Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A depreciable asset with a cost of $38650 has a residual value of $1900 and a useful life of 7 years. Total estimated units of

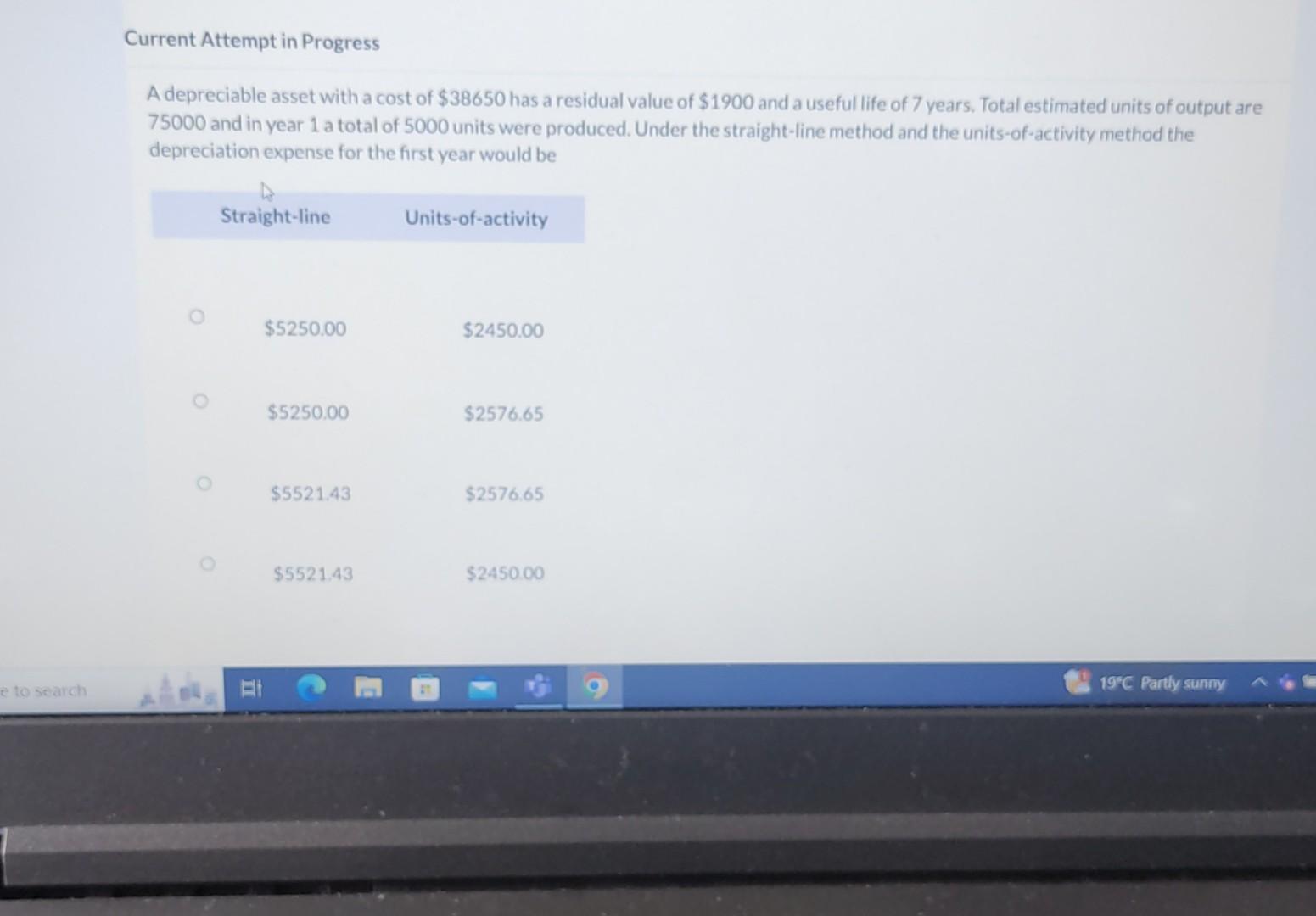

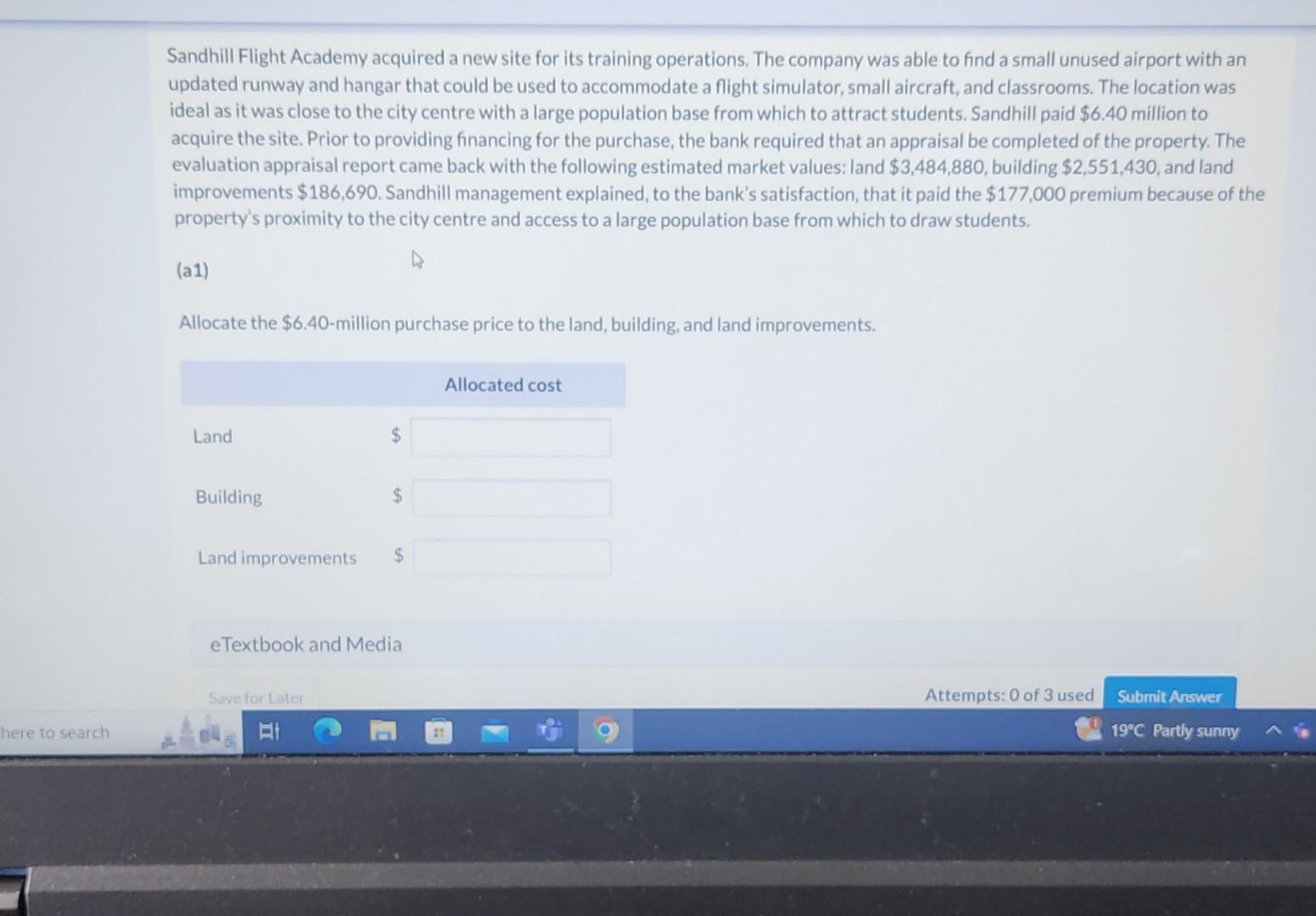

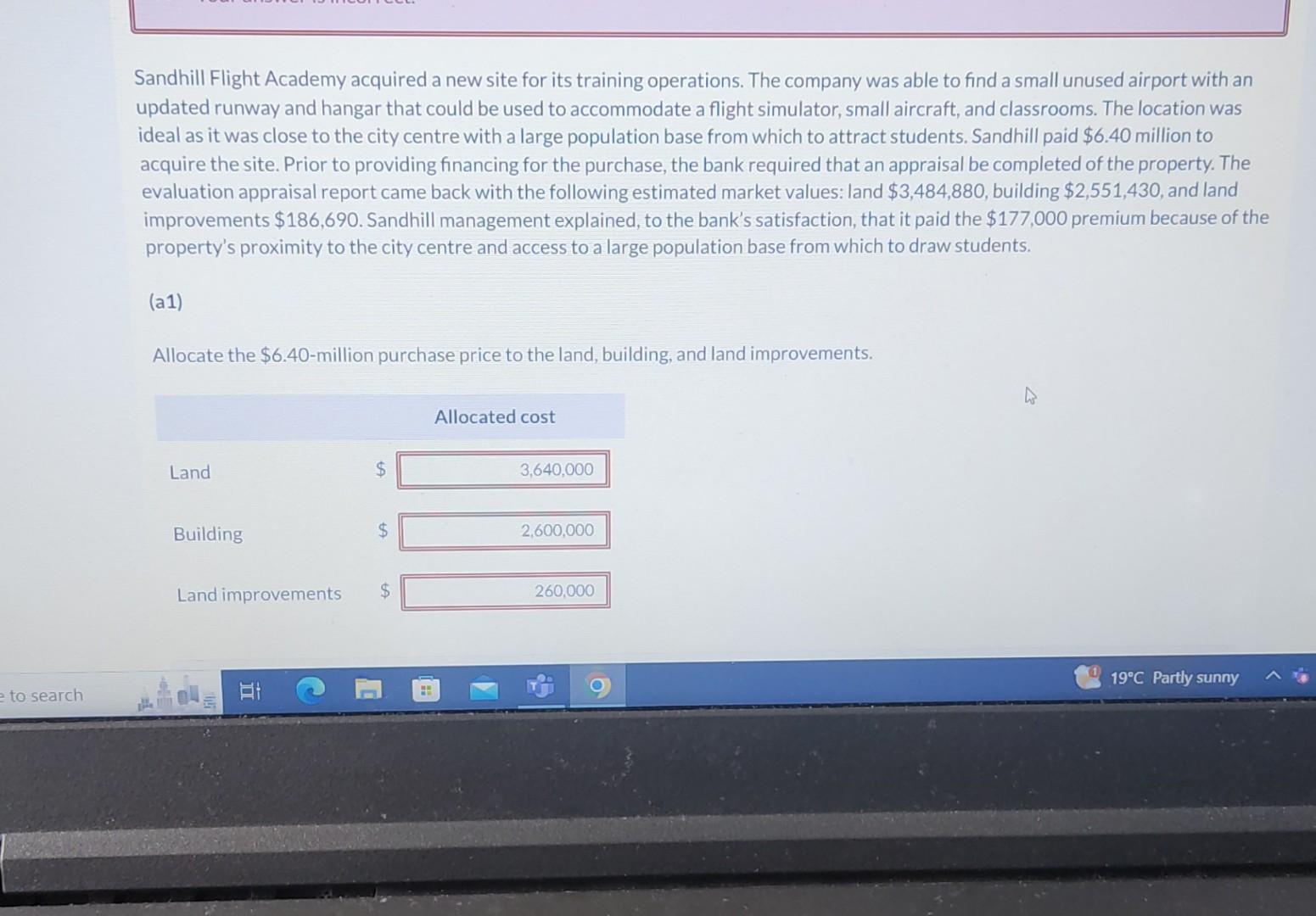

A depreciable asset with a cost of $38650 has a residual value of $1900 and a useful life of 7 years. Total estimated units of output are 75000 and in year 1 a total of 5000 units were produced. Under the straight-line method and the units-of-activity method the depreciation expense for the first year would be Straight-line Units-of-activity $5250.00 $2450.00 $5250.00 $2576.65 $5521.43 $2576.65 $5521.43 $245000 Sandhill Flight Academy acquired a new site for its training operations. The company was able to find a small unused airport with an updated runway and hangar that could be used to accommodate a flight