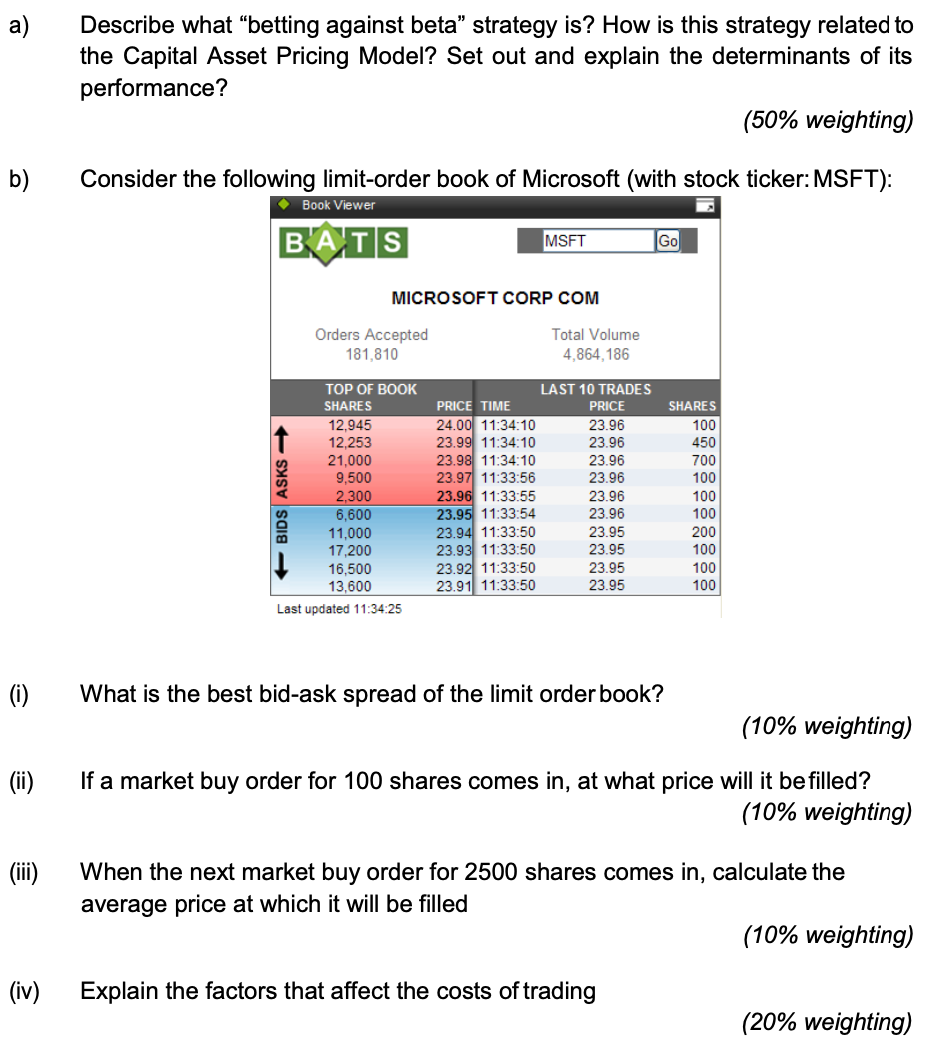

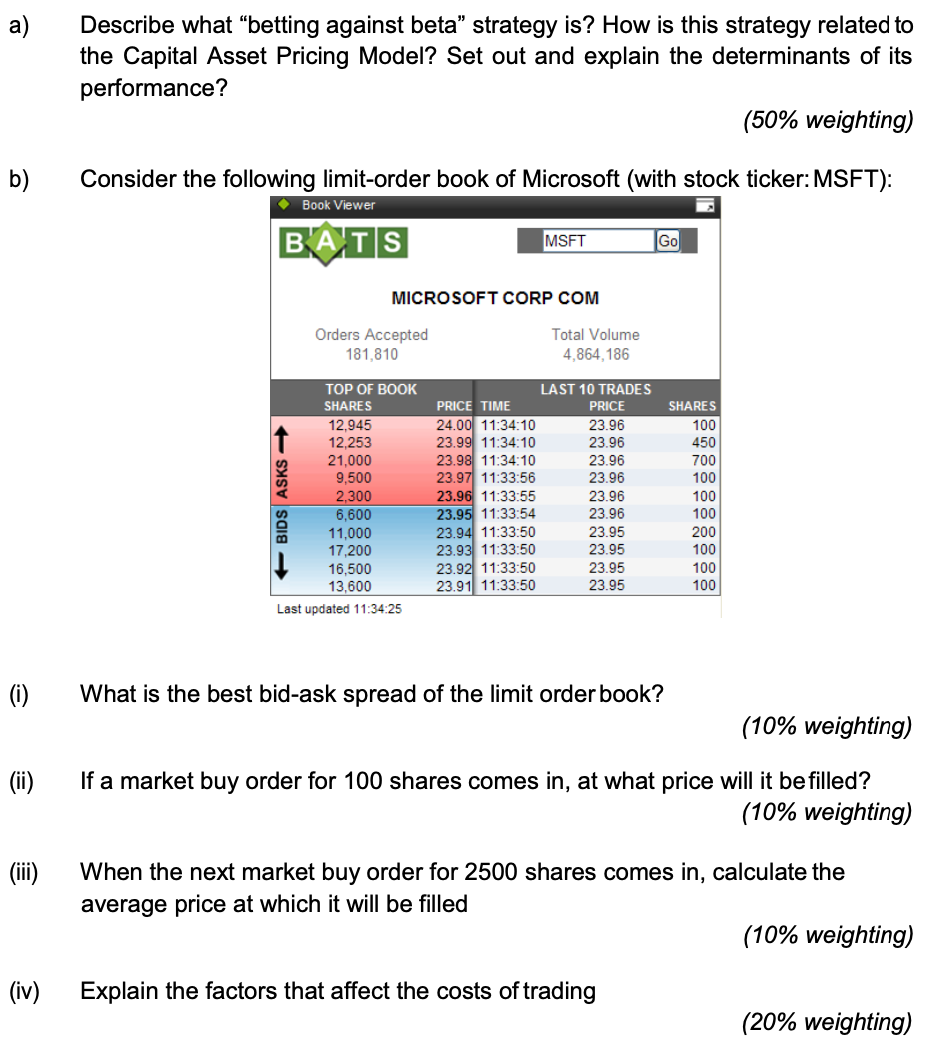

a) Describe what betting against beta strategy is? How is this strategy related to the Capital Asset Pricing Model? Set out and explain the determinants of its performance? (50% weighting) b) Consider the following limit-order book of Microsoft (with stock ticker:MSFT): Book Viewer BATS MSFT Go MICROSOFT CORP COM Orders Accepted 181,810 Total Volume 4,864,186 BIDS ASKS - TOP OF BOOK SHARES 12.945 12,253 21,000 9,500 2.300 6,600 11,000 17,200 16,500 13.600 Last updated 11:34:25 LAST 10 TRADES PRICE TIME PRICE 24.00 11:34:10 23.96 23.99 11:34:10 23.96 23.98 11:34:10 23.96 23.97 11:33:56 23.96 23.96 11:33:55 23.96 23.95 11:33:54 23.96 23.94 11:33:50 23.95 23.93 11:33:50 23.95 23.92 11:33:50 23.95 23.91 11:33:50 23.95 SHARES 100 450 700 100 100 100 200 100 100 100 (i) What is the best bid-ask spread of the limit order book? (10% weighting) (ii) If a market buy order for 100 shares comes in, at what price will it be filled? (10% weighting) When the next market buy order for 2500 shares comes in, calculate the average price at which it will be filled (10% weighting) (iv) Explain the factors that