Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(a) Determine the following variances, and state clearly whether each is favourable or unfavourable. (i) direct materials price, inventory, and quantity variances; (ii) direct labor

(a) Determine the following variances, and state clearly whether each is favourable or unfavourable.

(i) direct materials price, inventory, and quantity variances;

(ii) direct labor rate and efficiency variances;

(iii) variable overhead rate and efficiency variances;

(iv) fixed overhead budget and volume variances; and

(v) sales price and sales volume variances.

Explain and discuss possible interrelationships between the above variances which you have calculated.

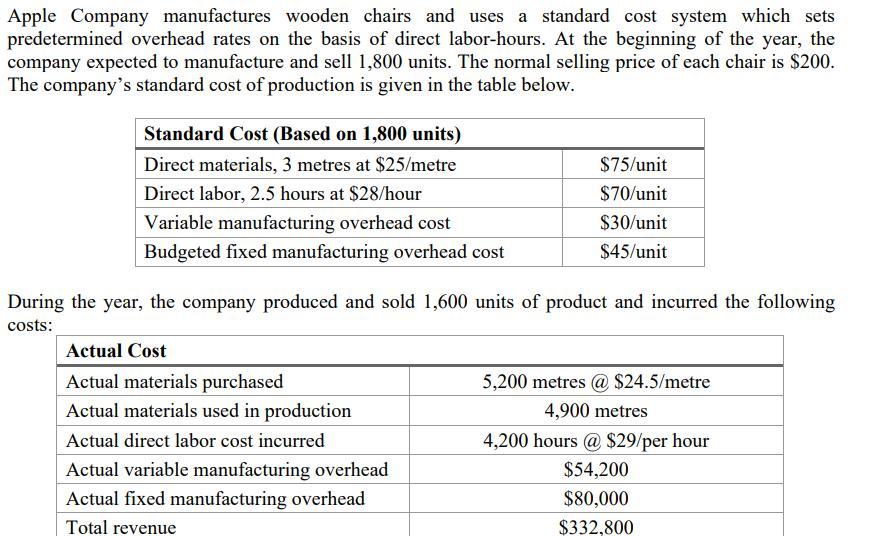

Apple Company manufactures wooden chairs and uses a standard cost system which sets predetermined overhead rates on the basis of direct labor-hours. At the beginning of the year, the company expected to manufacture and sell 1,800 units. The normal selling price of each chair is $200. The company's standard cost of production is given in the table below. Standard Cost (Based on 1,800 units) Direct materials, 3 metres at $25/metre Direct labor, 2.5 hours at $28/hour Variable manufacturing overhead cost Budgeted fixed manufacturing overhead cost $75/unit $70/unit $30/unit $45/unit During the year, the company produced and sold 1,600 units of product and incurred the following costs: Actual Cost Actual materials purchased 5,200 metres @ $24.5/metre Actual materials used in production 4,900 metres Actual direct labor cost incurred 4,200 hours @ $29/per hour Actual variable manufacturing overhead $54,200 Actual fixed manufacturing overhead $80,000 Total revenue $332,800Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started