simulator, small aircraft, and classrooms. The location was ideal as it was close to the city centre with a large population base from which to attract students. Sandhill paid $6.40 million to acquire the site. Prior to providing financing for the purchase, the bank required that an appraisal be completed of the property. The evaluation appraisal report came back with the following estimated market values: land $3,484,880, building $2,551,430, and land improvements $186,690. Sandhill management explained, to the bank's satisfaction, that it paid the $177,000 premium because of the property's proximity to the city centre and access to a large population base from which to draw students. (a1) Allocate the $6.40-million purchase price to the land, building, and land improvements. Sandhill Flight Academy acquired a new site for its training operations. The company was able to find a small unused airport with an updated runway and hangar that could be used to accommodate a flight simulator, small aircraft, and classrooms. The location was ideal as it was close to the city centre with a large population base from which to attract students. Sandhill paid $6.40 million to acquire the site. Prior to providing financing for the purchase, the bank required that an appraisal be completed of the property. The evaluation appraisal report came back with the following estimated market values: land $3,484,880, building $2,551,430, and land improvements $186,690. Sandhill management explained, to the bank's satisfaction, that it paid the $177,000 premium because of the property's proximity to the city centre and access to a large population base from which to draw students. (a1) Allocate the $6.40-million purchase price to the land, building, and land improvements

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started