affect the costs of trading (20% weighting) a) Describe what betting against beta strategy is? How is this strategy related to the Capital Asset Pricing Model? Set out and explain the determinants of its performance? (50% weighting) b) Consider the following limit-order book of Microsoft (with stock ticker:MSFT): Book Viewer BATS MSFT Go MICROSOFT CORP COM Orders Accepted 181,810 Total Volume 4,864,186 BIDS ASKS - TOP OF BOOK SHARES 12.945 12,253 21,000 9,500 2.300 6,600 11,000 17,200 16,500 13.600 Last updated 11:34:25 LAST 10 TRADES PRICE TIME PRICE 24.00 11:34:10 23.96 23.99 11:34:10 23.96 23.98 11:34:10 23.96 23.97 11:33:56 23.96 23.96 11:33:55 23.96 23.95 11:33:54 23.96 23.94 11:33:50 23.95 23.93 11:33:50 23.95 23.92 11:33:50 23.95 23.91 11:33:50 23.95 SHARES 100 450 700 100 100 100 200 100 100 100 (i) What is the best bid-ask spread of the limit order book? (10% weighting) (ii) If a market buy order for 100 shares comes in, at what price will it be filled? (10% weighting) When the next market buy order for 2500 shares comes in, calculate the average price at which it will be filled (10% weighting) (iv) Explain the factors that affect the costs of trading (20% weighting)