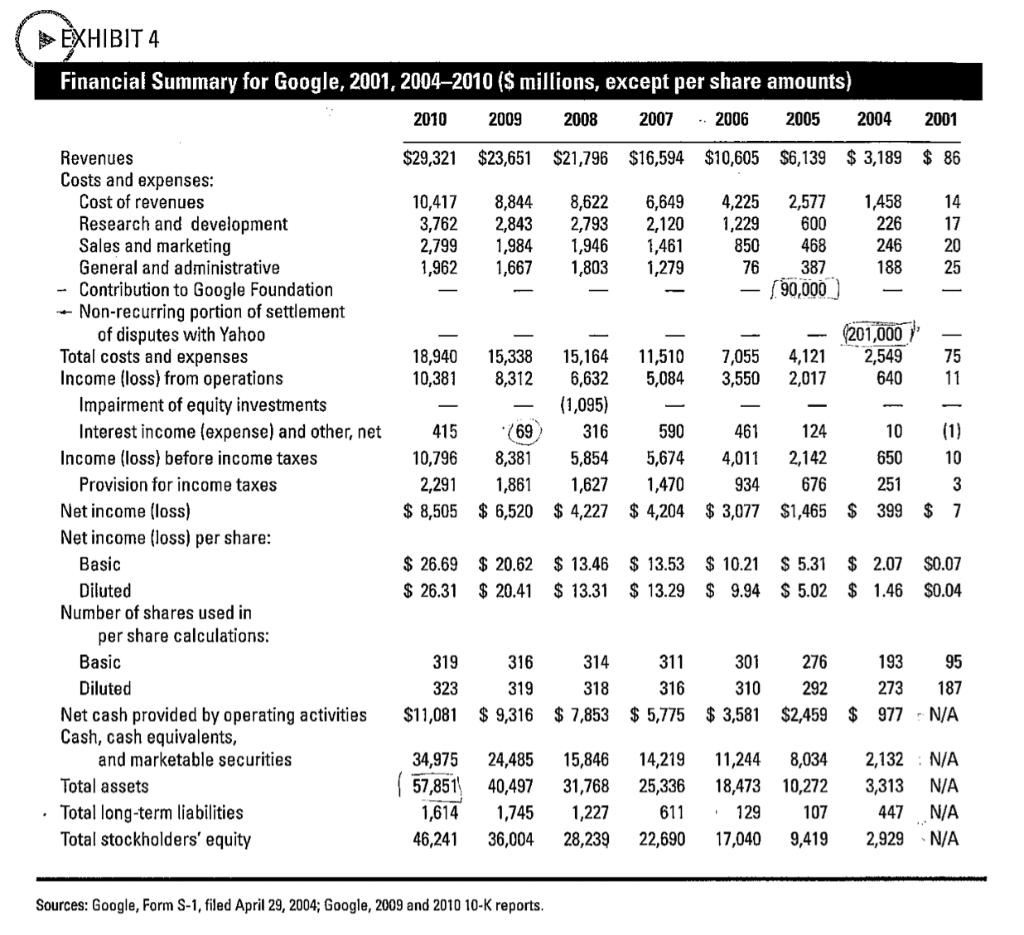

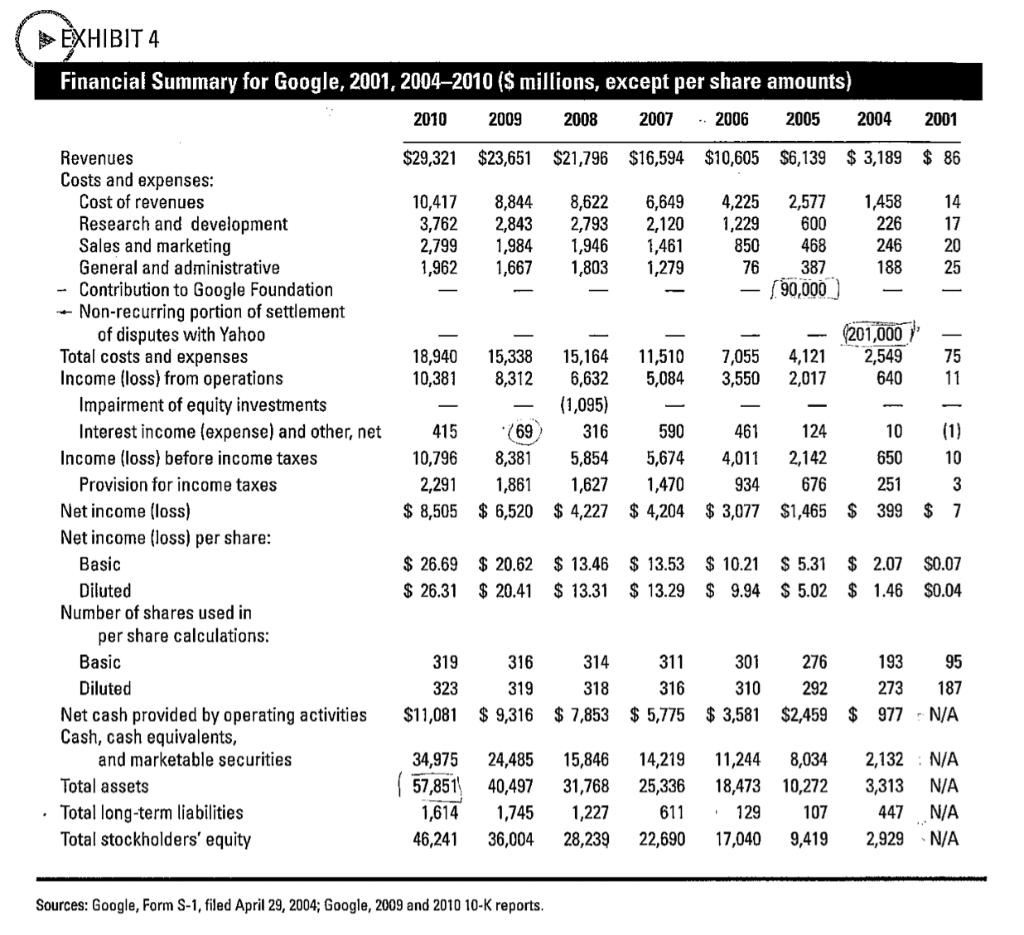

a) Describe briefly what is a Cos Gross Profit Margin [GPM]. Next, calculate the GPM for the company in the case. b) Describe briefly what is Return on Shareholders Equity. Next, calculate the Return on Shareholders Equity for the Co. c) Describe briefly what is Debt to Equity Ratio? Calculate the Debt to Equity Ratio for the Co. d) With reference to Return on Shareholders Equity, briefly describe what is the financial health of the Co.

