Question

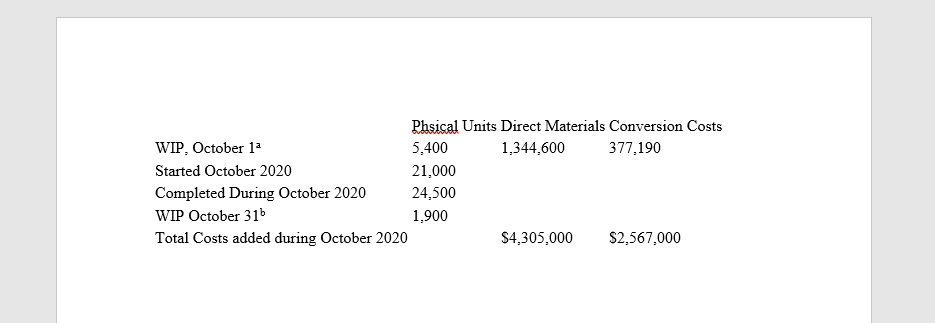

a Degree of completion: direct materials, ?%; conversion costs, 50 %. b Degree of completion: direct materials, ?%; conversion costs, 70%. Preston Company manufactures car

a Degree of completion: direct materials, ?%; conversion costs, 50 %.

b Degree of completion: direct materials, ?%; conversion costs, 70%.

Preston Company manufactures car seats in its Boston plant. Each car seat passes through the assembly department and the testing department. This problem focuses on the assembly department. The process-costing system at Preston Company has a single direct-cost category (direct materials) and a single indirect-cost category (conversion costs). Direct materials are added at the beginning of the process. Conversion costs are added evenly during the process. When the assembly department finishes work on each car seat, it is immediately transferred to testing. Preston Company uses the weighted-average method of process costing.

1. For each cost category, compute equivalent units in the assembly department. Show physical units in the first column of your schedule.

2. What issues should the manager focus on when reviewing the equivalent-unit calculations?

3. For each cost category, summarize total assembly department costs for October 2020 and calculate cost per equivalent unit.

4. Assign costs to units completed and transferred out and to units in ending work in process.

Requirement 1. For each cost category, compute equivalent units in the assembly department. Show physical units in the first column of your schedule.

Equivalent UnitsPhysicalDirectConversionFlow of ProductionUnitsMaterialsCostsWork in process beginning5,400Started during current period21,000To account for26,400Completed and transferred out during current period24,50024,50024,500Work in process, ending1,9001,9001,330Accounted for26,400Work done to date26,40025,830Part 2

Requirement 2. What issues should the manager focus on when reviewing the equivalent-unit calculations?

To show better performance, a department supervisor might report a

higher

degree of completion resulting in

understated

cost per equivalent unit and

overstated

operating income. In other words, estimates of degree of completion can help

to smooth earnings from one period to the next.

To guard against the possibility of bias,

managers should ask supervisors specific questions about the process they followed. Top management should always emphasize

obtaining the correct answer, regardless of how it affects reported performance.

This emphasis drives

ethical actions

throughout the organization.

Part 3

Requirement 3. For each cost category, summarize total assembly department costs for October

2020

and calculate cost per equivalent unit.

Begin by summarizing the total assembly department costs for October

2020. (bold numbers are incorrect)

TotalDirectConversionProduction CostsMaterialsCostsWork in process, beginning$1,721,790$1,344,600$377,190Costs added in current period68720004,305,0002567000Total costs to account for8593790$5,649,6002944190 \begin{tabular}{llll} & \multicolumn{3}{l}{ Phsical Units Direct Materials Conversion Costs } \\ WIP, October 1 & 5,400 & 1,344,600 & 377,190 \\ Started October 2020 & 21,000 & & \\ Completed During October 2020 & 24,500 & & \\ WIP October 31 & 1,900 & & \\ Total Costs added during October 2020 & $4,305,000 & $2,567,000 \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started