Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a. Delta Company announced that it will distribute a dividend of AED 6 per share at the end of the year and this dividend

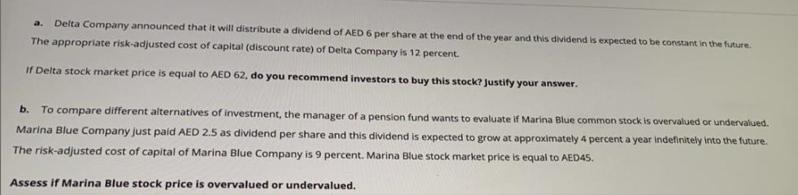

a. Delta Company announced that it will distribute a dividend of AED 6 per share at the end of the year and this dividend is expected to be constant in the future. The appropriate risk-adjusted cost of capital (discount rate) of Delta Company is 12 percent. If Delta stock market price is equal to AED 62, do you recommend investors to buy this stock? Justify your answer. b. To compare different alternatives of investment, the manager of a pension fund wants to evaluate if Marina Blue common stock is overvalued or undervalued. Marina Blue Company just paid AED 2.5 as dividend per share and this dividend is expected to grow at approximately 4 percent a year indefinitely into the future. The risk-adjusted cost of capital of Marina Blue Company is 9 percent. Marina Blue stock market price is equal to AED45. Assess if Marina Blue stock price is overvalued or undervalued.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To assess whether investors should buy Delta Company stock and whether Marina Blue stock is overvalued or undervalued we can use the Dividend Discount ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started