocated or overallocated manufacturing overhead be disposed of? 4. How can managers use accounting information to help control manufacturing overhead costs? Print Done Choose from any drop-down list and then click Check Answer. 5 parts remaining Clear All A Data Table Actual Budget 7,500 hours 6,300 hours $ 22,000 $ 48,500 6,000 hours 6,200 hours $ 22,000 $ 50,500 Direct labor hours Machine hours... Depreciation on salespeople's autos ........... Indirect materials ..... Depreciation on trucks used to deliver uniforms to customers Depreciation on plant and equipment Indirect manufacturing labor .. Customer service hotline $ 15,000 $ 70,000 $ 41,500 $ 21,500 $ 22,700 $ 70,000 $ 12,500 $ 71,500 $ 43,500 $ 23,500 $ 23,700 $ 86,000 Plant utilities .. Direct labor cost Print Done Hartley Uniforms produces uniforms. The company allocates manufacturing overhead based on the machine hours each job uses. Hartley Uniforms reports the following cost data for the past year: (Click the icon to view the cost data.) Read the requirements. Requirement 1. Compute the predetermined manufacturing overhead rate. Enter the formula for predetermined manufacturing overhead rate, then compute the rate. = Predetermined overhead rate Requirements 1. Compute the predetermined manufacturing overhead rate. 2. Calculate the allocated manufacturing overhead for the past year. 3. Compute the underallocated or overallocated manufacturing overhead. How will this underallocated or overallocated manufacturing overhead be disposed of? 4. How can managers use accounting information to help control manufacturing overhead costs? Print Done Choose from any drop-down list and then click Check Answer. 5 parts remaining Clear All