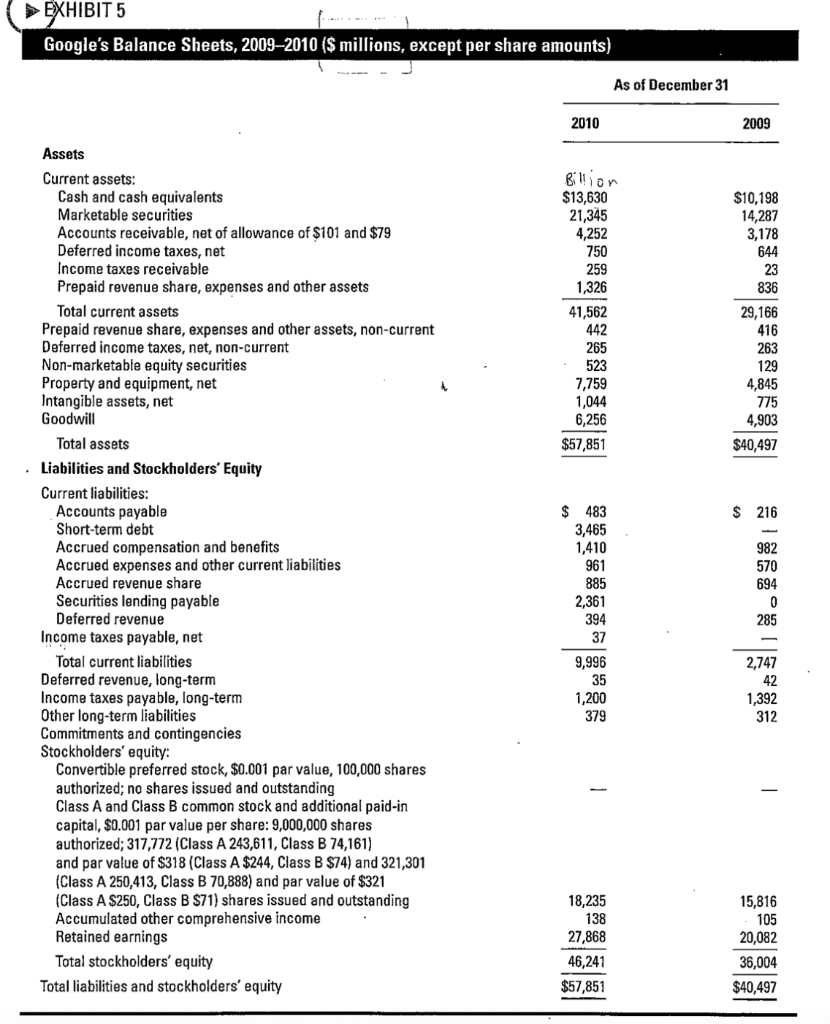

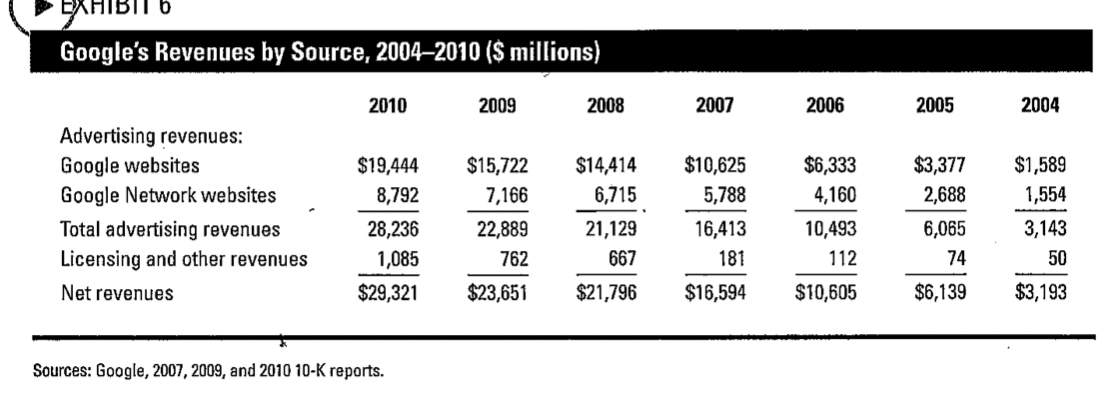

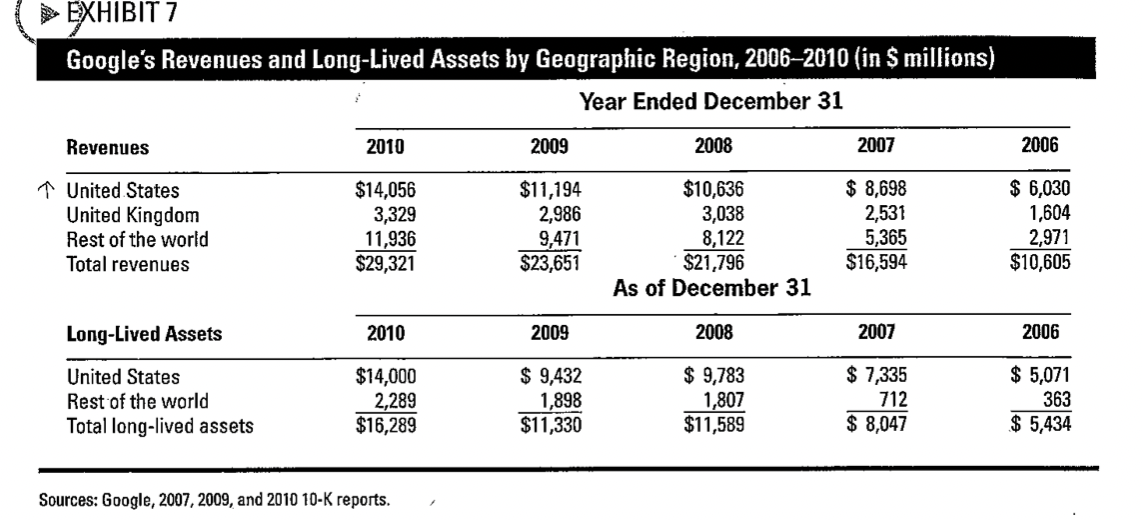

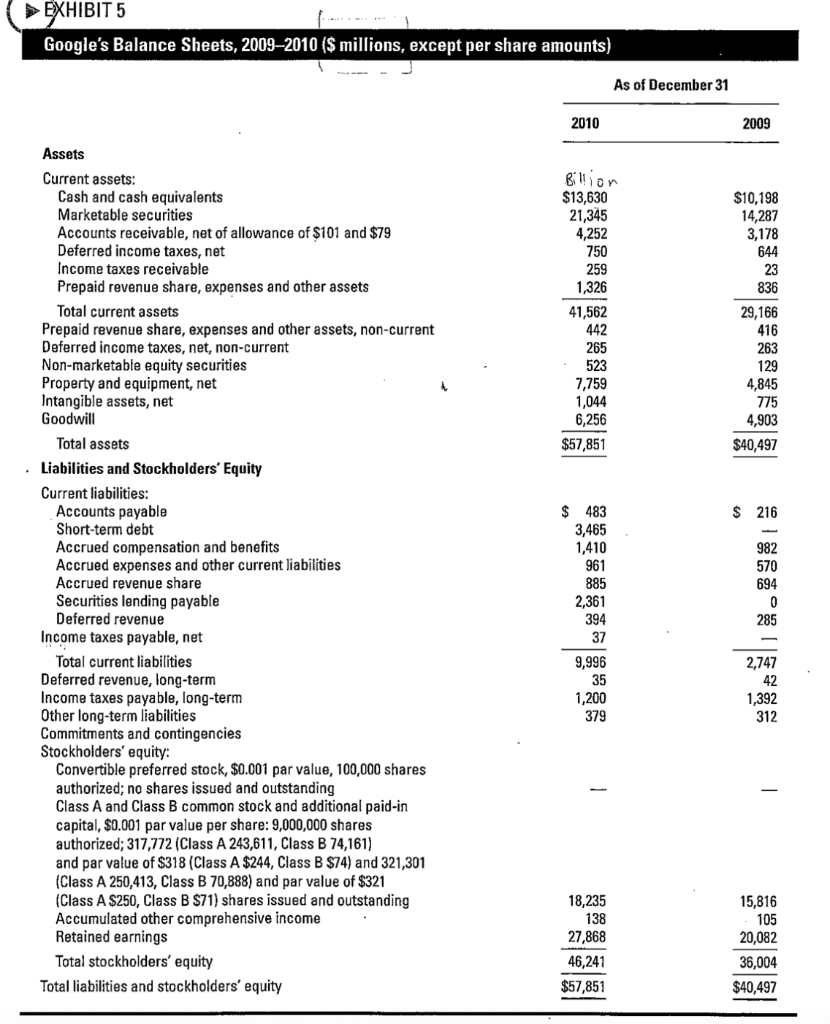

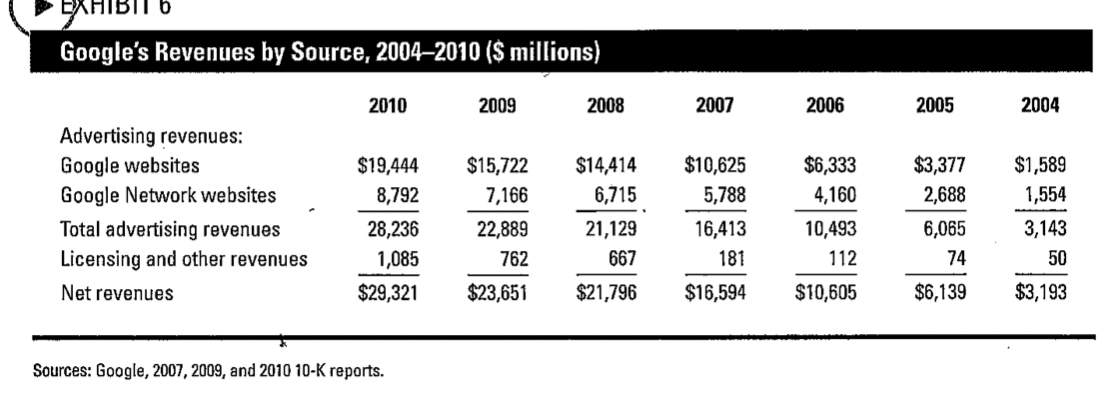

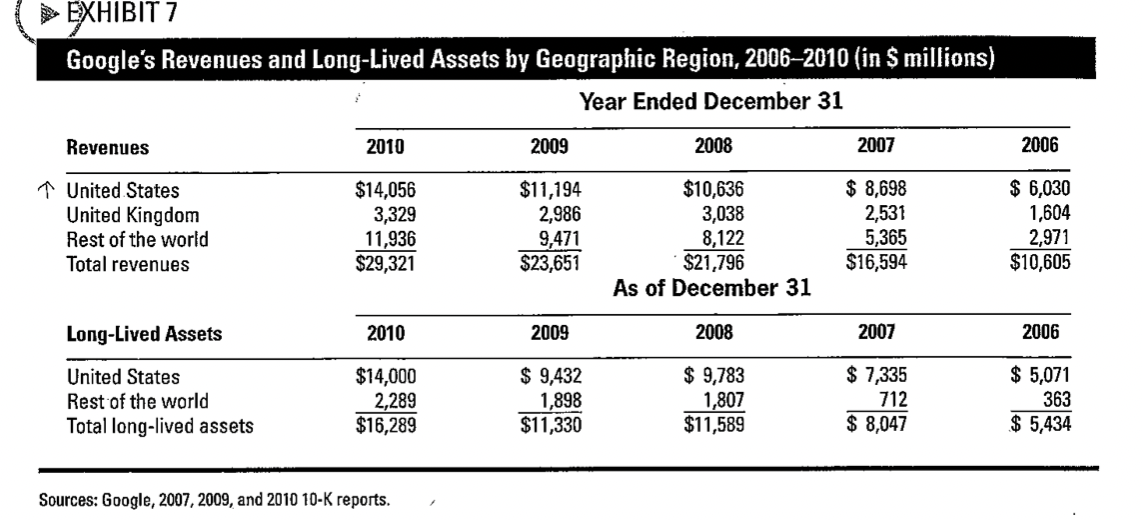

EXHIBIT 5 Google's Balance Sheets, 2009-2010 (\$ millions, except per share amounts) As of December 31 20102009 Assets Current assets: Cash and cash equivalents Marketable securities Accounts receivable, net of allowance of $101 and $79 Deferred income taxes, net Billion$13,63021,3454,252750$10,19814,2873,178644 Income taxes receivable Prepaid revenue share, expenses and other assets Total current assets 2383629,166 Prepaid revenue share, expenses and other assets, non-current Deferred income taxes, net, non-current Non-marketable equity securities Property and equipment, net Intangible assets, net Goodwill Total assets 2591,32641,5624422655237,7591,0446,256$57,851 Liabilities and Stockholders' Equity Current liabilities: Accounts payable Short-term debt Accrued compensation and benefits Accrued expenses and other current liabilities Accrued revenue share Securities lending payable Deferred revenue Income taxes payable, net Total current liabilities Deferred revenue, long-term Income taxes payable, long-term Other long-term liabilities Commitments and contingencies Stockholders' equity: Convertible preferred stock, $0.001 par value, 100,000 shares authorized; no shares issued and outstanding Class A and Class B common stock and additional paid-in capital, $0.001 par value per share: 9,000,000 shares authorized; 317,772 (Class A 243,611, Class B 74,161) and par value of $318 (Class A$244, Class B$74 ) and 321,301 (Class A 250,413, Class B 70,888) and par value of $321 (Class A \$250, Class B \$71) shares issued and outstanding Accumulated other comprehensive income Retained earnings Total stockholders' equity Total liabilities and stockholders' equity Sources: Google, rorm S-1, tiled April 29, 2004; lioogle, z00y and 201010K reports. Sources: Google, 2007, 2009, and 201010K reports. Sources: Google, 2007, 2009, and 201010K reports. EXHIBIT 5 Google's Balance Sheets, 2009-2010 (\$ millions, except per share amounts) As of December 31 20102009 Assets Current assets: Cash and cash equivalents Marketable securities Accounts receivable, net of allowance of $101 and $79 Deferred income taxes, net Billion$13,63021,3454,252750$10,19814,2873,178644 Income taxes receivable Prepaid revenue share, expenses and other assets Total current assets 2383629,166 Prepaid revenue share, expenses and other assets, non-current Deferred income taxes, net, non-current Non-marketable equity securities Property and equipment, net Intangible assets, net Goodwill Total assets 2591,32641,5624422655237,7591,0446,256$57,851 Liabilities and Stockholders' Equity Current liabilities: Accounts payable Short-term debt Accrued compensation and benefits Accrued expenses and other current liabilities Accrued revenue share Securities lending payable Deferred revenue Income taxes payable, net Total current liabilities Deferred revenue, long-term Income taxes payable, long-term Other long-term liabilities Commitments and contingencies Stockholders' equity: Convertible preferred stock, $0.001 par value, 100,000 shares authorized; no shares issued and outstanding Class A and Class B common stock and additional paid-in capital, $0.001 par value per share: 9,000,000 shares authorized; 317,772 (Class A 243,611, Class B 74,161) and par value of $318 (Class A$244, Class B$74 ) and 321,301 (Class A 250,413, Class B 70,888) and par value of $321 (Class A \$250, Class B \$71) shares issued and outstanding Accumulated other comprehensive income Retained earnings Total stockholders' equity Total liabilities and stockholders' equity Sources: Google, rorm S-1, tiled April 29, 2004; lioogle, z00y and 201010K reports. Sources: Google, 2007, 2009, and 201010K reports. Sources: Google, 2007, 2009, and 201010K reports